Central Bank Watch: Fed Speeches And Interest Rate Expectations Update

ALL TOGETHER NOW: ON HOLD

In this edition of Central Bank Watch, we’ll review the speeches made over the past week by various Federal Reserve policymakers, including the Fed Chair himself. In the run-up to the April 28 meeting (and ahead of the blackout window), Fed policymakers were extremely present in the day-to-day machinations of financial markets. The signposts have been made clear: policy isn't changing soon.

FEDERAL RESERVE MEETS NEXT WEEK

Federal Reserve policymakers are heading towards their April rate decision culminating tomorrow, but that doesn’t mean policy is heading anywhere new soon. For the past two-plus weeks, Fed officials have been extremely disciplined with respect to a persistent drumbeat of keeping rates low and policy accommodative at the onset of the US economy’s recovery from the coronavirus pandemic.

April 11 – Powell (Fed Chair) promises to keep easing in place while striking an optimistic tone, noting “we feel like we’re at a place where the economy is about to start growing much more quickly and job creation coming in much more quickly.”

April 12 – Bullard (St. Louis president) says that getting three-quarters of the population vaccination would be a “necessary condition” for the Fed to consider tapering its bond-buying program.

Rosengren (Boston president) says that the Fed needs to be careful with allowing inflation to overshoot, saying “in the post-war period we don’t have a pandemic experience with a new monetary policy framework with very aggressive fiscal policy all happening at the same time.”

April 13 – Harker (Philadelphia president) says the Fed won’t be changing course soon, noting “for now, Fed policy is going to hold steady. We’ll keep the federal funds rate very low and continue making more than $100 billion in monthly Treasury bond and mortgage-backed securities purchases.” This stance didn’t reflect a lack of optimism over the economy, as he also said that he’s “expecting GDP growth to come in around 5% to 6% in 2021…the labor market to parallel GDP growth and unemployment to fall throughout this year.”

Barkin (Richmond president) says that he sees “long-term disinflationary forces, like the power of big-box retailers in the purchasing departments, like the price transparency which is enabled by the internet, and like global access to lower-cost product and talent.”

April 14 – Powell provides clarity on the timeline around tapering and rate hikes, saying that “We will reach the time at which we will taper asset purchases when we’ve made substantial further progress toward our goals from last December, when we announced that guidance...that would in all likelihood be before -- well before -- the time we consider raising interest rates. We haven’t voted on that order but that is the sense of the guidance.”

The Beige Book is released, and limited supply the theme: references to labor and/or material “shortage” or “shortages” are noted nearly 40 times, due to a combination of workers seeking higher wages and the Suez canal crisis creating a backlog in trade.

April 15 – Bostic (Atlanta president) says that the Fed is “going to take an approach where we are not going to preemptively try to slow down the economy and prevent it from overheating.” He underscored his position by noting “what we have seen in the last 10 years is that the economy can run a lot hotter than we ever expected without seeing that inflation.”

Daly (San Francisco president) speaking on financial reform says the Fed doesn’t “want to go so fast that we miss important discussions that would highlight trade-offs, but we do want to have a patient sense of urgency.”

April 16 – Waller (Fed governor) joins the drumbeat of resolutely signaling ongoing support, saying “just because the growth rates are really good and everything’s looking like we’re heading out in the right direction, we’re still trying to make up a lot of ground.” Furthermore, he said that “we’ve got a long way to go. There’s no reason to be pulling the plug on our support until we’re really through this.”

April 20 – Powell, in a written response to Senator Rick Scott (R-FL) obtained by Reuters, downplays inflation threats, saying the Fed does not “seek inflation that substantially exceeds 2 percent, nor do we seek inflation above 2 percent for a prolonged period.”

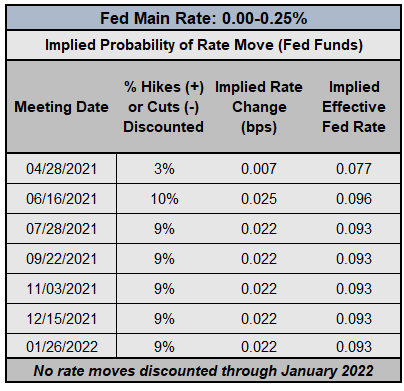

FEDERAL RESERVE INTEREST RATE EXPECTATIONS (APRIL 27, 2021) (TABLE 1)

Fed policymakers have been disciplined with their messaging in recent weeks, so disciplined that rates markets haven’t moved in the interim period since our prior Fed edition of Central Bank Watch. Like on April 8 and April 22, Fed funds futures are still pricing in a 91% chance of no change in Fed rates through January 2022.

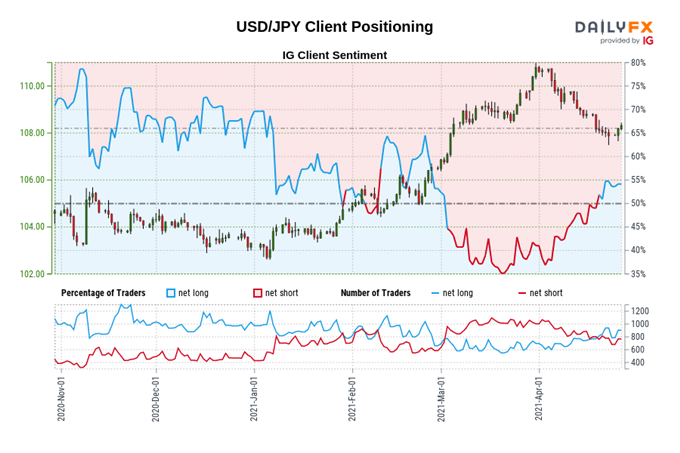

IG CLIENT SENTIMENT INDEX: USD/JPY RATE FORECAST (APRIL 27, 2021) (CHART 1)

USD/JPY: Retail trader data shows 59.31% of traders are net-long with the ratio of traders long to short at 1.46 to 1. The number of traders net-long is 22.49% higher than yesterday and 36.32% higher from last week, while the number of traders net-short is 10.55% lower than yesterday and 8.04% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/JPY prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bearish contrarian trading bias.