Canadian Dollar Forecast: USD/CAD Languishes, NZD/CAD Breaks Out

The Canadian Dollar is in the midst of an important week from a fundamental perspective with looming employment data on the horizon. Due Thursday, the data could make or break the Canadian Dollar’s status which has become varied across a number of crosses. In the case of USD/CAD, important event risk could serve to finally spark a determined move in either direction after the pair has languished about since the beginning of July.

USD/CAD PRICE CHART: 4 - HOUR TIME FRAME (APRIL 2020 – JULY 2020)

(Click on image to enlarge)

Unsurprisingly, USD/CAD has seen relatively little progress for the month as the 200-period moving average and Fibonacci level near 1.36 look to influence price over the coming days. Already, the level has shown some ability to stall gains. As a result, the longer-term downtrend has remained intact.

Since progress has been minimal, a break above the late June highs or beneath the mid-June swing low would constitute as a meaningful price development at this stage. In the meantime, USD/CAD will likely await fundamental catalysts as it grasps for a defined trend in the shorter-term.

NZD/CAD FORECAST

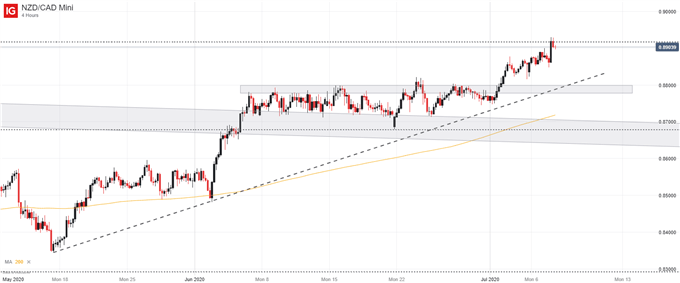

Conversely, NZD/CAD has initiated what appears to be a bullish break higher, a possibility we highlighted just last week. The attempt higher began in earnest after resistance around the 0.88 mark was surpassed which allowed the pair to quickly progress higher until encountering a Fibonacci level at 0.8916 – a line that may act as resistance. With gains established, NZD/CAD will look to the upcoming Canadian jobs report to fuel a continuation higher.

NZD/CAD PRICE CHART: 4 – HOUR TIME FRAME (MAY 2020 – JULY 2020)

(Click on image to enlarge)

With that in mind, a reversal lower would have to negotiate possible support at the 0.88 level, an ascending trendline projection nearby and a flurry of technical levels within reach of 0.87. Either way, recent price action may suggest the New Zealand Dollar is in the midst of a larger rally against the Canadian Dollar while the CAD remains lackluster in other pairs like USD/CAD.

Thus, traders looking to capitalize on the upcoming influence of the Canadian jobs report might consider NZD/CAD as an attractive opportunity regardless of direction.