British Pound (GBP) Forecast: New Quarter Carries Over GBP Pressures

GBP Fundamental Backdrop

The pound sterling is having a tough time this week against the U.S. dollar and euro respectively. The ECB Sintra Forum saw the Federal Reserve via Jerome Powell surprise markets on the hawkish side thus boosting the dollar. Yesterday, Russia withdrew troops from Ukraine as a “gesture of goodwill” leaving the euro bid in conjunction with looming ECB rate hikes to quell inflationary pressures in the eurozone. These fundamental headwinds left the pound weaker while UK economic data showed housing prices slipping in the month of June.

Brexit developments may also play a role in the pound although up until now we have not seen significant reactions within GBP crosses.

To close off the week, eurozone core inflation and U.S. ISM Manufacturing PMI will be in focus. Eurozone core inflation is estimated to come in higher than the previous release which could support further EUR upside. ISM data on the other hand is forecasted lower and could play into the hands of an already fearful market with regard to an impending recession.

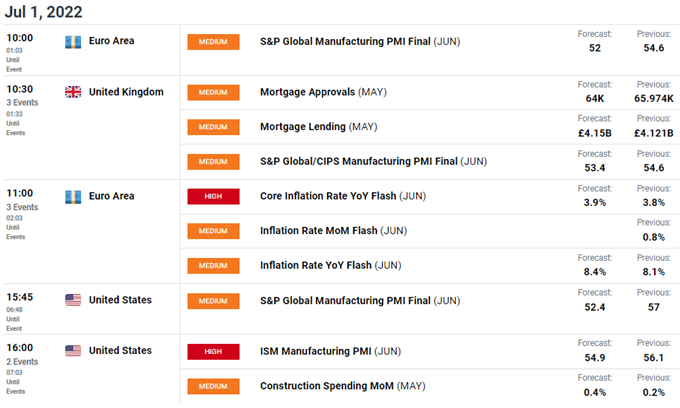

GBP/USD & EUR/GBP Economic Calendar

Source: DailyFX Economic Calendar

Technical Analysis

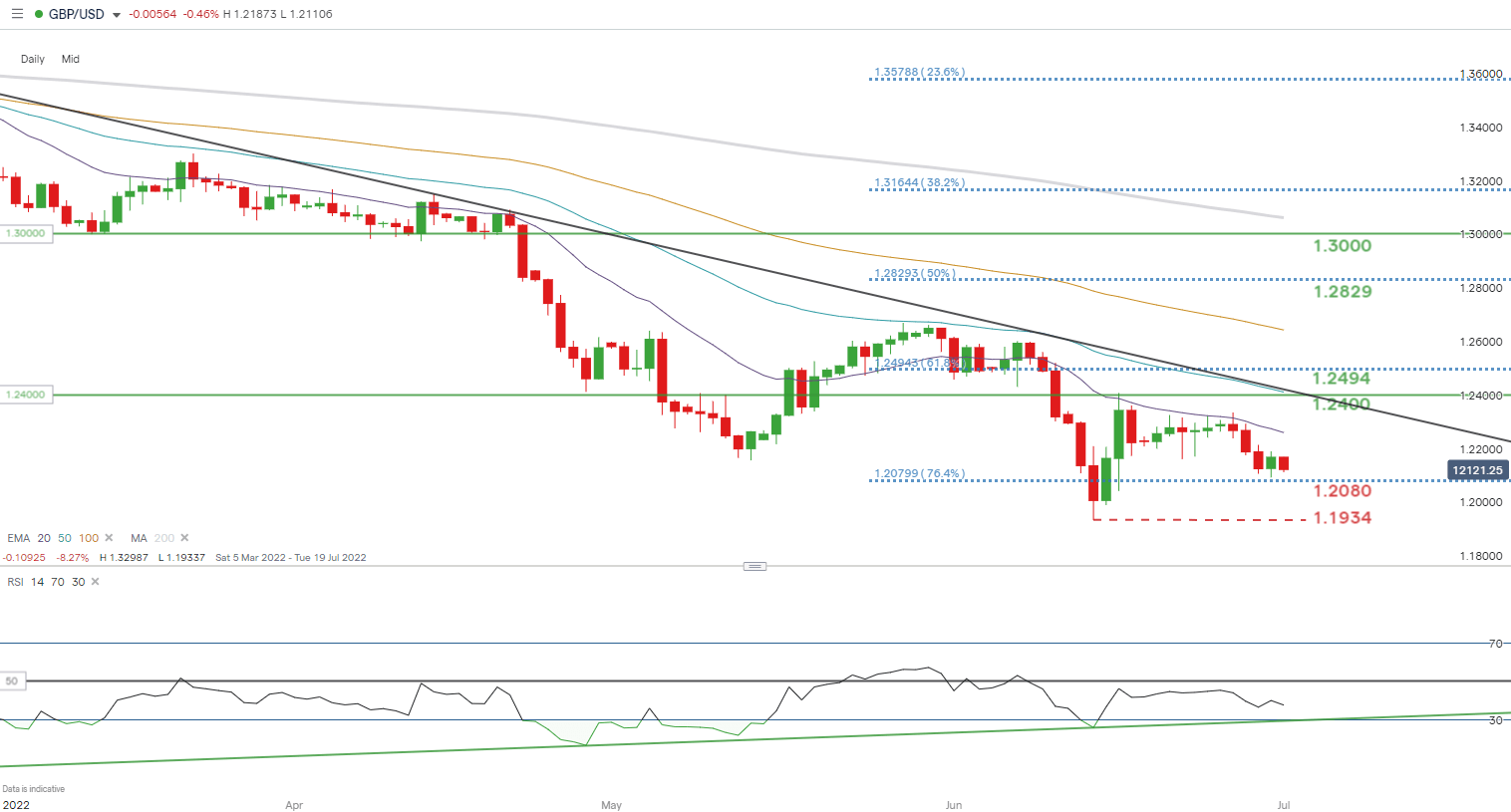

GBP/USD Daily Chart

(Click on image to enlarge)

Chart prepared by Warren Venketas, IG

Cable has been relatively muted but remains in its recent consolidatory pattern as bears look to retest the 1.2080 (76.4% Fibonacci) level. We could see further downside towards the 1.1934 swing low but I am leaning towards some sort of bullish recovery medium-term (albeit incremental).

Key resistance levels:

- 1.2494

- 1.2400/50-day EMA (blue)/Trendline resistance (black)

- 20-day EMA (purple)

Key support levels:

- 1.2080

- 1.1934 (swing low)

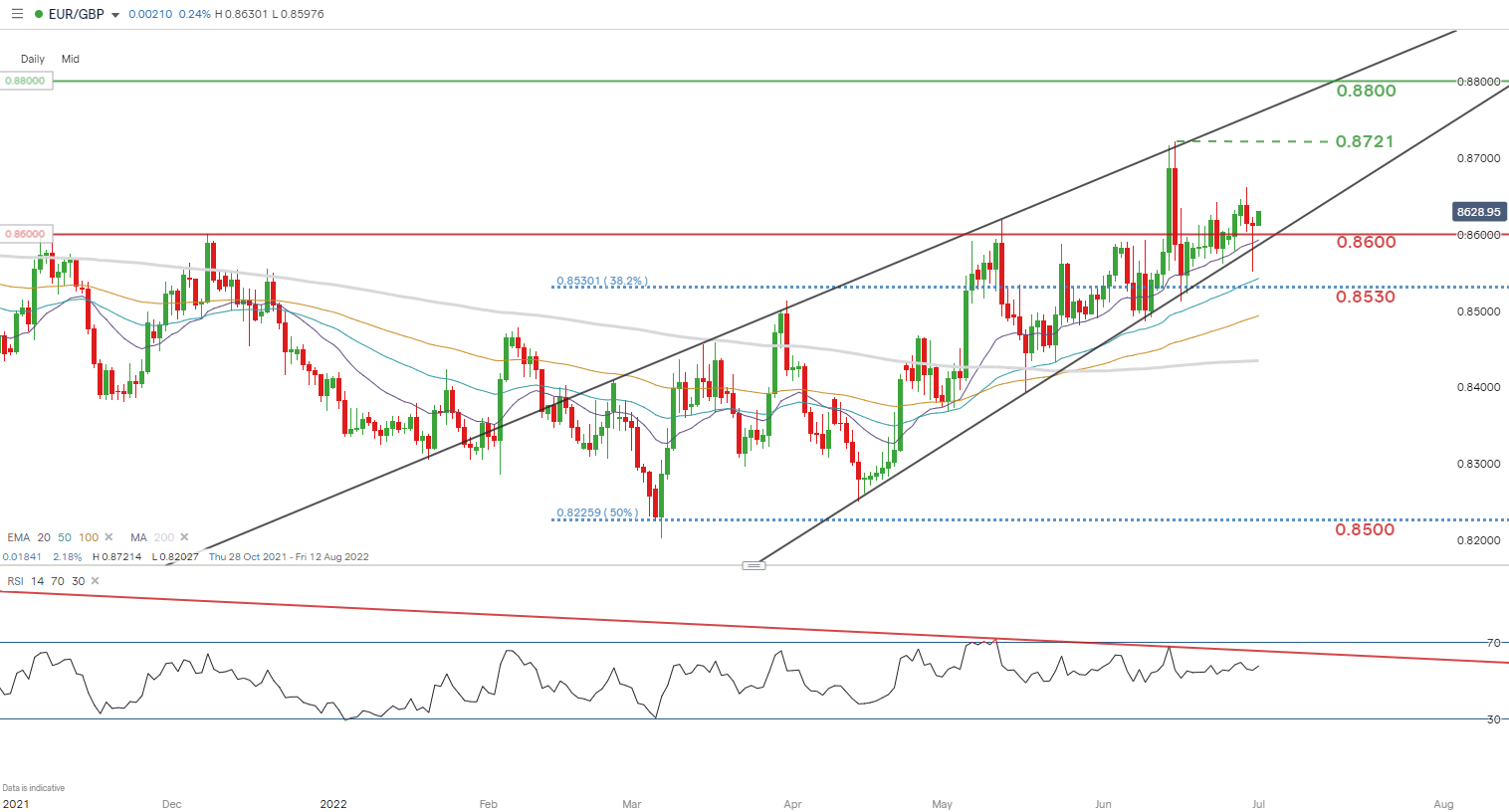

EUR/GBP Daily Chart

(Click on image to enlarge)

Chart prepared by Warren Venketas, IG

Daily EUR/GBP price action shows yesterday’s long lower wick setting up the bullish bias for today as prices remain within the medium-term rising wedge formation (black). Technical analysis points to a pullback by the pound as the RSI reveals slowing upside momentum contradicting corresponding price action (bearish divergence) however, timing divergence can be difficult.

Key resistance levels:

- 0.8800

- 0.8721

Key support levels:

- 0.8600/ Wedge support

- 0.8530

Disclosure: See the full disclosure for DailyFX here.