AUD/JPY Technical Outlook: Rally Rejected At Resistance

The Australian Dollar has traded within a nearly 4% range against the Japanese Yen since the start of May trade with the AUD/JPY pullback from a key resistance range last week risking further losses. Here are the levels that matter as we head into major event risk later this week.

AUD/JPY DAILY PRICE CHART

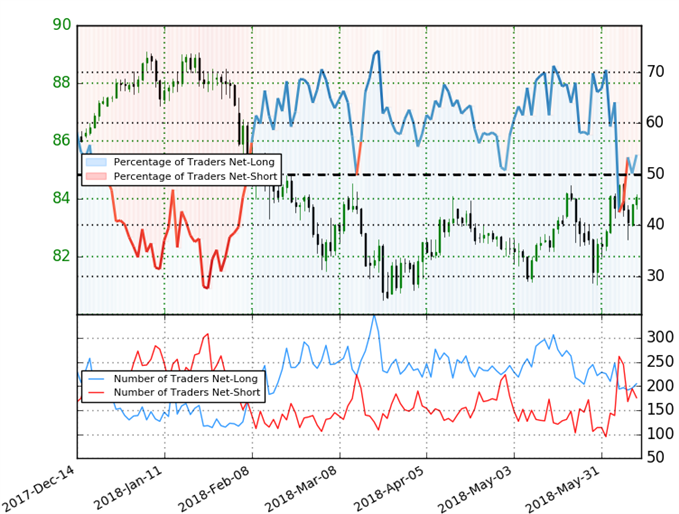

Technical Outlook: In this week’s Technical Perspective on AUD/JPY, we highlighted a well-defined price range on the weekly charts while noting that, “from a trading standpoint, I’ll favor fading strength near-term but respect this range with a weekly close needed to validate a break on either side.” The daily chart shows price trading within a shallow ascending channel formation with daily RSI marking strong bearish divergence into the monthly high. The focus remains on this turn from the range-highs with the near-term risk lower while below 84.25.

Initial daily support rests with the monthly open at 82.34 backed closely by the 61.8% retracement of the March advance at 82.04. Ultimately a break/close below the lower parallels would be needed to mark resumption of the broader downtrend. A topside breach of the monthly opening-range highs shifts the focus towards subsequent resistance objectives at the 85-handle backed by the 200-day moving average / 50% retracement at 85.35/40.

AUD/JPY 120MIN PRICE CHART

Notes: A closer look at AUD/JPY price action sees the pair turning from Fibonacci resistance today at 84.12 with an outside-reversal bar off the highs shifting the near-term focus lower. Initial support targets are eyed at the weekly open at 82.95 backed by 82.52. Key support rests at 82.04/21 where the 100% extension and the 61.8% retracement converged on parallel support. A breach above today’s highs puts us neutral, with a rally surpassing 84.48 needed to fuel the next leg higher targeting 84.79 and the 100% extension at 85.01.

Bottom line: The reversal off range resistance has us looking lower for now. With major central bank interest rate decisions from the FOMC, ECB, and BoJ likely to drive market sentiment, look for this ‘risk-sensitive’ pair to respond in the days ahead. From a trading standpoint, I’ll favor fading strength while within this near-term slope formation.

AUD/JPY IG CLIENT POSITIONING

- A summary of IG Client Sentiment shows traders are net-long AUD/JPY- the ratio stands at +1.16 (53.8% of traders are long) – weak bearish reading

- Long positions are 6.8% higher than yesterday and 2.8% lower from last week

- Short positions are 0.6% higher than yesterday and 15.8% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/JPY prices may continue to fall. Yet, traders are more net-long than yesterday but less net-long from last week and the combination of current positioning and recent changes gives us a further mixed AUD/JPY trading bias from a sentiment standpoint.

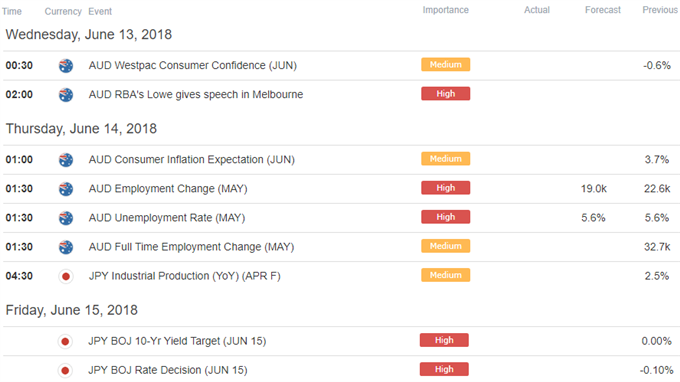

RELEVANT AUD/JPY DATA RELEASES

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more