Are Oil And The Dollar Actually Inversely Related?

“Davidson” submits:

There are multiple consensus relationships that have become embedded mechanically as part of algorithmic trading. The relationships of oil prices to other economic trends are a part of accepted lore. The two most prominent are:

- Oil prices are inverted to shifts in the US$-i.e. US$ rises and WTI falls

- Oil prices correlate directly with shifts in economic trends-i.e. rising-falling WTI precedes economic demand and predicts economic trends.

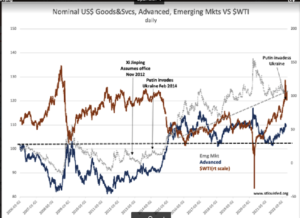

The fact that the consensus has traded WTI with these perspectives does not mean there is in fact a viable economic connection between them. Lately giving proof to consensus misperception is the recent history of rising US$ and rising WTI. Yet, enough believe today that “Growth” issues represent overall economic growth and when the perception of ‘growth’ falters portfolios should be hedged by shorting WTI. One needs to look frequently beneath the surface to capture how market participants are thinking and behaving, how these perceptions are reflected in the media and trading vs what the long-term economic trends eventually reveal as the factual. In this analysis, it is the Net/Net of those who take action on short-term price trends vs those who look to the broader mix of human behavior. The recent history of WTI vs US$ clearly shows a rising US$ vs rising WTI as in Nominal US$…WTI. This is very much counter to how many short-term investors proclaim. Capital is flowing into the US bolstering the US$ and in recent weeks it is mostly from other Advanced markets. This keeps US rates lower than they would be normally and provides upward pressure for equity prices even as rates rise.

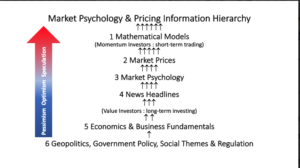

The illustration Market Psychology…Information Hierarchy is a simplistic representation of how complex the market and pricing actually is. There are still government policies improperly put in place 50yrs+ ago having an impact today. No newly minted portfolio manager has ever considered this information. No one can properly evaluate the ‘Top-Down’ picture, yet many claim expertise. The price of everything is established by short-term perceptions and expectations of traders basing decisions on the news of the day vs the current price in conjunction with intersecting price trends. They receive the majority of media attention and can make broad economic proclamations that can swing 180 degrees in a few days. This makes for great eye candy but falls far short of useful.

To invest properly in my opinion, one needs to begin one’s decision process at level 6, work to locate skilled management teams at level 5, and then be patient as the better situations percolate to level 1. This is quite a different process than the mathematical process taught and sanctified by Wall Street. It is human behavior that innovates and creates value for society. It is human behavior that converts innovation into consumables that society can acquire and continue the process profitably. It is the individual desire to advance one’s standard of living that drives the process. Consumers must perceive value or product offerings will fail. None of this can be as easily taught as submitting numbers into a spreadsheet. It is the intangibles that are nearly impossible to quantify that end up in market prices, the richness of human creative activity, that is reduced by Wall Street to price targets without understanding the basics. In my opinion, one must understand the intangibles so one is not trapped by taught relationships as society evolves into new territory.

Heraclitus(c. 535 – c. 475 BC) is quoted as saying, “No man ever steps in the same river twice, for it’s not the same river and he’s not the same man”. What is apparent today is an economy trending higher with the US$ the best option for investors and the better-managed US as the only option investors should consider. One needs to evaluate the economic details continuously and have one’s evaluation confirmed by contemporary earnings reports and individual management forecasts. Investing is a process requiring daily analysis.

Managements and economic indicators support continued economic expansion with 3yrs-5yrs timeframe.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more