Cotton Forecast: Markets To Continue Consolidating

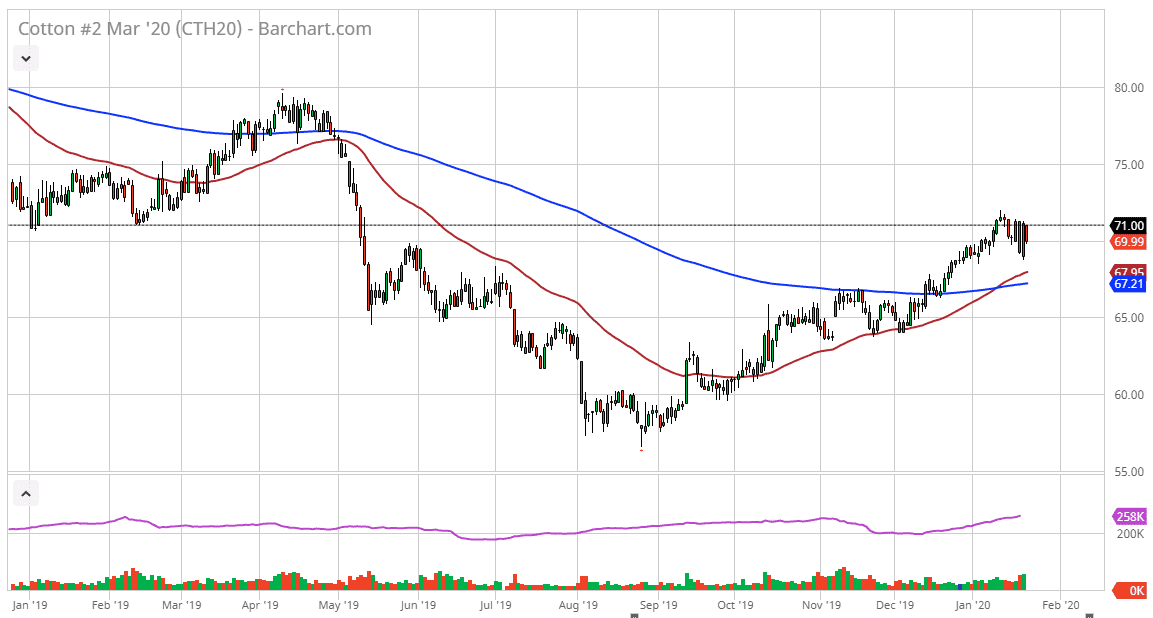

Cotton markets have pulled back a bit during the trading session on Thursday, as the $71 level continues to offer a lot of resistance. That is an area that has been important more than once, and it is also where we have seen a lot of noise recently. That being said, the last three days have been very interesting.

The negativity that had been seen on Tuesday was completely reversed on Wednesday, only to be reversed again on Thursday. With the action that we have seen in the last couple of sessions, it tells me that there is a lot of inertia in a market that is trying to decide where to go next. That being said, I believe that cotton needs to take a bit of a breather, and as a result, it would not surprise me at all to see this market go sideways for several sessions. After an extensive move like we have seen in this market, it’s not uncommon to see the market simply go sideways in order to “kill time.” This allows the market enough time to get used to the idea of being at these lofty levels, allowing for the psychology of traders to continue thinking that it’s okay to go higher.

Looking at the 50 day EMA underneath, we are reaching to the upside and it has even broken above and crossed the 200 day EMA in order to form a “golden cross”, which shows that longer-term traders are starting to look at this from a “buy-and-hold” perspective as well. If we can clear the $71 level on a daily, or perhaps even a weekly close, then the market is likely to go to the $75 level. To the downside, I believe there should be plenty of support near the 50 day EMA, which currently is trading at the $68 level.

This type of choppy behavior does offer nice range bound trading opportunities for those who are short-term inclined, but if you are not then you have to look at everything through the prism of buying dips or buying and holding. At this point though, cotton certainly looks very strong at this point, so I believe that the cut market will eventually break out to the upside, but as for when it does, that is more or less a guess so at this point it’s likely that the channel that we have been and should continue to push to the upside as well.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more