Copper Speculator’s Bearish Bets Surged To A New Record High

Copper Non-Commercial Speculator Positions:

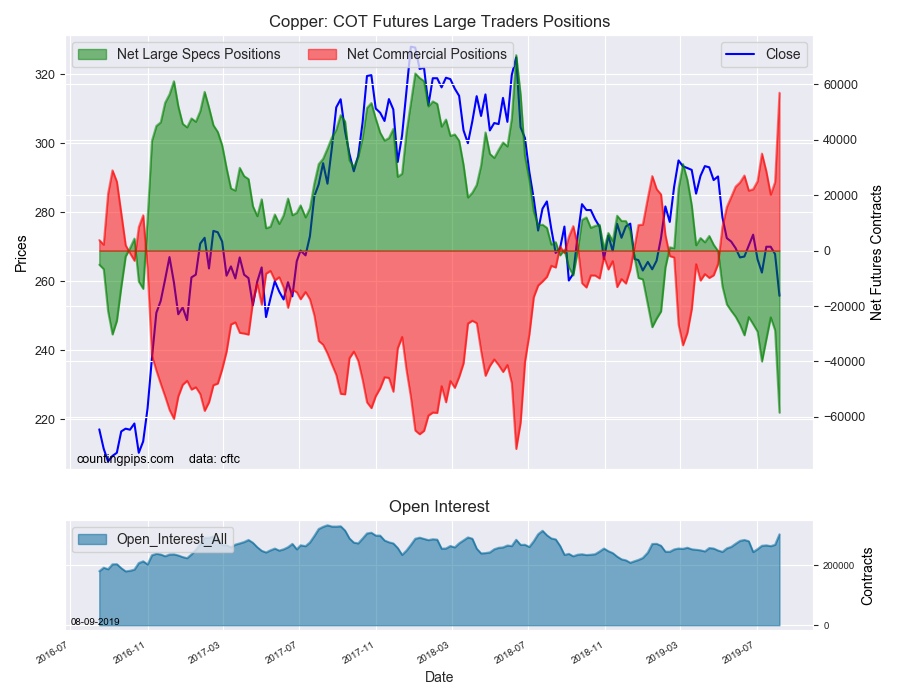

Large precious metals speculators raised their bearish bets very sharply this week in the Copper futures markets, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Copper futures, traded by large speculators and hedge funds, totaled a net position of -58,449 contracts in the data reported through Tuesday August 6th. This was a weekly change of -29,694 net contracts from the previous week which had a total of -28,755 net contracts.

The week’s net position was the result of the gross bullish position (longs) advancing by just 1,799 contracts (to a weekly total of 79,133 contracts) while the gross bearish position (shorts) jumped by a total of 31,493 contracts on the week (to a total of 137,582 contracts).

The copper speculator’s bearish sentiment rose for a second straight week and landed at the most bearish level on record at a position over -58,000 contracts, according to the CFTC data going back to 1989. The previous bearish record was a total of -44,811 contracts on June 14th of 2016.

The weekly rise in bearish bets by -29,694 contracts also marked the largest one-week bearish change on record. The previous record was a change of -22,266 contracts on June 26th of 2018.

Copper, traditionally known as a gauge on the health of the global economy, has now been in an overall bearish standing for fifteen straight weeks and has been in stark contrast to the rising sentiment for both silver and gold.

Copper Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 56,967 contracts on the week. This was a weekly boost of 32,230 contracts from the total net of 24,737 contracts reported the previous week.

The commercial position this week also hit an all-time record high position on the bullish side and the weekly gain marked the largest one-week jump in commercial bullish positions.

Copper Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Copper Futures (Front Month) closed at approximately $255.75 which was a fall of $-12.10 from the previous close of $267.85, according to unofficial market data.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).