Consumer Spending Is Stuck

Survey On Recovery

Initially, in March and April people were calling for a depression. Price changes sentiment, though as people got more optimistic as the stock market recovered. It was very difficult to quantify what was going to happen because we didn’t know much about COVID-19 early this spring. After the initial recovery data was strong, we saw a slowdown in July. Even the spike in the stock market couldn’t make people ignore this.

In fact, the stock market recognized this slowdown as well in June by punishing the cyclical stocks and rewarding the work from home and cloud stocks. It’s still not clear how this recovery will go and which industries will take the longest to get back to normal. This slowdown was a setback that will quickly end. Nike swoosh recovery flatlined, but it will likely get back to the trend in August or September.

(Click on image to enlarge)

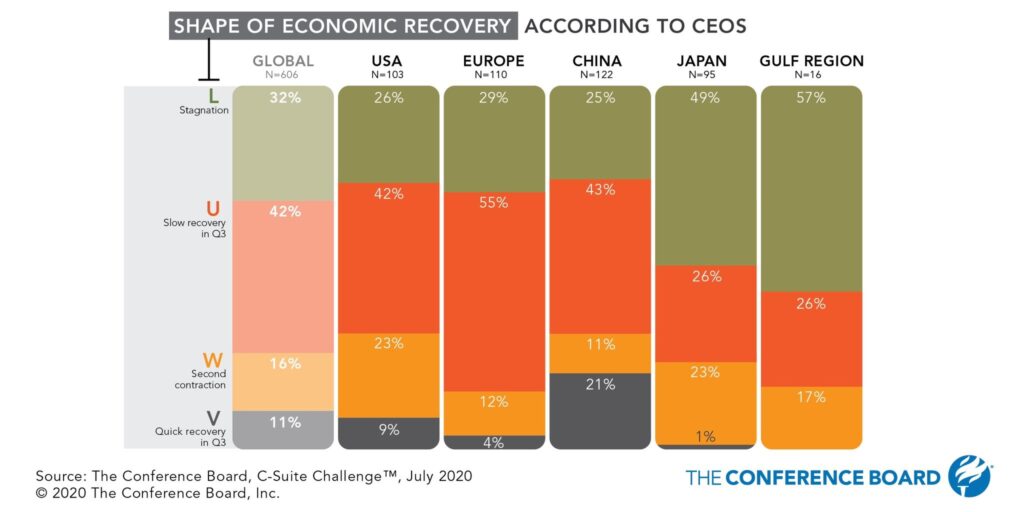

As you can see from the chart above, just 9% of CEOs see a V-shaped recovery in America. It's not surprising because most CEOs have been cautious the whole time. Only exuberant investors called for a V-shaped recovery. Since we haven’t had one yet, it’d be tough to ever qualify this as a V-shaped recovery even if we saw sharp improvement starting today.

26% of CEOs see an L shaped recovery which would be a disaster. We’d need to see COVID-19 cases spike again and no fiscal stimulus for the economy to flatline here. It's shocking that CEOs are more bearish on Europe even though Europe did a better job at squashing the virus. They might be too negative.

COVID-19 situation is similar for Japan, yet CEOs are even more negative. Clearly, they are looking at demographics instead of how COVID-19 is doing even though the virus caused the recession. 49% see an L shaped recovery in Japan and 1% see a V-shaped recovery. Sentiment can’t get much worse than that.

Consumer Spending Growth Stuck For Now

Redbook same-store sales growth in the week of August 1st improved from -7.2% to -7.1%. This is a terrible reading even though it continued to improve. It's unlikely there will be an improvement until the stimulus is passed. Mitch McConnell stated he is willing to push forward a plan that pays people $600 per week like the last one.

GOP is playing defense with this election because it holds more power. Usually, the GOP goes against this type of spending, but because of that position and the weakness in the economy, it has little choice. That’s why some have consistently been saying legislation will pass within the first 2 weeks of August. The market never waits for the final details. It prices news in as it is reported. If Congress says it will get something done, the market forges ahead before the official law is in place.

(Click on image to enlarge)

![]()

As you can see from the chart above, the Chase spending growth rate has been stagnant for about 6 weeks. It's impressive that it has stayed this high. It’s high because consumers had a 19% savings rate in June. This implies there is pent up demand and cash to spend once the stimulus is passed and economic restrictions are lifted.

COVID-19 Cases Falling

On Tuesday, there were only 54,504 new cases as the 7-day average is in free fall. There were 1,362 new deaths which was up 32 from last week. On Monday, deaths fell 30 from the prior week. This implies there is clear stabilization this week like I predicted. Declines will pick up steam as the month goes on.

August and September will be like June. The economy is in an in-between phase where it is recovering, but things can’t go back to normal. There needs to be a breakthrough on treatments. Even if that occurs later this year, there won’t be an immediate full recovery because of the damage that has been done. The good news is the stimuli will dramatically limit the damage.

As you can see from the chart below, dining traffic, hours worked, and mobility are all negatively correlated with the COVID-19 infection rate just like in April. When the infection rate was falling in May and June, the correlation wasn’t as negative because COVID-19 became less relevant.

The 2nd wave changed that. It’s good for the long term health of the economy if people stop moving for a few weeks to lower the spread of the virus. We’ve seen many countries such as Italy successfully keep the infection rate low.

(Click on image to enlarge)

ISM Manufacturing PMI Improves Again

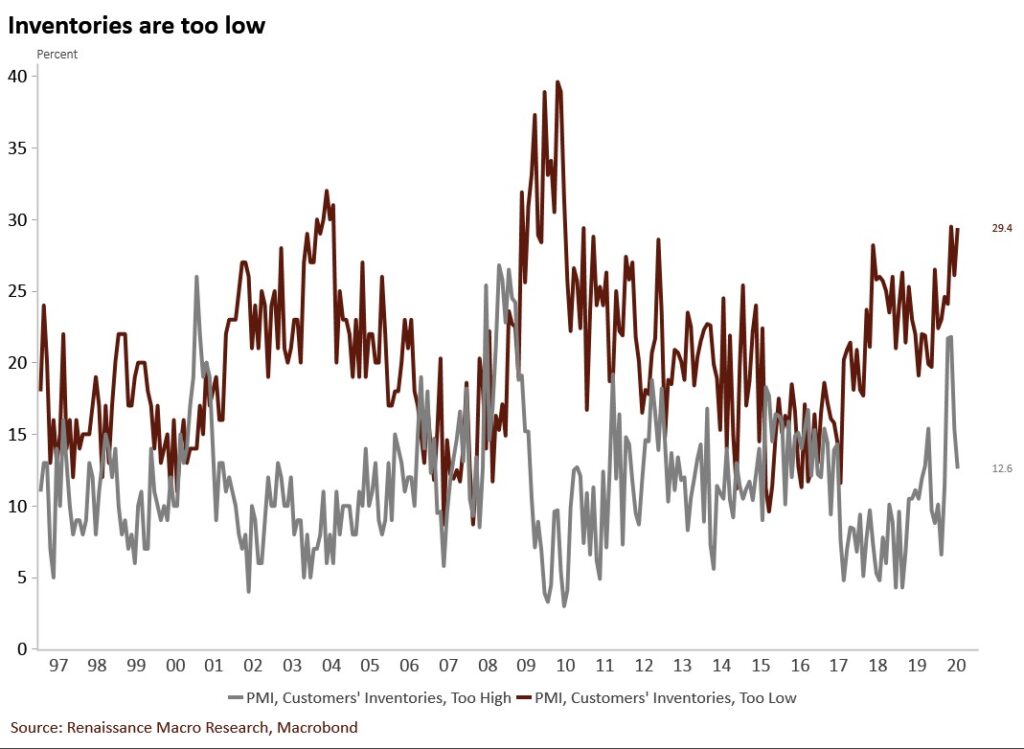

ISM manufacturing PMI improved again for 2 reasons in my opinion. Consumers are demanding more goods than services (relative to history) because of social distancing. Secondly, manufacturing rebounds quickly. Slowdowns like this are common. July PMI was up from 52.6 to 54.2 which beat estimates for 53.5. The new orders index was up 5.1 points to 61.5 and production rose 4.8. That means this report was even better than the headline reading implies. Supplier deliveries and inventories indexes fell 1.1 and 3.5 points to 55.8 and 47.

As you can see from the chart below, the net difference between those saying inventories are too high and those saying inventories are too low is high like it was early in the last expansion. Production is going to increase as this cyclical recovery in manufacturing takes hold. We can expect Q4 to be strong for the sector on an absolute basis.

(Click on image to enlarge)

This report is consistent with 3.3% GDP growth. Obviously, last quarter was terrible which means this quarter will have very strong quarter over quarter growth. With that in mind, the Atlanta Fed Nowcast calls for 19.6% growth. 13 industries expanded and only 2 declined as the sector has done a complete 180 turn.

A chemical products firm stated, “Orders starting to pick up. [An] increase of about 35 percent to 40 percent.” On the other hand, a miscellaneous products firm stated, “We are still seeing our customers shut down or affected by COVID-19. We are hoping for a bounce back in September.”

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more