Consumer Looks Better Than Before

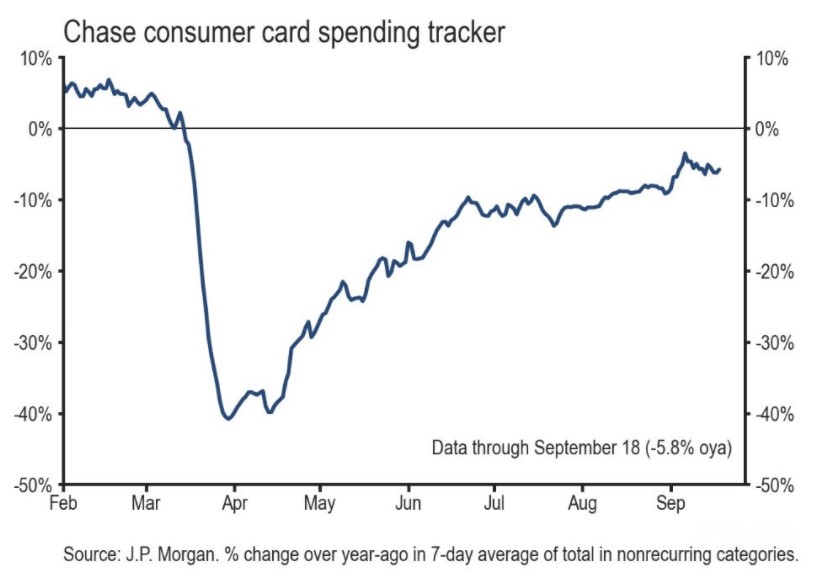

Slight Improvement In Chase Card Spending

We got 2 new good data points on spending which suggest the consumer isn’t in disaster mode. Redbook same store sales growth increased from -1.2% to 1.5% in the week of September 19th. That’s a nice improvement, but on an absolute basis, it’s still very low growth. Ending the streak of growth declines in a positive though. The chart below shows similar information.

As you can see, Chase card spending growth improved from -6.5% to -5.8% in the past week. Spending growth was hurt by it being the week after Labor Day weekend. Sure enough, spending growth rebounded slightly. This isn’t a great number on an absolute basis, but it shows the consumer isn’t headed in the wrong direction terminally.

Those who disagree think the fiscal stimulus was the only thing propping the economy up and that the labor market is too weak to survive on its own. There's no doubt that there will be pain as the economy transitions to surviving on its own. Some would rather see a stimulus. In the end, it will likely make it without a double-dip recession even if there is no stimulus.

(Click on image to enlarge)

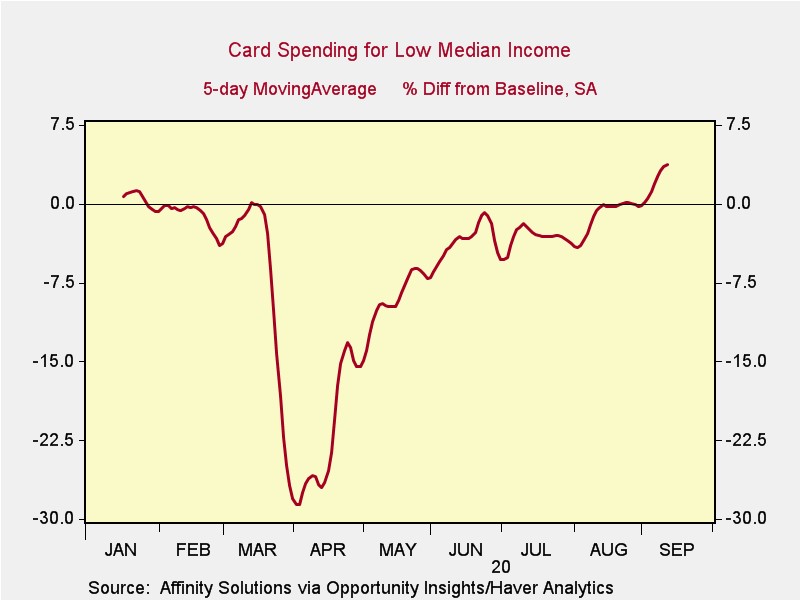

Low Median Income Grows?

Those without a job are doing the worst and people who make less money are more likely to be without a job. That’s shown by the leisure and hospitality industry which has seen its employment fall 25%. It pays workers the least as businesses such as restaurants don’t pay workers well.

On the other hand, the chart below shows the 5 day average of card spending for low median income workers is up 3.6% as of September 13th as compared to this January. It has been a long recovery process. This data could be biased in that the low income people who have been hit the hardest might not have cards. Even still, this is good news.

(Click on image to enlarge)

Households Are Doing Well

U.S. household net worth is at a record high because of the rise in home prices and the stock market. Furthermore, as you can see from the chart below, household debt as a percentage of household income is 85.3% is the lowest since Q3 1995. Low interest rates have helped stocks and house prices. The lower debt servicing costs. The biggest issue here is disposable income was boosted by the fiscal stimulus.

Currently, consumers have a huge savings rate. With a fiscal stimulus and more job creation, there could be a boom in spending next year. Of course, a stimulus is less of a want and more of a need for low income consumers. A stimulus will come after the election. If it comes sooner, it will be better of course. The current Senate session ends on October 9th, so it’s now or never if something is to be passed this year.

(Click on image to enlarge)

Detailed Review Of Vaccine Timelines

The chart below shows the complete updated predictions on when the various vaccines that are in trials will be approved. As you can see, there are pivotal data releases from Moderna and Pfizer coming in October. AstraZeneca data is also coming in Q4. If all 3 give bad news, we will need to wait a couple more months for new data. Approvals will likely come quicker than Q2 2021, but frankly, that's not a negative as that’s in about 8-10 months.

(Click on image to enlarge)

On the bottom, it shows pivotal data on treatments will come from Regeneron and Lilly in Q4 as well (Vir year-end). Even if all the vaccines give no sign of optimism, we can easily get good news from treatments. Lowering the death rate is equally as important as lowering the spread. When you combine vaccines, neutralizing antibodies, and rapid testing the situation looks good. October will be a huge month for news on COVID-19 solutions.

All the negativity on COVID-19 is coming from Europe because the data in America is quite good. There are now 29,448 hospitalizations which is up slightly from the recent low but continued to push the 7-day moving average lower. It will probably get below the late-June low later this month. There were 35,696 new positive tests which is good for a Tuesday which is usually the peak for the week.

Now there are 9 states reporting rapid test results. It’s still in its infancy though which is disappointing. There were 1,050 new deaths which is also relatively low for a Tuesday. This sent the 7-day average down to 735 which is the lowest since July 10th.

New Spending Plan

House passed a new spending plan to avoid a government shutdown (deadline was September 30th). This will now be voted on in the Senate where it should pass. Now the government won’t shut down until December 11th which is a minor positive. There is $8 billion in the bill for nutrition assistance for kids and families.

More important than this bill is that it gives the government time to pass a stimulus. Usually, the government waits until the last minute. Getting this done 8 days before the deadline could signal it is serious about passing a stimulus. There will at least be an attempt, but we're not sure how much faith to have on those prospects. At this point, passing basically anything will be considered a win by the market. Expectations are so low; they are through the floor.

Conclusion

We got some improved spending data in the 3rd week of September. Households aren’t indebted at all. COVID-19 deaths continue to fall in America, but investors are worried about Europe. October will be the most important month of the year in dealing with COVID-19 as there will be results from 2 vaccines and rapid testing will be expanded. In the final 2 months of the year, we have data on 1 more vaccine and 3 possible treatments.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more