The Biotech Growth Trust Industry Backdrop Remains Favourable

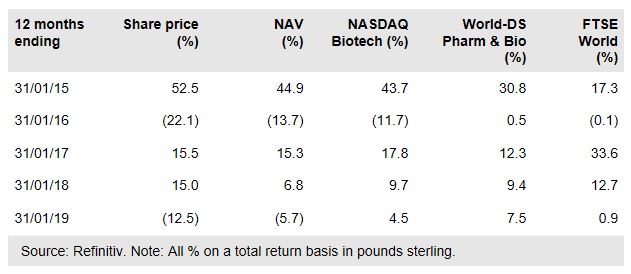

The Biotech Growth Trust (BIOG) is managed by Geoff Hsu and Richard Klemm at OrbiMed Capital, one of the leading global healthcare asset managers. The year 2018 proved to be tough for the trust’s performance as biotech companies delivering negative news were heavily penalised, while those delivering good news went unrewarded. However, the managers are optimistic about BIOG’s prospects. They cite a rich industry innovation pipeline that includes a series of technologies with multi-billion-dollar revenue potential; a favourable regulatory environment; and a higher level of deal activity, including major pharma company Bristol-Myers Squibb’s recent bid for Celgene (one of BIOG’s largest holdings) at a significant premium to its pre-bid share price.

Investment strategy: Rigorous bottom-up analysis

The managers are able to draw on the broad resources of OrbiMed to construct a diversified portfolio of biotech stocks, aiming to generate long-term capital growth. Potential investee companies undergo thorough fundamental research, which includes an assessment of their product pipelines. The portfolio typically has around 50 stocks and is diversified across the market cap spectrum; holdings can be classified in one of three ‘buckets’: large-cap, emerging and early-stage biotech companies. The majority of BIOG’s holdings are in US companies, which dominate the global biotech market, although the fund has exposure to other areas including Europe and China.

Market outlook: Supportive industry backdrop

During 2018, the high-beta nature of biotech stocks led to significant drawdowns during periods of stock market weakness such as in October and December. However, over the long term, the sector has outperformed the global equity market by quite some margin. Industry fundamentals remain robust, with innovative technologies under development and a supportive regulatory environment, and there appears to be an uptick in merger and acquisition (M&A) activity. These factors have historically been supportive for biotech share prices.

Valuation: Broadly in line with historical averages

BIOG is trading at a 6.7% discount to cum-income NAV, close to the middle of the 0.8% to 11.3% range over the last 12 months. Over the last one, three, five and 10 years the trust has traded at average discounts of 6.6%, 6.2%, 5.9% and 5.3% respectively. BIOG does not pay a dividend – it aims to generate capital growth and the majority of portfolio companies are early stage and investing for future growth rather than distributing income.

Investment strategy: Rigorous bottom-up analysis

The managers are able to draw on the broad resources of OrbiMed to construct a diversified portfolio of biotech stocks, aiming to generate long-term capital growth. Potential investee companies undergo thorough fundamental research, which includes an assessment of their product pipelines. The portfolio typically has around 50 stocks and is diversified across the market cap spectrum; holdings can be classified in one of three ‘buckets’: large-cap, emerging and early-stage biotech companies. The majority of BIOG’s holdings are in US companies, which dominate the global biotech market, although the fund has exposure to other areas including Europe and China.

Market outlook: Supportive industry backdrop

During 2018, the high-beta nature of biotech stocks led to significant drawdowns during periods of stock market weakness such as in October and December. However, over the long term, the sector has outperformed the global equity market by quite some margin. Industry fundamentals remain robust, with innovative technologies under development and a supportive regulatory environment, and there appears to be an uptick in merger and acquisition (M&A) activity. These factors have historically been supportive for biotech share prices.

Valuation: Broadly in line with historical averages

BIOG is trading at a 6.7% discount to cum-income NAV, close to the middle of the 0.8% to 11.3% range over the last 12 months. Over the last one, three, five and 10 years the trust has traded at average discounts of 6.6%, 6.2%, 5.9% and 5.3% respectively. BIOG does not pay a dividend – it aims to generate capital growth and the majority of portfolio companies are early stage and investing for future growth rather than distributing income.

Read the full report or download as PDF.

Disclaimer: Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. This material is being provided for informational purposes only and nothing ...

more