Qutoutiao Could Dip When IPO Lockup Expires

March 13, 2019, concludes the 180-day lockup period on Qutoutiao Inc. (QTT).

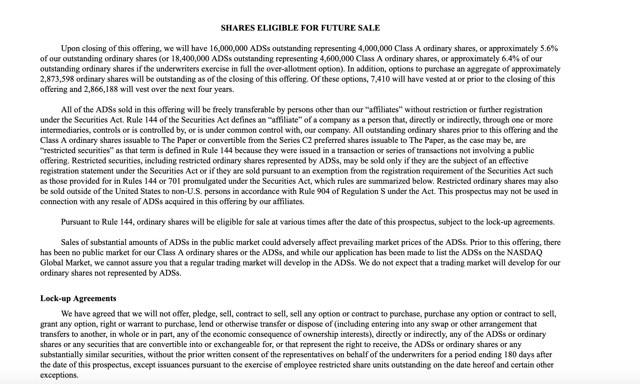

When the lockup period ends for Qutoutiao, its pre-IPO shareholders and company insiders will have the opportunity to sell large blocks of currently restricted stock for the first time. The potential for a sudden increase in stock traded on the secondary market may negatively impact the share price of QTT in the short term.

Currently, QTT trades in the $12-12.50 range. QTT had a first-day return of 128.1%. It has a return from IPO of 94.3%.

Business Overview: Content Platform in the People’s Republic of China

Qutoutiao is a mobile app that provides content such as articles and short videos to its users. The content comes from both freelancers and professional media. The company notes in its SEC filing that it is the number 2 mobile content aggregator in the country.

The content feed is adjusted in real time based upon each user’s behavior, profile, and social relationships using the company’s proprietary AI-driven content recommendation software.

The company launched in June 2016. By August 2018, it had approximately 62 million MAUs and approximately 21.1 million DAUs.

Qutoutiao uses a gamified loyalty program to increase its popularity and engagement. Registered users earn loyalty points by referring friends, consuming content, and engaging with the platform. The company reports that this loyalty program has a positive impact on keeping customer acquisition costs low while enhancing user stickiness.

Qutoutiao focuses on light-hearted content such as humor and human interest stories. The content generally comes from professional media and a base of over 230,000 freelancers registered on the QTT platform. In June 2018, the platform had around 6 million pieces of content added. Approximately 3 million of those were videos. In May 2017, QTT launched a mobile application enabling users to create and upload videos. QTT plans to diversify into other types of content, including casual games, literature, animations, live streaming, and comics.

Company information sourced from QTT's F-1/A and company website.

Financial Highlights

QTT reported the following financial highlights for the third quarter ended September 30, 2018:

-

Net revenues for the third quarter were RMB 977.3 million (US$142.3 million), for an increase of 520.3% from RMB 157.6 million

-

Advertising revenues were RMB 896.5 million (US$130.5 million) for an increase of 472.3% from RMB 156.7 million

-

Other revenues were RMB 80.9 million (US$11.8 million) for a considerable increase from RMB 0.9 million

-

Cost of revenues were RMB 153.8 million (US$22.4 million), an increase of 638.4% from RMB 20.8 million

-

Gross profit was RMB 823.5 million (US$119.9 million), an increase of 502.3% from RMB 136.7 million

Financial highlights sourced from QTT's company website.

Management Team

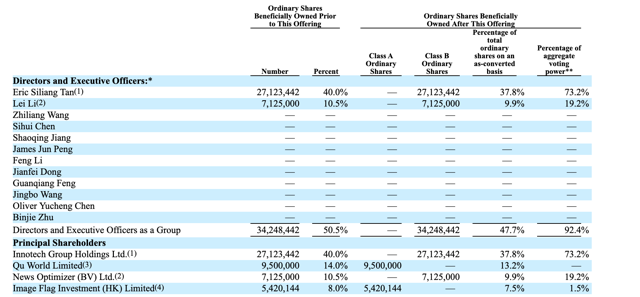

Co-founder and Chairman Eric Siliang Tan has over 12 years of experience in the Internet industry. He also serves as CEO of AdIn Media Ltd. His previous experience includes positions at Shanghai Shengyue, Wealink.com, 51.com, and Yahoo China. He holds a bachelor’s degree in engineering from Tsinghua University and a master’s degree in engineering from Chinese Academy of Sciences.

Co-founder and CEO, Lei Li, has over 10 years of experience in the Internet industry. His previous experience comes from positions at Anhui Aoding Information Technology, Shanghai Shengyue Advertising, and 51.com. He holds a bachelor’s degree in law from Open University of China.

Management information sourced from QTT's company website.

Competition: Tencent, Kuaibao, and News Providers

Qutoutiao faces competition from other mobile content providers such as Yidianzixun, Tencent (TME), Kuaibao, and Jinritoutiao. In addition, the compete for users with news platforms, including Phoenix New Media (FENG), NetEase News (NTES), Sohu News, Sina News, and Tencent News.

Early Market Performance

The underwriters priced the IPO at $7 per share, at the low end of its expected price range of $7 to $9. QTT had a first-day return of 128.1%. The stock began to decline afterwards to reach $4.15 on December 11, 2018. After recovering to $14.07 on February 12, it declined again, but the stock has a return from IPO of 94.3%.

Conclusion: QTT an Attractive Short Ahead of IPO Lockup Expiration

When the QTT IPO lockup expires on March 13th, pre-IPO shareholders and company insiders will be able to sell currently-restricted shares of QTT. This group of shareholders includes the company's management and several corporate entities.

We believe that these shareholders and corporate entities will be particularly eager to cash in on at least some of their gains since QTT has such a positive return - more than 90% - from IPO.

Significant sales of currently-restricted stock could cause a sharp, short-term decline in QTT share price when the lockup expires. Aggressive, risk-tolerant investors should consider shorting shares ahead of the March 13th lockup expiration. Interested investors should cover these short positions either late in the trading session on March 13th or over the course of the March 14th trading session.

Please note: Shares of QTT have been hard to borrow in recent days, so shorting the stock may require patience on the part of investors. Alternatively, investors might consider an options strategy that could provide short exposure.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this ...

more