Plant-Based Food Company Plant&Co Up 250% In Just 2 Months

There is a massive demand for plant-based foods across North America and that is benefiting constituent companies in the munKNEE Pure-Play Plant-Based Food Stocks Index (as reviewed in earlier exclusive TalkMarket articles on):

- Beyond Meat Inc. (Nasdaq Global Select:BYND) - see article here;

- Laird Superfood (NYSE American:LSF) - see article here;

- Else Nutrition Holdings (TSXV:BABY; OTC:BABYF) - see article here

- The Very Good Food Company Inc. (CSE:VERY; OTC:VRRYF) - see article here;

- Modern Meat Inc. (CSE:SUV; OTC:SUVRF) - see article here;

- Guru Organic Energy Corp. (TSX:GURU; OTC:GUROF) - see article here;

- Eat Beyond Inc. (CSE:EATS) - see article here;

- and now here is a review of the Plant&Company Brands Inc. (VGANF) which was added to the Index earlier this week.

The Growth of the Plant-Based Foods Market

- According to a recent survey by Fona International, 94% of Americans say they are willing to eat more plant-based foods;

- according to a 2019 food and health survey by the International Food Information Council Foundation, 24% of consumers say they are eating more plant-based protein than they were a year ago;

- according to the Plant Based Foods Association, the plant-based food market could be worth as much as US$27.9 billion in the next five years;

- according to Emergen Research, the plant-based food and beverage market is expected to reach US$32.29 billion by 2027;

- according to UBS the plant-based food market is going to grow from $5 billion to $85 billion by 2030;

- according to the Good Food Institute, 2019 was a record-breaking year for plant-based meat, egg, and dairy companies in the U.S.;

- according to Meticulous Research, the industry sector received a staggering US$741M in just the first quarter of 2020 compared to the US$747M received for all of 2019;

- according to Euromonitor International, plant-based meats sales, which grew to almost US$800 million in 2019 - up 37% from 2017 - could reach over US$2.5 billion by 2023 and,

- according to the Government of Canada report "Plant-Based Protein Market - Global and Canadian Market Analysis", the market is expected to reach almost US$11 billion by 2022 supported by a CAGR of 6.7%.

The Road to Prominence For Plant&Company

Given that plant-based foods and other products have become such an important part of health and wellness lifestyle choices in North America EuroLife Brands expressed plans to expand the scope of its target markets to include North America, and specifically Canada, in the near term and, to that end,

- announced late in August 2020 that it that it was acquiring 100% of Plant & Co Marche Inc., a privately held Canadian corporation which owned and operated "Plant & Co Marche" in Toronto, Ontario with a retail location offering niche products catering to health and wellness conscious consumers with a focus on plant-based, vegan, vegetarian, hemp, and specialty immune boosting products;

- announced on November 25, 2020, that it had entered into a "three cornered" amalgamation agreement among Plant & Co., Plant & Company Group Brands Group Inc. (a wholly owned subsidiary of Plant & Co) and Holy Crap Brands Inc. whereby a wholly-owned subsidiary of the Company would amalgamate with Holy Crap Brands to form a new division focused on creating innovative brands such as their Holy Crap cereal products with the intention of expanding both the product offering and total addressable market of Holy Crap and generate revenues in excess of $1 million in 2021 (The global breakfast cereal market size was valued at US$37.4 billion in 2016 and is projected to expand at a compound annual growth rate of 4.3% from 2017 to 2025.);

- announced on November 26th, 2020, that it would be changing its name to "Plant&Co. Brands Inc." and its ticker symbol in Canada to "VEGN" (not to be confused with the US Vegan Climate ETF which trades on the NYSEArca using the same symbol.;

- began trading on December 4, 2020 under the new name and symbol and with the new CUSIP number 72724R104 (see article on using CUSIP numbers to identify a security if you are an American trying to buy one of the above securities that is not listed on one of the major exchanges);

- announced on December 14th that it has closed its over-subscribed non-brokered private placement raising gross proceeds of $4,200,500;

- announced on January 6 that the Annual General and Special Meeting of Holy Crap shareholders had approved the three-cornered amalgamation;

- reported that its Holy Crap breakfast cereals sales were up almost 60% for the second and third quarters of 2020 compared to the same time period year prior and experienced a 95% increase in first time buyers online in the second half of 2020;

- announced on January 18 that it had agreed to acquire all of the issued and outstanding shares of YamChops, a Canadian company specializing in the preparation, distribution, and retail sales of over 17 proprietary plant-based meats, chicken, pork, fish, and various other vegan style food products through its business-to-business model based on four of the most popular food delivery platforms: Uber Eats, Skip the Dishes, Corner Shop and Ritual One, and its business-to-consumer revenue model through its retail location in the heart of Toronto's food district.

- announced on January 22 that it had been listed on the OTC with the symbol VGANF.

Stock Performance

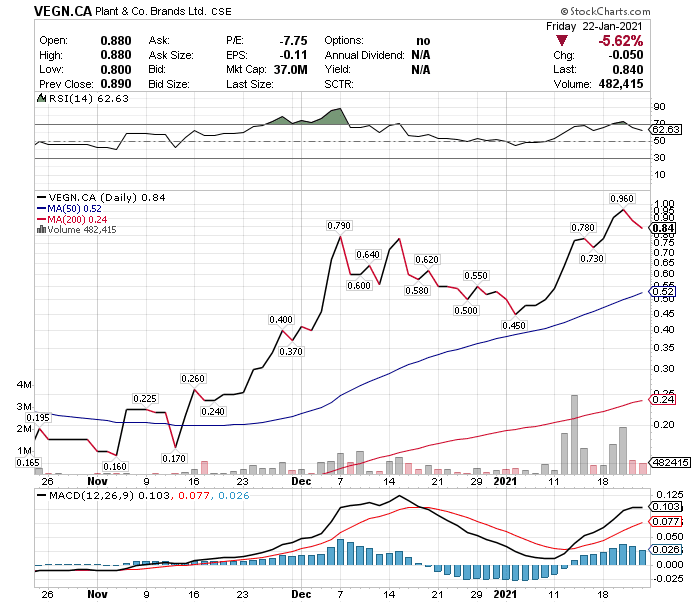

As illustrated in the chart below the "three cornered" amalgamation agreement between Plant&Co., Plant & Company Group Brands Group Inc. and Holy Crap Brands Inc. back on November 25, 2020, was the spark that lit up VEGN.CA's stock price and the purchase of YamChops has only added to its 250% stock increase over the past 2 months. The stock has been so recently listed on the OTC exchange with the symbol VGANF that the charts here have little to show so the Canadian chart below will have to do for the time being. The chart below is in Canadian dollars, so go here to convert prices to another currency if desired.

As always, please keep in mind that stocks that trade for less than $1/share (i.e. are penny stocks) are susceptible to manipulation by unscrupulous speculators and, therefore, it is incumbent upon you to do your own own due diligence before investing in the sector.

Disclosure: i was not compensated for writing this exclusive TalkMarkets article. I or my partners may now or in future invest in or have commercial relationships with one or more index ...

more

I see profits and share prices rising for all of these plant based food companies, and so it must be that the products are high profit ones. That is fine for those folks who have the money to spend on such products but it does not do anything for those folks who do not have the means to buy them.

So while the products have appeal and provide healthy meals they do not help the less fortunate hungry people.