Market Briefing For Jan. 13, 2020

Special Saturday commentary: as we were about to post the weekend report Friday night, the first glimmer of truth was emerging from a source in Qatar, suggesting that Iran was going to do what we implored them to do; 'man up and admit they shot down the Ukrainian jetliner'. So I held up the Daily Briefing to better see the revised backdrop.

Everything was prepared, including the videos; and I won't change them at all. I think it's self-evident as reflects where things appeared prior to the news.

By now we all know that Tehran (imagine the future for the officer who did launch the missiles) accepts responsibility and blame for the atrocity. It's highly unusual, perhaps unprecedented, for the theocratic regime; and it might be an overture for progress emerging from the disaster; though as I hope that's not just a dream, I could see how sobering this could be.

It's not just the awakening of 'some' Persians to the reality of demagogue, incompetent, aggressive, intolerant and corrupt governance, nor even the realization they cannot win (that's why confronting them matters) before it gets to the point of more overthrows or undermining of regional states as their use as their only effective weapon.. hence removal of Soleimani as part of that. Increasingly the masses in Iran realizing they've been played by their government, which can't even have decent command and control between civil aviation and the military; or a military over the IRGC's more radical elements. A high price to pay but the death of the beautiful people on the 737 may awaken a degree of humanity within Iran... we pray.

People can hate Trump. Fine. They can have an agenda to get rid of him. Fine. (If they don't realize what the alternative might be, since he is not a warmonger and that's clear by how he dangerously rolls the dice, but with a goal to end conflict.) However, in reading news this week, we know how vitriol by U.S. and Iranian sides is merely a 'superficial face' (like Twitter) and not the real story. Even anti-Trumpers, given a balanced view, might continue to hate or oppose Trump; but as Americans not to distort what's done to avoid compounding possibly earlier missteps (by both sides).

What am I driving at? Now we know that amidst ongoing accusations with Iran, that the Swiss in Bern were intermediaries, and Trump begged Iran to start deescalating; and that the Iranian Foreign Minister concurred with Trump; amidst the chaos that got so much fervor going in Tehran, as it all transpired, or those who don't understand the tactics, going nuts here.

This was several days before truthful admission surfaced today, of Iran shooting down the 737. I understand desires for political change; but also how Trump was truthful about 'other things' going on behind the scenes. It was the Swiss (known for confidentiality) and the now-recognized very private communiques between Trump, Pompeo and the Iranians, entirely absent of vindictive propaganda, and working toward stabilizing matters.

So what's my dream? Something else happened you likely know of now; the death of the 79 year old Sultan of Oman. He took over by coup years ago; but served as sort of a 'Switzerland of the Middle East', hence the meeting ground for all the players; Iran, Saudi Arabia, UAE, Iraq, even for the USA and Israel. His successor (he didn't leave an heir) promises that the same policies will continue; ie: communication between adversaries in one sense; but 'real politik' in another. Hence a way to keep order.

So, it is speculated that in the Sultan's Funeral, global leaders will attend. It means from Iran, Saudi Arabia AND the United States (probably UK & France as well). One can only hope that at the Funeral for the Sultan of Oman, our leaders recognize the precipice that region is hurtling toward, and actually meet to try to find some common ground to go forward. Or in the best of circumstances, with the mourning for the losses in the crash uppermost in whatever part of their brains is advanced and not mired in a 12th Century mentality, Iran consider actually moving towards peace; and I would say that to the Saudi's as well (mostly who attacked us on 9-11).

Personally I have no affection for intolerant Wahhabi Sunnis or Shia; and do respect 'real' Persians and Sunnis, such as in Jordan and Egypt, who cast extremism aside, tolerate other religions and human rights (more or less, but still backward compared to the more-civilized world), and realize that Trump, with all his faults, brings this forth as a means for extrication from the region; not further involvement. As frankly that was his pledge; and he's said that this week; if anyone listened and didn't gloss it over. In any event, it matters not if you like Trump or not; we are Americans and we grieve for what has happened; and finally a hint of grief emerging out of Tehran, while still spinning it somehow to cover their grave fanaticism.

Maybe the U.S. will sign an Alliance with Israel so she'll be protected, and otherwise wind things down? Ya think it's possible? Don't know; but think, wishful as it is, that if a 'summit' could be planned to sort all this out after the Funeral for the Sultan of Oman; perhaps in Switzerland or Vienna; it must might be a fitting memorial for the 176 victims of Iranian lunacy. In fact, it might be appropriate for everyone to meet in Kiev to ponder what's sensible for the future of mankind, and the region. And help move Islam a bit more into the 21st Century, as some have tried to do for years now.

My prayers and best wishes for the weekend; the rest of the report again follows without any changes. Sadly the world will 'superficially' jump back to the 'blame-game' but I refuse to give up on humankind progressing. Oh and yes, I think the S&P will bounce back at least temporarily.

Structural market strength - isn't 'essentially' sound based on valuation. It persists because of monetary policy perceived as an 'immovable force', and the perception that is unlikely to change basically for the whole year.

No denying the Labor Market and wage info was not constructive; but in a sense that keeps the Fed at bay and ironically slow growth persists as a plus for the market. If they ever get the growth Wall Street and Trump for sure calls for, then the market will be in-trouble because the Fed will have to reassess, more than simply vacillating about a lateral low policy. At the moment the market is sort of stalled, and that's not unexpected.

To summarize this week: up after a fast overnight purge on the war scare; then holding traction while looking at nuanced events; then DJIA hitting 29,000 (hooray sell celebrations) hence an up and then down Friday, very much as suspected, with a defensive posture going into the a jittery and uncertain weekend. Thus it was what I call a 'buyers strike'; not more.

As we get past the China signing; and providing geopolitics does little to ruffle things beyond hurling accusations, we could be another effort trying for higher highs, but not dramatically so. I suspect a renewed pullback will be due regardless of geopolitics or earnings expectations; but not horrid, not too dramatic and possibly firms right back up into early February. But then it gets dicier and we'll assess risk (technically and event-driven as it all evolves). There's no plunge of great drama likely 'yet'; especially with so many skeptics .. watch the 10 year of course and get more nimble if you're a trader.Of course focus on fundamentals in certain areas. If you do wave counts or so on; technically a short-term contraction's near.

Of course the Fed 'is' about done; the ECB is looking at 'emerging' from a suppressive low and negative interest rate policy, while everyone forgets the stock market (TINA for now... there is no alternative) as a 'discounting mechanism', may not conform to the standard idea of Goldilocks to 2021. But that doesn't mean even if we get a full correction; that it's other than a pullback just enough to get people negative, before upside returns.

I'm fine should that be the case: after all we're among the few (near only) analysts viewing Christmas Eve of 2018 (not 2019) as a 'cycle low' that represented the troughing for the majority of downtrodden stocks that had corrected during the 'Rinse & Repeat' (I named 2018 a Maytag) market, andcalled it) and it lasted until late 2019. So sure, 'relatively', lots looks a bit better, but be careful before concluding too much from minor moves.

Yes about 80% of stocks overall are above their 200 Day Moving Average now; but that doesn't mean as much as cynics say, because they were so low for so long. Again the market 'peaked' back in January of 2018 for the 'real' market internals; and thus a large majority in the interim (which is almost two years keep in mind) were in correction or just languishing.

So with nominal small-cap rebounds, it technically looks more significant with cursory glances. Now for FANG types; sure that's supposedly where the growth is (not so much; also the buybacks), and yes there you'd have a real case for an overbought market (if the S&P were the entire or whole enchilada); but it's also risky, given the easy-decision managers have, by just chasing those sectors (hence debates among analysts about stocks like Apple (AAPL), which S&P really hinges its hopes on; excessively).

The conventional view of this market of as a 10 year or longer cycle sure continues predominate; but we believe it's applicable primarily to FANG types as noted; and others that comprise the small group of stocks that led the serious upside in the S&P or NDX, but not for the broader market. A look at Apple alone is a great example of how they guided this market, as it's the single biggest (capitalization) influence on the S&P or NDX.

One thing that can help the market stay 'sort of' alive this year is rotation, as I have described, with some 'heavy lifting' by the FANG types assisted by the broader participation of the myriad of ignored stocks. Also if you're able to get Energy (not just Oil stocks) firming, along with Financials a bit more; that will help. But a few component issues firming matters too. All of it is not going to prevent corrections; even now; with one of 5-10% due; and of course we don't require a decline to be of any particular degree as we listen to the market's messages to ascertain when it's done. We have and will suggest possible measures as things evolve.

Furthermore, though it appears unlikely so far, if over some period of time Boeing (BA) is able to emerge from the incredible pressures, that it deserves (quite frankly, as we've often assessed before media focused on design and aerodynamic 737 Max problems they still won't confront), you might see a surprise helpful contributor to the DJIA.

Boeing hasn't dropped as much as I would have preferred (and we do not trade BA); but all they need do .. really must do ..at some point this year is unveil a 797 (a new planned-for aircraft that uses the newer composite materials and passenger-healthy pressurization that I have occasionally mentioned) or whatever they want to call it. That's why airlines like Delta (DAL), which does not own or operate 737 Maxes, want Boeing to step-up and try to look forward amidst all these conflicting pressures. (It's beyond the need for two viable competing manufacturers though that's part of it; and Boeing will be here for sure; but we need the spirit and vitality to step-up and do an advanced design that many older executives at Boeing clearly preferred before the ridiculous design of the 737 Max.)

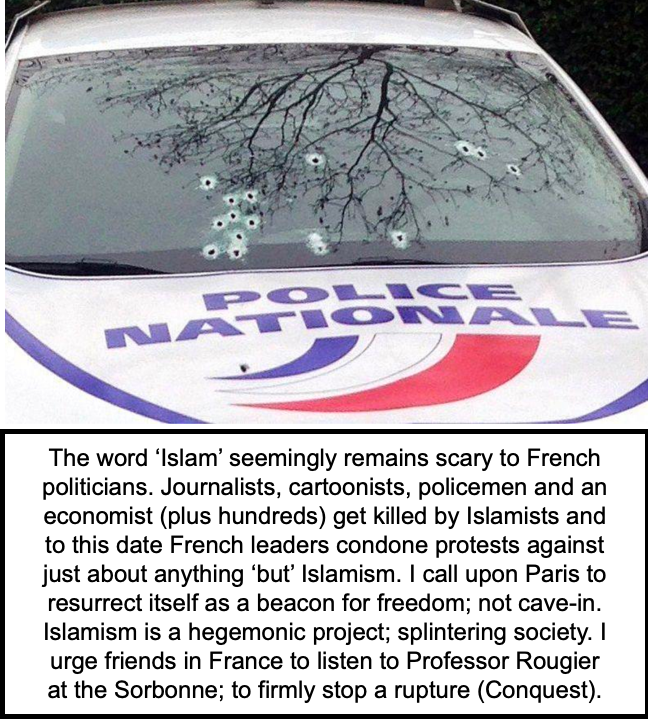

Meanwhile the 737 that crashed in Iran (a 737-800 NG which has a solid safety record) was pretty obviously shot-down it appears; and we were a bit bold (but apparently correct) in posting the pictures we did a day or so before mainstream media moved in the same direction.

Hearing a few of the official (and politically weak) apologists out there for Iran, is sickening; as all they care about is their image; I don't even hear them expressing sorrow or compassion for the victims. At the same time they're busily destroyed evidence by sanitizing (now bulldozing) the crime scene. What they've done is a crime beyond stupidity arguably occurring in other military 'inadvertent' attacks against commercial aircraft; given the 737 was in ascent from the main airport runway; not descending and not a threat but obviously taking-off. If Iran is so worried about liability the new sanctions should contribute to their leadership's sobering isolation.

I've also talked about Oil and I think the price ranges I mentioned several times recently (with higher highs and higher lows; but not dramatic swing move other than when geopolitical issues compel), makes some sense.

In-sum: the market hesitates ahead of a military and psychological type of weekend. There is an awareness that just because no Americans were killed by the missile attack, doesn't mean Iran didn't desire that, despite a few misgivings and debates as to whether they 'intentionally' mis-targeted the bases (pictures suggest they meant to harm; but there were warnings relayed by Iraqis who got a call 3 hours earlier that the attack was 'on').

Next week gets interesting for 'relatively normal' market influences; shall we say at least so far (?). Those don't include Impeachment which isn't a market factor for now (might change; hasn't yet as outlined all along). We have the JP Morgan health and biotech conference to watch and Amarin and it's generic interlopers convening in Reno for a Court hearing. If that drags on it's a negative; if it's resolved or settled in a way favorable to the Amarin team (shall we say similar to Teva's deal) then it's fine.

There's a bit of conjecture out there suggesting no buyout forthcoming or we'd have heard about it. I'm unsure about that; if Amarin goes it alone it is a longer process but perhaps more profitable (but riskier given that lots of others are aiming at cardiovascular treatments, where heretofore most had basically minimized it in-favor of expensive rare disease drugs). The reason, by the way, is that a mass market product, like statins, becomes a generic soon enough; and that's why they're caught-off-guard when a single drug like Vascepa shows up. So they want to minimize its impact, or perhaps get on-board. But they'd want to do so 'after' generic litigation is sorted-out, which makes the outcome of Reno potentially important.

I also hope JT (the CEO) doesn't undermine his own company by stoking modest expectations as he talks of higher overhead, slow take-up (which is not the case) and perhaps provides an explanation beyond the usual in regard to insider sales. Otherwise he gives the impression of limited gain potential. For now we continue optimistic (wish some cushion since our buy was as it competed the double-bottom in the 14-15 area last year). I would like to see not cheer-leading; but guidance towards better progress to enhance shareholder value; especially shareholders entering later or for that matter now.

Bottom-line: market momentum is stalled a bit; and in a sense that's sort of a plus, because it takes the edge of overbought conditions without big spikes or drama.

(Overall Reflections via Friday's Midday video.)

Daily action - closely followed our general idea for Friday; new highs for the DJIA (not very relevant); and then gradually defensive ahead of what of course is both a militarily and psychologically sensitive weekend.

Regardless of that, I thought there was no reasons for assuming traders would embrace big new positions ahead of the weekend tensions; so an absence-of-bids mostly was the characteristic in the afternoon. Absolutely nothing in the news to cause 'an investor' to anticipate anything coming that's already not in the mix.

Heaven knows there was enough fluctuating in the week just past; and as suspected, the military action actually created a washout and rebound of course; but nothing particularly sustainable, and that's in either direction.

The new week has plenty to focus on as I've already noted: ranging from Iran, Iraq, possible encounters over the weekend; to (for Amarin holders) an important Court Hearing in Reno (remember Amarin is the plaintiff in this; alleging infringement by the generics); where early hints one 'thinks' has the Judge not wanting to upset hundreds of US Patents, which could be the outcome were she to rule against Amarin. She probably won't but might compel them to enter some sort of settlement negotiation.

CVD generics get to show up soon enough, which is part of why few firms have invested in markets for mass proactive preventative drug treatment such as CVD treatments; which is a shame (they seek extreme profits in drugs for rare conditions). However this market is so huge and potentially Vascepa (Amarin's sole product) has efficacy in other conditions; so that the industry is fairly shell-shocked not just by REDUCE-It trial results, and wider-label approval granted last month; but also an interim EVAPORATE glimmer, which showed (CT & MRI studies) significant plaque regression. That implies 'potential' efficacy for early-onset dementia or Alheizemer's; plus there's the NASH Trial that added Vascepa to treat 'fatty liver', and it is an expectation we hadn't thought of, but obviously Gilead (GILD) considered.

Oh next week... yes there is also something ongoing about 'Impeachment Trial', and witnesses or not; for now the market isn't showing real concern about this. Probably (again) the ultimately-decided Democratic opponent will be the key issue triggering some angina or calm by the markets..

Friday was an outside-down-day (higher high, lower low and lower close) but.. I question the sustainability of the expected defensive up-down day, because of the military weekend we're entering; and the prospect of the signing of the China deal at least creating a relief rebound.

Prior highlights follow:

Defusing anxieties - resulted in a dramatic overnight turnaround, which was signaled immediately by reports of 'no American' causalities; then of course affirmed by the President's 'all's well' (sort of sleep well) tweet. So the early speculation was that Iran intentionally targets the missiles for a series of 'near misses' (or more properly said, 'near hits'). While there's a debate ongoing about that; video shown by networks affirms that craters were clearly 'on' the Base, just just near. Hence they tried to inflict harm.

Nevertheless tensions are eased, but not replaced. The public statement around 11 am ET was both a palliative for Americans, and clearly aimed to be sobering for our NATO allies (plus Russia and China); while inviting Iran to mature and move towards peace and harmony; not insane vitriol. At this point while everyone catches their breath and the market's breadth concurrently, there's no assurance of a period of stability, though clearly it was Trump who threw it back in Iran's court via his slightly magnanimous remarks, again aimed at the citizens of Iran, if they could hear it.

The crisis isn't evaporated; but is short-term deescalated; while of course continuing to give Iran a shadow of plausible deniability when (not if) their proxy forces engage in more pinpricks against our allies in the region. It's hard to tell if the request for NATO involvement evokes the idea of getting their cooperation on dropping the 'nuclear deal' remnants with Iran, but also becoming more involved as intermediaries, to work toward peace.

That's not out of the question, as Putin tried to offer his 'services' while he stood next to Erdogan today. Remember, Putin flew to Syria yesterday as he was possibly in-the-air flying back to Moscow when the missiles flew. I think he too is aware of Russia's benefit in the Syrian power vacuum that we created by a staggered withdrawal and Russia is still shopping S400's (their anti-missile system) to countries in the region; including Iraq.

Again I believe Trump;s comment was aimed at the Iranian people; and if their horrible theocratic regime allows Trump's Address to be carried on their television networks (that's why Trump said some things; that's really the audience he wanted to hear it, and that's a good thing).. if so they got a message that the United States wants to see them prosperous or even rejoin the family of nations in a 'normal' cooperative way. Trump looked a bit pale, both today and in the Situation Room last night, as he grasps the severity of the evolving situation; which 'at best' rescinds to a standoff.

Of course that hints at support for opposition elements; though frequently opposing the Iranian mullahs just gets one imprisoned or killed given that horrible Islamic environment. That's clearly the 1500 protestors killed that Trump referred too. Also note that on the Ukrainian Airlines Boeing 737 that crashed (we suspect shot-down by trigger-happy jittery Iranians, and a complacent air-traffic-control that shouldn't have allowed commercial or other flights to resume so quickly).. on that flight over half were holders of Canadian passports. And most were students on an Exchange program.

Canada is home to the largest Iranian diaspora (it's said to exceed even Los Angeles); and so this is actually the largest 'loss' of Canadians (or bi-nationality residents of Canada) in any commercial airline crash perhaps. The refusal of Iran to allow Boeing or investigators to inspect the crash scene suggests some sort of cover-up (residue of any explosive device or the black box might very readily reveal the truth -as does shrapnel holes found in videos of the wreckage- as it was not at a high enough altitude to suffer extreme decompression; so it argues at least the real possibility -as Kiev also hints at- that it was shot down by trigger-happy Iranians).

In-sum: we got the 'carrot-and-stick' approach from the President; and of course that was balanced and about the best one could hope for. Clearly responding to that, Oil dropped, and the S&P immediately went to record highs. That's partially a short-squeeze, as not that much changed overall aside no immediate engagement; as it remains to be seen if the follow-on action from Soleimani's rabble or organized militias rises to a high level.

In the right sequence the market can handle this and focus on China; for sure it remains as the primary consideration aside exogenous events that interrupt the market's tactical ideas of holding together. The instinct that's got traders buying the huge (FANG type) old leaders is questionable with those being less attractive valuations (relative to potential gains); at the same time that's just what the doctor ordered for new recovery highs.

(What the doctor didn't order was a fake news story United Healthcare moving Vascepa to a non-preferred tier on their formulary; which means higher co-pay. Hard to say if it indicating they aren't enthused about it; or the opposite..'greed' if they realize it will be broadly prescribed and wish to increase their profit).

Bottom-line: stock market resilience is not so amazing when one looks at how this is played; and how wrong-headed shorts into weakness easily can be; something we warned about not just last night but regularly.

When another attack occurs; traders will 'assume' the similar pattern as a probability; down; then sharply up. One should not assume that because it is absolutely uncertain what interdiction or attack may occur; and/or if the President responds aggressively (depends what it is).

Conclusion is similar:

There's no catalyst to warrant committing new funds as yet; although I expected 'recent' extensions, and leaned very clearly towards a China Deal coming; with initially higher S&P records. If anything I've been conservatively optimistic and reiterated the old sayings: 'don't fight the tape', and 'don't fight the Fed'.

It's all on-top of capturing the entire gain on the number 1 stock: AMD (AMD); and presumed additional gains ahead (over time) for Amarin (AMRN). And this year the rocky start (fling sort of an S&P flail) followed immediately by a controversial undertaking in the Persian Gulf, has various aspects or outcomes that we'll try our best to follow as impacts markets.

We remain circumspect while market stresses were notably alleviated by making a 'Phase One' deal with China (superficial or not); while of course near-term Middle East chaos throws a wrench into behavior of the market and more uncertainties to contend with ahead.