Dividends, Dividends, Dividends

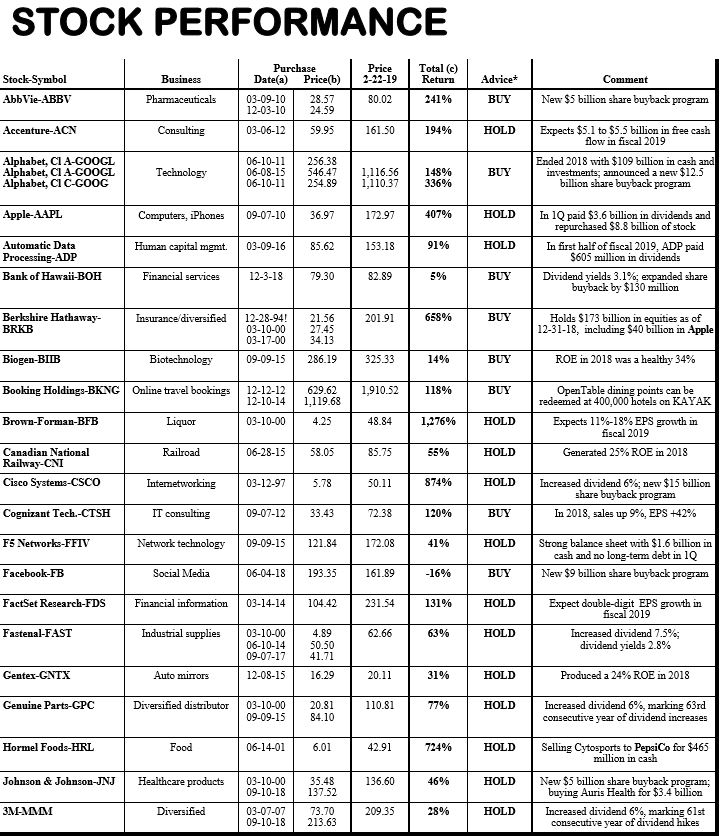

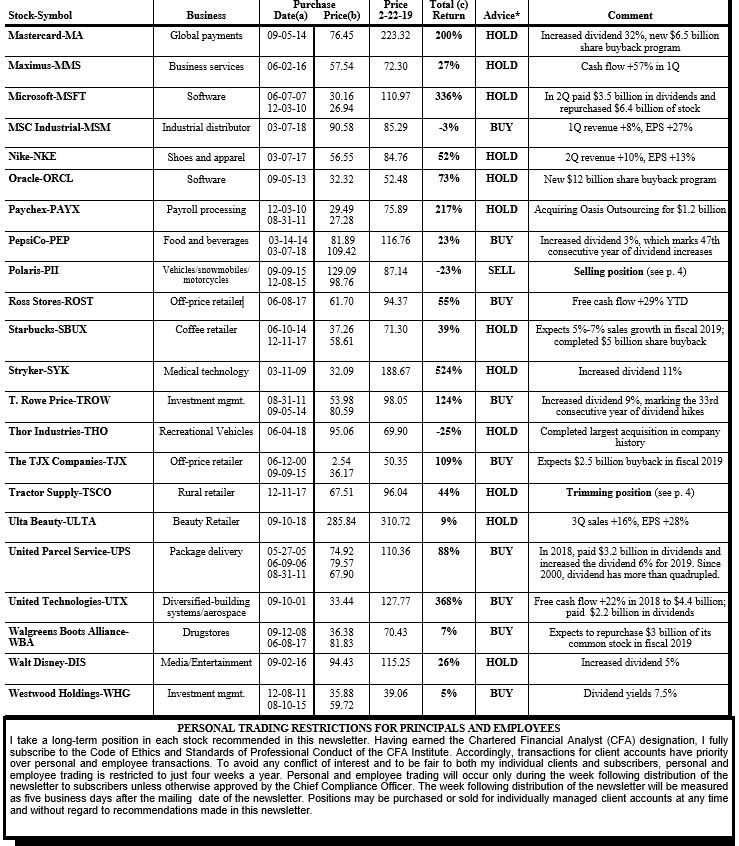

A key task of management is to carefully allocate a company’s capital between investments in the growth of the business and distributions to shareholders. With strong cash flows and sturdy balance sheets, our high-quality companies have the financial flexibility to simultaneously reinvest for growth while also returning value to shareholders. Although we do not require a dividend before making an investment, most of our companies have the financial strength to pay a dividend. A good example is Apple (AAPL), which did not pay a dividend when we initially purchased the stock. Today, Apple is the world’s biggest dividend payer having paid nearly $78 billion in dividends since fiscal 2012 along with spending $247 billion on share repurchases.

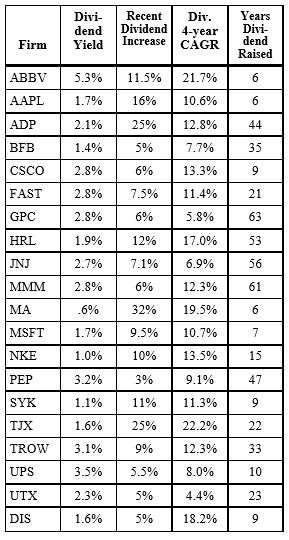

The 20 HI-quality companies in the accompanying table demonstrate desirable dividend traits in terms of current yield, inflation-beating growth and consistent annual increases. In fact, several of the companies, such as Genuine Parts (GPC), Hormel (HRL), Johnson & Johnson (JNJ) and 3M (MMM), have increased their dividends each year for more than half a century. Thanks to record earnings and cash flows, Hormel announced a meaty 12% increase in its annual dividend, marking the 53rd consecutive year of dividend increases. This is the 10th consecutive year of double-digit dividend increases and the 90th year Hormel has paid a dividend. Paying a dividend every year since 1948, Genuine Parts increased its dividend 6%, representing the 63rd straight year of dividend increases.

3M recently boosted its dividend 6%, marking 61 consecutive years of dividend hikes. 3M has paid dividends without interruption for more than 100 years. UPS recently increased its dividend by 6% resulting in a current yield of 3.5%. Since 2000, UPS’s dividend has more than quadrupled. The TJX Companies increased its 2018 dividend a dressy 25%, marking 22 consecutive years of dividend increases with the dividend impressively compounding at a 23% annual rate for more than two decades. Further rewarding shareholders, several of the companies also periodically pay special dividends

like Brown-Forman, Fastenal, Microsoft, T. Rowe Price and United Technologies. Companies which boost their dividends on a regular basis signal management’s confidence in the future of the firm. With durable competitive advantages, all these firms have shared theirprofits with investors no matter what the economic climate, whether it be inflation, deflation, recession and/or popped asset bubbles. Steadily growing dividends provide powerful returns to long-term investors while mitigating volatile market conditions—a divine dividend combination!

Hopping Off Polaris

For the full 2018 year, Polaris Industries (PII) revenues rose 12% to $6.1 billion with adjusted EPS up 29% for the year to $6.56 thanks in part to tax reform and the financial results from the acquisition of Boat Holdings.

During the year, Polaris Industries acquired Boat Holdings, a leading pontoon boat manufacturer, which increased the company’s debt load significantly. Return on shareholders’ equity in 2018 was 39%, reflecting a boost from higher leverage. Free cash flow declined 37% during the year to $252 million due to a big jump in inventories and higher capital expenditures. Polaris expects capital expenditures to rise further in 2019.

During the year, the company paid $149 million in dividends and repurchased $349 million of its common stock. Polaris Industries recently approved a 2% increase in the dividend, marking the 24th consecutive year of dividend hikes. During 2019, management expects to give debt repayment a priority over share repurchases.

The company announced its adjusted sales and earnings guidance for the full year 2019 with adjusted sales expected to increase in the range of 11% to 13% and adjusted net income expected to decline 5% to 9% to the range of $6.00 to $6.25 per share due to the impacts of tariffs, adverse foreign exchange and higher interest rates.

With free cash flow declining, debt increasing significantly and earnings in fiscal 2019 expected to be down once again, Polaris Industries’ business fundamentals have deteriorated.

We have decided to hop off Polaris Industries by selling the stock with a 23% loss after a disappointing three year ride.

Tractor Supply Harvesting Profits

Tractor Supply (TSCO) reported fourth quarter sales increased 9% to $2.1 billion with net income up 25% to $136.9 million and EPS up 28% to $1.11. Earnings from the prior year include a charge of $4.9 million, or $.04 per share, related to U.S. tax reform. Sales growth was driven by a solid 5.7% increase in comparable store sales growth consisting of a 3% increase in the average ticket and a 2.6% increase in customer transactions. All geographic regions and all major product categories had positive comparable store sales growth. The company opened 17 new Tractor Supply stores and four new Petsense stores in the quarter and closed 10 underperforming Petsense stores.

For the full year, sales increased 9% to $7.9 billion with net income up 26% to $532 million and EPS up 31% to $4.31. Return on shareholders’ equity for the year was a strapping 34%. Free cash flow increased 9% to $416 million during the year. The company paid $147 million in dividends and repurchased $350 million of its common stock at an average price of $70.14 during the year. Since inception of the repurchase program, the company has repurchased $2.5 billion of its stock with $520 million remaining authorized for future share repurchases.

For 2019, management expects revenues of $8.31 to $8.46 billion with EPS in the range of $4.60 to $4.75 reflecting earnings growth of 8.5% at the midpoint. Comparable stores sales growth is expected to be in the range of 2% to 4% with 80 new Tractor Supply and 10 to 15 new Petsense store openings.

We planted seeds with Tractor Supply 15 months ago, and our total return has grown 44% over that period. With the stock now appearing fully valued, we plan to harvest some profits by pruning back our position.

Johnson & Johnson $3.4 Billion Acquisition

Focused on creating the next frontier of surgery, Johnson & Johnson (JNJ) entered into an agreement to acquire Auris Health, Inc. for approximately $3.4 billion in cash. Additional contingent payments of up to $2.35 billion, in the aggregate, may be payable upon reaching certain predetermined milestones. Auris Health is a privately held developer of robotic technologies, initially focused in lung cancer, with an FDA-cleared platform currently used in bronchoscopic diagnostic and therapeutic procedures. This acquisition will accelerate Johnson & Johnson's entry into robotics with potential for growth and expansion into other interventional applications. Johnson & Johnson continues to make meaningful investments to transform the surgical experience, connecting digital solutions to enhance surgical performance. The transaction is expected to close by the end of the second quarter of 2019. Hold.

*******

Raytheon - A New Buy

With the proceeds from Polaris and the profits from Tractor Supply, we plan to buy Raytheon (RTN). To read that article, click here.

Disclosure: None.