Britvic: A Steady Start To The Year

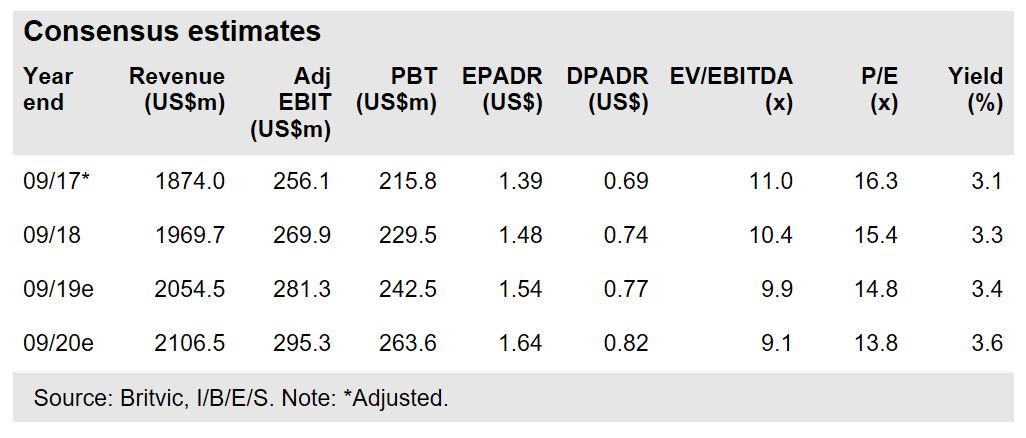

Britvic’s (BTVCY) Q1 trading was in line with expectations, with organic constant currency revenue growth of 1.5% excluding the soft drinks levies, and reported revenue growth of 4.5%. With five-year EPS CAGR of 9.8%, DPS CAGR of 8.9% (to September 2018) and debt within the target range, this is a textbook consumer staples company. During FY19, the business capability program is due to be completed, bringing higher capacity and increased flexibility to the company. Trading at 9.9x consensus FY19e EV/EBITDA, the shares offer interesting value.

Light on detail but performance in line

Following feedback from shareholders, Britvic’s management has decided to scale back the level of detail disclosed with its trading statements, hence brand and regional performance are no longer supplied on a quarterly basis, with the intention of focusing more on the longer term. We believe the trends witnessed towards the end of FY18 are likely to have continued: geographically, we would expect France to have remained slightly weaker, while the businesses in Great Britain and Ireland would have continued to win market share. We believe the business capability program implementation continues on schedule, with the commissioning of new lines, and a new warehouse in Rugby becoming operational later this year.

Strategy: Good shareholder returns

Britvic’s strategy revolves around four key themes: (1) generate profitable growth in core markets; (2) realize global opportunities; (3) step-change its business capability; and (4) build trust and respect. This has generated good returns with a five-year EPS CAGR of 9.8% and DPS CAGR of 8.9%, and management believes it will continue to be a winning combination to deliver dependable and profitable growth.

Valuation: Reducing leverage and sustained growth should narrow discount

Britvic trades at a consensus FY19e P/E of 14.8x, a 31% discount to the UK beverages sector, and a 35% discount to AG Barr (calendarized), reflecting its geared balance sheet, partial ownership structure and steady earnings growth. However, we believe that with sustained earnings and income delivery, and reducing balance sheet leverage, those discounts may narrow.

For full report click here.

Disclaimer: Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. This material is being provided for informational purposes only and nothing ...

more