Yen To Strengthen Amid Fed’s Policy & Risk-Off Sentiment

With Fed’s rate cut discussion on the table, USD/JPY could continue to tank.

More Fed officials are joining the “dovish team” as global risks elevate

The US jobs report bolstered views that the US economy is rebounding from a soft patch but not enough to revive inflation. Meanwhile, risk-off sentiment across the world are pushing the yen higher.

The surprisingly strong payroll gains of 263,000 in April and the unemployment rate reaching its lowest since 1969 calmed some fears that a recession could be brewing. Meanwhile, the lack of a surge in wages kept speculation alive on Wall Street that the Federal Reserve will still be forced to cut interest rates. Traders maintained bets on Fed to lower rates by mid-2020, and White House Economic Adviser Larry Kudlow said he thinks the central bank will eventually make a reduction. For now, Fed Chairman Jerome Powell will likely feel validated in having resisted such pressure. Powell said officials wouldn’t ignore inflation that ran too low for too long below their 2% target but argued price pressures should be supported by a healthy economy and historically low unemployment rate. Data released on Friday have shown surprisingly strong hiring and cooler-than-projected wage gains, suggesting the hot labor market could extend its run.

However, two Federal Reserve officials laid out the case for a possible interest-rate cut just days after Chairman Jerome Powell said there was no reason to move in either direction. St. Louis Federal Reserve Bank President James Bullard and Chicago Fed President Charles Evans, both policy voters this year, expressed caution last Friday over weak prices and said that the central bank might have to act to lift inflation out of a persistently low trend.

That contrasted with Powell’s dismissal of the most recent dip in inflation readings as temporary during his press conference on Wednesday after the Fed held rates steady, pushing back against external pressure for a cut from traders and President Donald Trump. Inflation excluding food and energy prices slowed to 1.6% in the 12 months through March compared to 1.95% in December.

A diversity of views among officials is not uncommon at the central bank. Still, those views so far have not led to any dissent by policy voters since Powell became chairman in February 2018. Furthermore, during the post-meeting press conferences, he has not conveyed much sense of the variety of views on the Fed, which are more apparent in meeting minutes released with a three-week lag.

There might be an obvious reason for the unity around Powell at this time. The Fed has suffered a barrage of attacks from Trump and others in his administration, who are demanding that Powell cut rates. The drumbeat continued on Friday when Vice President Mike Pence told CNBC that low inflation means “this is exactly the time, not only to not raise interest rates but ought to consider cutting them.”

Our Picks

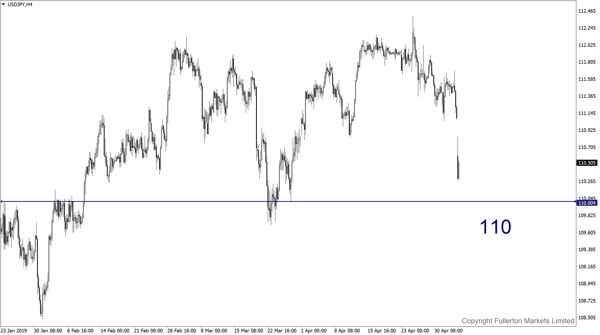

USD/JPY: The pair may drop towards 110 amid fresh trade war concerns.

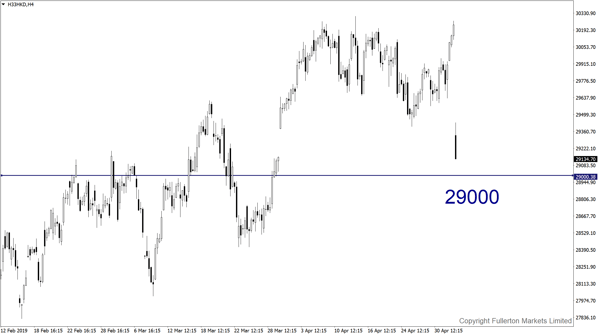

H33/HKD (Hang Seng Index): This pair may drop to 29000 this week after the Shanghai composite index broke the key 3000 level support.

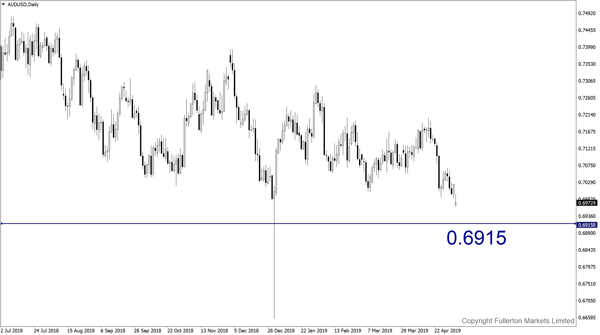

AUD/USD: This pair may drop towards 0.6915 as global investors are selling stocks due to risk-off sentiment.

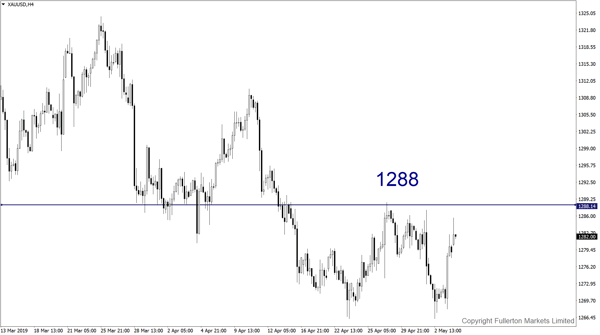

XAU/USD(Gold): This pair may rise towards 1288 this week.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more