Wuhan Worries

Energy

Energy markets came under pressure yesterday, with ICE Brent settling almost 1% lower on the day. This downward trend has continued in early morning trading in Asia. The more recent pressure appears to be reflective of growing concerns over the Wuhan virus outbreak, and the potential hit this may have on growth. This was evident in Asian equity markets yesterday, which all closed lower as the epidemic spread and fears grew. However, could markets be overreacting to the virus? Read what our Asian chief economist thinks.

Moving back to oil fundamentals, and yesterday the EIA released its Drilling Productivity Report, in which they forecast that US shale production would increase by 22Mbbls/d over February to 9.2MMbbls/d, with increases driven predominantly by the Permian, and to a lesser extent the Bakken region. Meanwhile, unsurprisingly, the number of drilled but uncompleted wells (DUCs) continued to decline over December, falling by 50 to total 7,573. The US DUC count has fallen by 900 since May 2019, highlighting the slowdown in drilling activity in the US, and this is something echoed by the oil service industry, with Halliburton taking a US$2.2bn impairment charge over 4Q19, owing largely to the shale slowdown in the US. With most signals pointing towards a slowdown in US activity, this calls into question the EIA’s crude oil production growth forecast of a little over 1MMbbls/d in 2020. Any downside surprises to US output will obviously tighten the global oil market, and as a result, reduce the potential cuts we would need to see from OPEC+.

Meanwhile, the gasoil market remains weak. In Europe, the spot crack is now trading below US$12/bbl, and the prompt time spread continues to edge deeper into contango. This is all reflective of a market which is well supplied, and speculators have also started to add to the weakness, by liquidating longs in recent weeks. The weakness in the gasoil market has surprised many, with expectations that it would get a boost from IMO 2020 shipping regulations. However, clearly, that has not been the case, with the industry appearing more comfortable to use very low sulphur fuel oil rather than marine gasoil. This is even the case in Asia, where Singapore VLSFO is trading at a premium to gasoil. The outlook for middle distillates is clearly not as constructive as many had initially thought, but there is some pressure from NGOs to ban low sulphur fuel blends that increase black carbon emissions. Any momentum with this issue could see demand for middle distillates benefitting.

Looking ahead to today, the API will release its weekly US inventory report later on, and market expectations are that crude oil inventories increased by 1MMbbls over the last week. Meanwhile fairly large builds of 3.16MMbbls and 2.5MMbbls are expected for gasoline and distillate fuel oil respectively.

Metals

The base metals complex was generally weaker yesterday amid growing concerns over the Wuhan virus outbreak and its potential economic impact.Copper took a further hit, following significant inflows of the metal into LME warehouses, with stocks increasing by almost 39kt (biggest intraday addition since Mar'19), and taking total inventories back to levels seen in mid-December. LME 3M copper sank to an intra-day low of US$6146/tonne, and settling 1.58% lower for the day. Meanwhile, aluminum inventories continue to flow outwards, declining by 18.6kt yesterday (largest since May’19) to 1.31m tonnes.

As per the latest NBS data, monthly copper output in China reached an all-time high of 930kt in December, up 11% YoY due to the continued expansion of the domestic smelting industry. This took full-year production to a record high of 9.78mt in 2019. Among other base metals, monthly outputs of zinc and lead also touched record highs to stand at 607kt (+19% YoY) and 595kt (+6% YoY) respectively in December.

Turning to precious metals, the latest data from the China Gold Association shows that total gold consumption dropped by almost 13% YoY to 1,003t in 2019, marking its first annual decline in three years, and reflective of stressed economic conditions and the higher price environment. Jewelry consumption in the nation declined by more than 8% YoY to 676t, with higher prices holding back consumers, while bar and coin demand also fell sharply by 27% YoY to 226t. Given spot gold prices are expected to remain fairly well supported over the year, this is likely to continue weighing on physical gold demand.

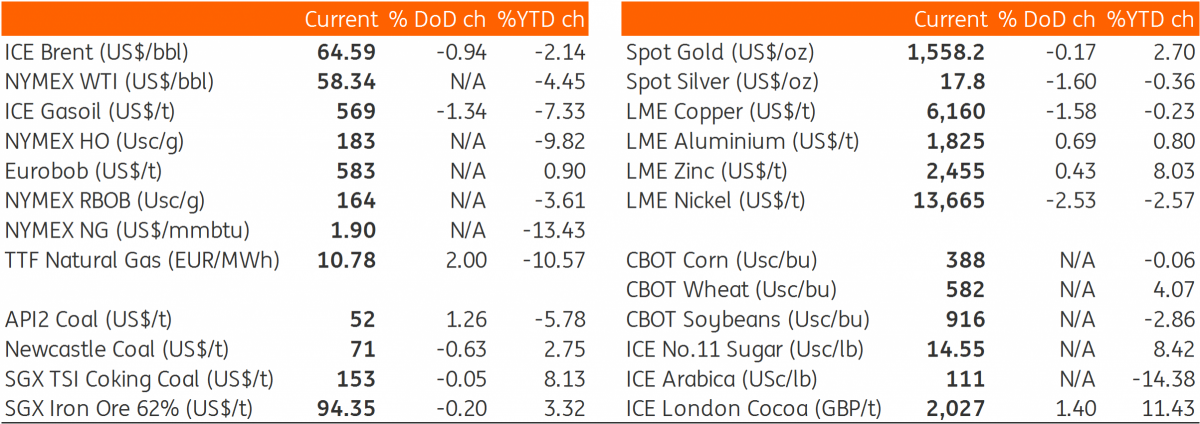

Daily price update

(Click on image to enlarge)

Bloomberg, ING Research

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more