WTI Slips From 12-Week Highs After Surprise Crude Inventory Build

Oil prices held near three-month highs today, helped by OPEC+ production plans, trade deal optimism, and, as we will see tonight, hope that inventories are starting to drop.

“For the market to push even higher, the key element is the signing of a trade agreement” between China and the U.S., said Gene McGillian, manager for market research at Tradition Energy.

“That will rekindle expectations of economic growth and fuel demand growth.” Nevertheless, “we don’t have proof that there’s actually going to be a trade agreement,” he said.

After rising for 10 of the last 11 weeks, crude inventories are expected to decline for the 2nd week in a row...

API

- Crude +1.41mm (-2.5mm exp)

- Cushing -3.53mm

- Gasoline +4.92mm

- Distillates +3.24mm

But, against expectations, API reported a surprise 1.41mm barrel crude build - the 11th build of the last 13 weeks... and product inventories also showed big builds.

(Click on image to enlarge)

Source: Bloomberg

Notably, despite inventories at their highest since July, oil closed at its highest since September...

(Click on image to enlarge)

Source: Bloomberg

With WTI trading in an ascending channel...

(Click on image to enlarge)

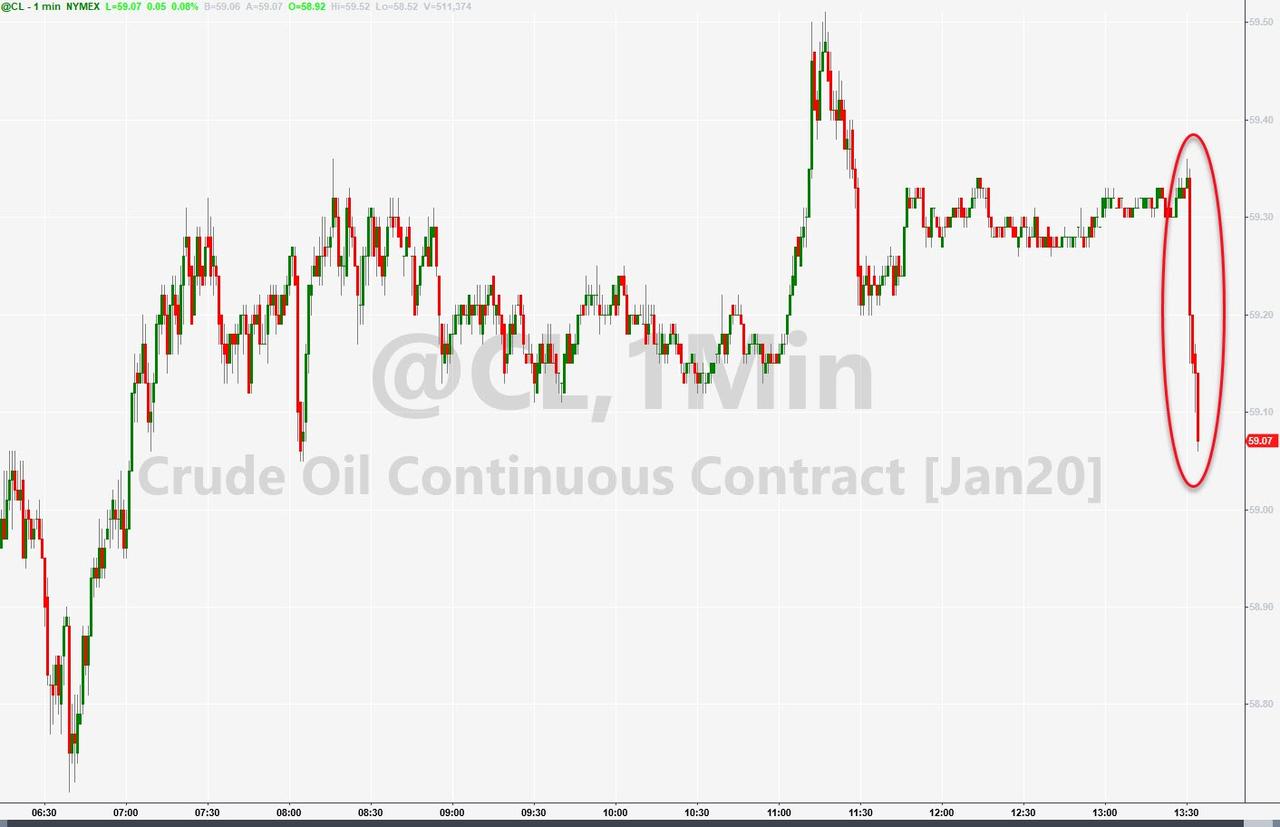

But tonight's inventory data sent prices lower...

(Click on image to enlarge)

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more