WTI Rebounds Back Above $73 After Bigger Than Expected Crude Draw

Oil retreated on the day after Brent topped $75/bbl in London for the first time in over two years, as Russia and other OPEC+ nations were said to consider increasing production.

"Just the rumors that OPEC+ will consider adding additional production is enough to pull us back from the $75 mark," said Gary Cunningham, director of market research at Tradition Energy.

On the positive side - for crude - negotiations to revive the Iran nuclear deal remain on pause after hardline judge Ebrahim Raisi won the country's presidential election.

Crude stocks were expected to fall for the 5th week in a row (and gasoline stocks to rise for the 4th straight week).

API

- Crude -7.199mm (-6.3mm exp)

- Cushing -2.55mm

- Gasoline +959k (+1.3mm exp)

- Distillates +992k (+1mm exp)

Crude stocks fell more than expected (down 7.199mm barrels) for the 5th straight week...

(Click on image to enlarge)

Source: Bloomberg

"There's a lot of people talking about $100 crude and that's driving the market," said Bob Yawger, director of energy futures at Mizuho, as WTI hovered around $72.80 ahead of the API print, jumping back above $73 after...

(Click on image to enlarge)

"(Because) of tight physical markets and healthy demand perceptions, the risk remains skewed to the upside," oil brokerage PVM said.

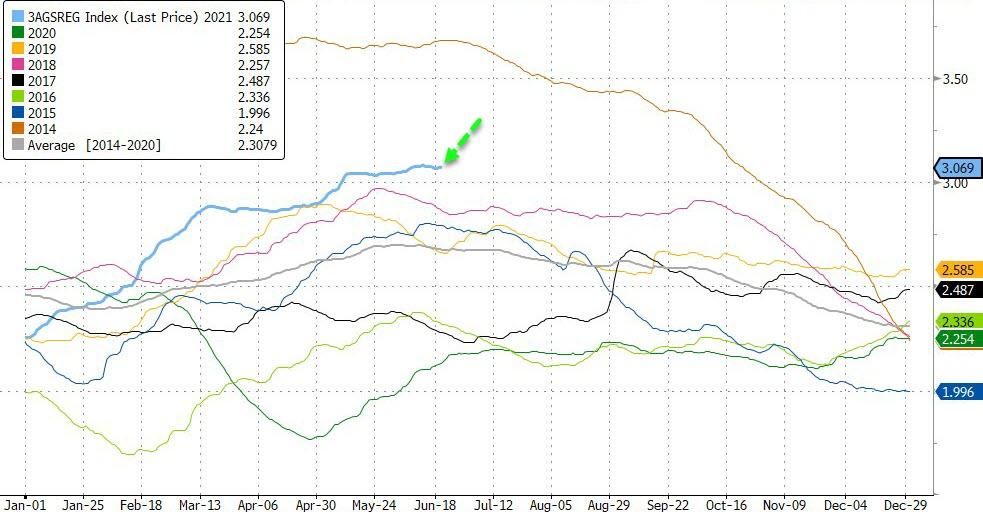

Finally, we note that gas prices (at the pump) are higher now that at any time during the Trump administration, directly benefiting Russia. And seasonally, this is the highest price (over $3 a gallon) for gas for this time of year since 2014...

(Click on image to enlarge)

Source: Bloomberg

The global supply deficit and further spikes in oil prices could loosen the lid that the U.S. shale industry has kept on their production and Saudi Arabia will want to avoid giving producers a reason to bring wells online, according to Tariq Zahir, managing member of the global macro program at Tyche Capital Advisors LLC. “They don’t want to see shale come back quickly.”

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more