WTI Rebounds Above Key Technical Level As Big Crude Draw Trumps OPEC Demand Downgrade

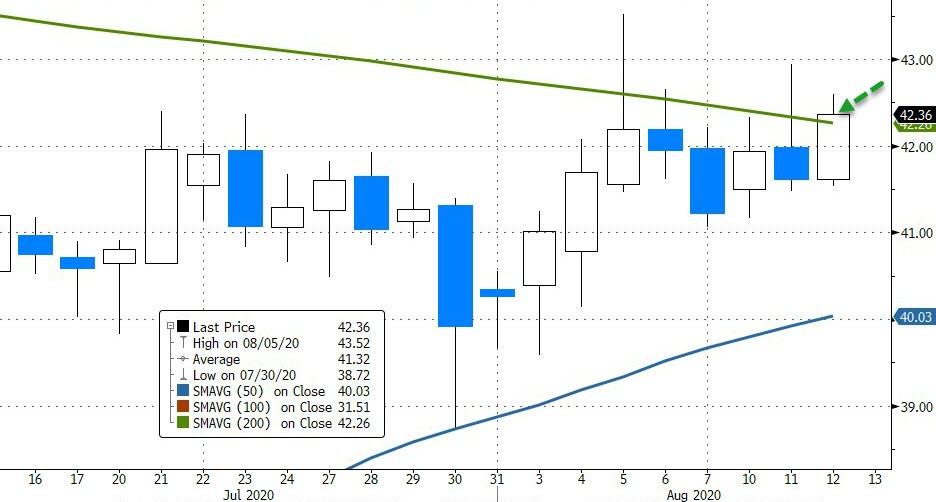

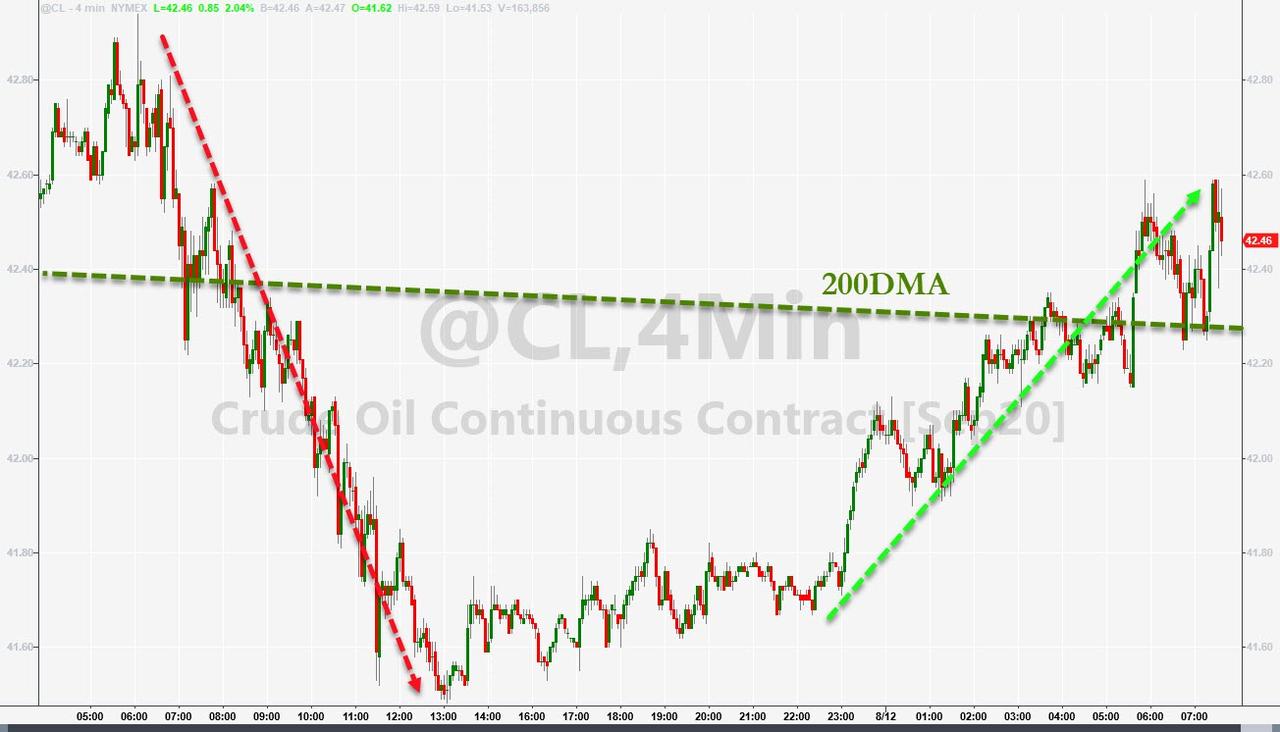

WTI continues its rebound from yesterday's flush lower (after API's bigger than expected crude draw), pushing back above the 200DMA once again this morning...

Source: Bloomberg

As Bloomberg notes, oil has battled its 200-day moving average for the last week, with prices kept in check amid ongoing uncertainty over the trajectory of the demand recovery from the pandemic. At the same time, OPEC+ is adding barrels back to the market, though the U.S. picture is more uncertain.

“Both crude markers are regaining ground amid expectations for a drop in U.S. oil inventories,” said Stephen Brennock, analyst at PVM Oil Associates Ltd.

“Market players are cheering the easing U.S. oil glut but the upside will be capped by nagging fiscal uncertainty in Washington.”

So for now, the official inventory data will decide if WTI holds above the key technical level. According to Bloomberg Intelligence Energy Analyst Fernando Valle, a large draw in inventories, as indicated by the API report yesterday, may not be enough to give Brent and refined products a boost.

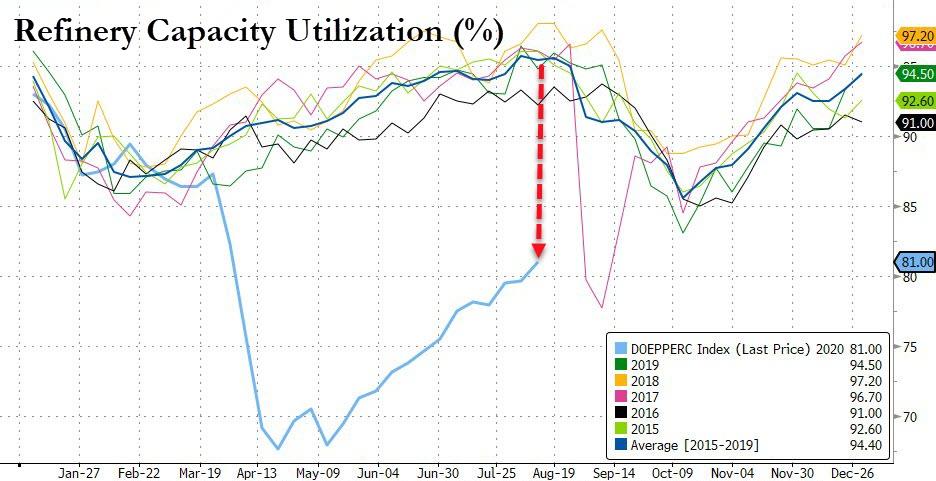

With producers ramping shut-in production back to pre-virus levels, inventory draws are likely to ease in the coming weeks, as refiners continue to run around 80% utilization.

Demand is still reeling from lockdowns and could face further headwinds if schools operate remotely come the fall.

API

-

Crude -4.40mm (-3.2mm exp)

-

Cushing +1.073mm

-

Gasoline -1.31mm (-1.50mm exp)

-

Distillates -2.949mm (-100k exp)

DOE

-

Crude -4.512mm (-3.2mm exp)

-

Cushing +1.336mm

-

Gasoline -722k (-1.50mm exp)

-

Distillates -2.322mm (-100k exp) - biggest draw since March

Analysts expected a 3rd weekly crude draw (and API added confidence) and EIA confirmed, adding that Distillates saw the biggest draw since March...

Source: Bloomberg

US crude production tumbled by 300k b/d in the prior week as the rig count has stabilized at 15 year lows...

Source: Bloomberg

WTI was trading around $42.50 ahead of the print and was unchanged after...

Finally, we noted that, in its monthly report, OPEC deepened its forecast of the extent to which the pandemic will reduce global oil demand this year, extending its estimate to 9.1 million barrels a day -- a drop of more than 9% from last year's demand figure.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more