WTI Pops Back Above $40 After Biggest Distillates Draw Since 2003

Oil prices plunged overnight, with WTI back below $40, as last night's bullish API-reported bigger-than-expected draw was trumped by traders fears that weaker than expected US jobs data and new virus restrictions in Europe will further threaten any sustained demand rebound.

U.S. labor market data is providing “more fuel for the fire of a sour economic outlook,” said Gary Cunningham, a director at Tradition Energy. “If there are further restrictions or new restrictions put in place in Europe or here in the U.S., then that further decreases travel demand for petroleum.”

API

- Crude -5.422mm (-2.3mm exp)

- Cushing +2.199mm

- Gasoline -1.513mm (-1.8mm exp)

- Distillates -3.93mm (-2.5mm exp)

DOE

- Crude -3.818mm (-2.3mm exp)

- Cushing +2.906mm

- Gasoline -1.626mm (-1.8mm exp)

- Distillates -7.245mm (-2.5mm exp) - biggest draw since 2003

Official data showed a crude draw that was smaller than API reported, a big build at Cushing, and a huge draw in Distillates (biggest since 2003)...

(Click on image to enlarge)

Source: Bloomberg

US Crude production remains noisy given the storm-related impacts, with shut-ins sending production levels down 500k barrels per day...

(Click on image to enlarge)

Source: Bloomberg

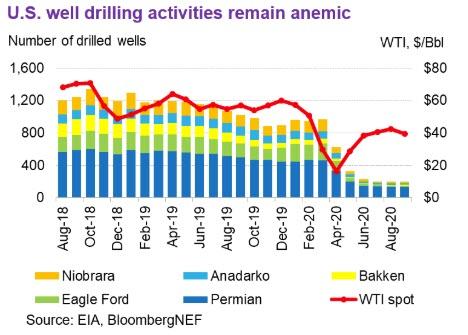

The latest EIA data indicate drilling activities remain anemic in September, even as WTI recovered to near $40 per barrel.

(Click on image to enlarge)

WTI traded just below $40 ahead of the official inventory data, popping back above $40 after the draws...

(Click on image to enlarge)

As Bloomberg reported, oil-market sentiment had improved this week amid some positive signals on consumption from Asia. But the likelihood of drastic limitations on movement being reintroduced in some of Europe’s largest cities has reignited demand fears, with London set to face harsher measures from Friday night.

“The growing use of localized lockdowns are raising fears that energy demand could once again be set to tumble,” TD Securities commodity strategists including Bart Melek said in a note. “With a second wave well underway, this is the primary risk for energy bulls at the moment.”

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more