WTI Holds Gains After Small Gasoline Draw, Distillates Build

Oil prices are higher overnight following API's report of a small crude build and large gasoline draw and the ongoing geo-economic push-pull.

"The oil market remains caught between fears of recession and the consequences of the zero-Covid policy in China on the one hand, and tight supply, especially of oil products, coupled with the prospect of US gasoline demand picking up during the summer driving season on the other," Commerzbank analyst Carsten Fritsch said in a note.

All eyes, for now, are on the official inventory data and any signs of demand destruction.

API

-

Crude +576k

-

Cushing -731k

-

Gasoline -4.223mm

-

Distillates -949k

DOE

-

Crude -1.02mm (-778k exp)

-

Cushing -1.061mm

-

Gasoline -482k

-

Distillates +1.657mm - biggest build since Jan 2022

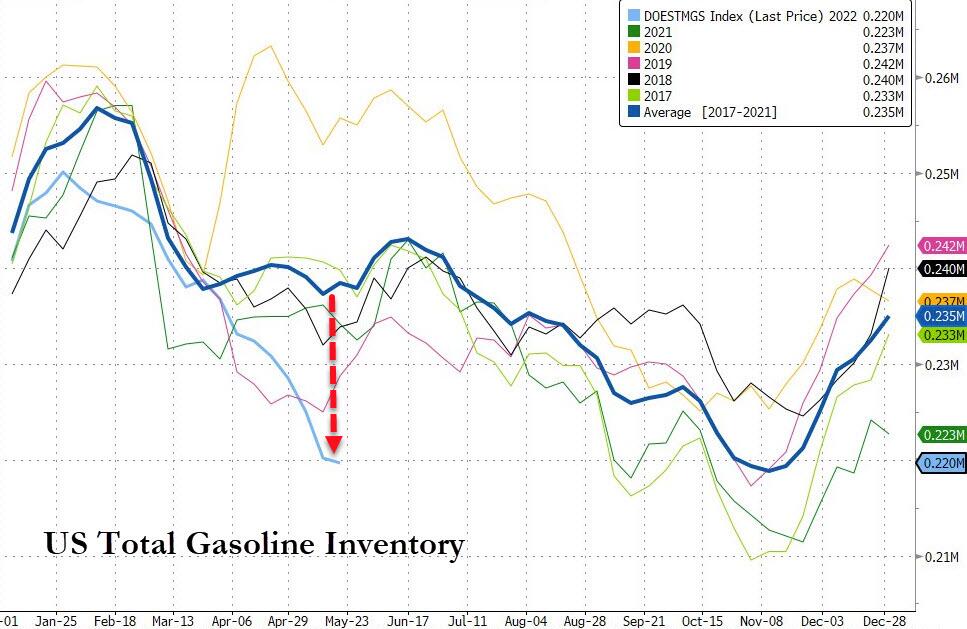

The official DOE data showed a significantly smaller gasoline draw than API and also showed a slightly bigger than expected crude draw. This was still the 8th straight week of gasoline draws (and the 15th of the last 16 weeks). Distillate inventories rose by the most since Jan 2022...

(Click on image to enlarge)

Source: Bloomberg

Crude stocks at Cushing, Oklahoma, have resumed their slide, falling for a third straight week and dropping below 25 million barrels again.

Many traders think critical levels at Cushing are likely around the 22 million-barrel level, so this will be closely watched heading into the summer months.

Gasoline stocks remain dramatically below normal for this time of year...

(Click on image to enlarge)

Source: Bloomberg

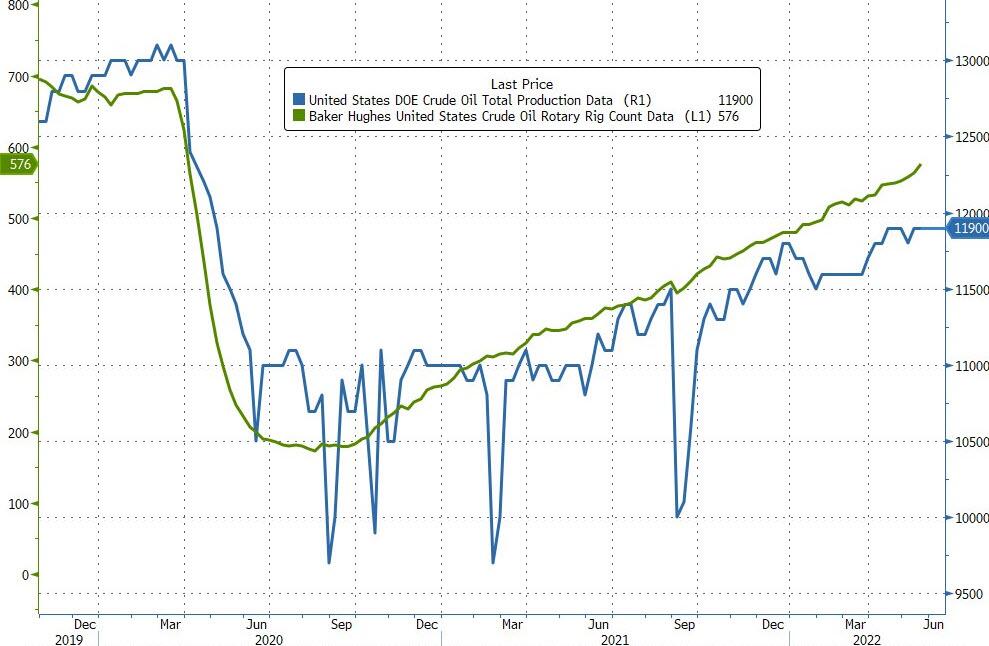

US Crude production held at its recent highs as rig counts continued to rise...

(Click on image to enlarge)

Source: Bloomberg

WTI was hovering just below $111 before the official data and held on to the gains after the mixed data...

(Click on image to enlarge)

Notably Jet Fuel and Diesel prices have tumbled recently (the chart below shows per barrel equivalents) as refiners focused their attention on the higher-margin cracks.

(Click on image to enlarge)

Jet fuel yields and outright production rose to the highest level since February 2020 last week, suggesting jet is somehow winning the yield battle even with gasoline prices at record highs daily for the past few weeks and distillates inventories hovering near historic lows. With gasoline margins recently overtaking diesel, some refiners will likely soon go into max gasoline mode.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more