WTI Holds Gains After Bigger Than Expected Crude Draw

Oil prices closed higher on the day, but well off the intraday highs, on optimism that the omicron variant may not be as severe as feared, easing concern over the demand outlook.

“While there is probably going to be some demand destruction because of omicron, the market priced in a lot worse than what it’s going to be,” said Phil Flynn, senior market analyst at Price Futures Group Inc.

“We are getting back to more real fundamentals versus the fear fundamentals we were trading on last week.”

Adding to bullish sentiment, the prospect of a deal to unlock sanctions on over 1 million barrels per day of Iranian oil exports is receding, RBC analyst Helima Croft said in a report.

API

- Crude -3.089mm (-1.2mm exp)

- Cushing

- Gasoline (+1.4mm exp)

- Distillates (+900k exp)

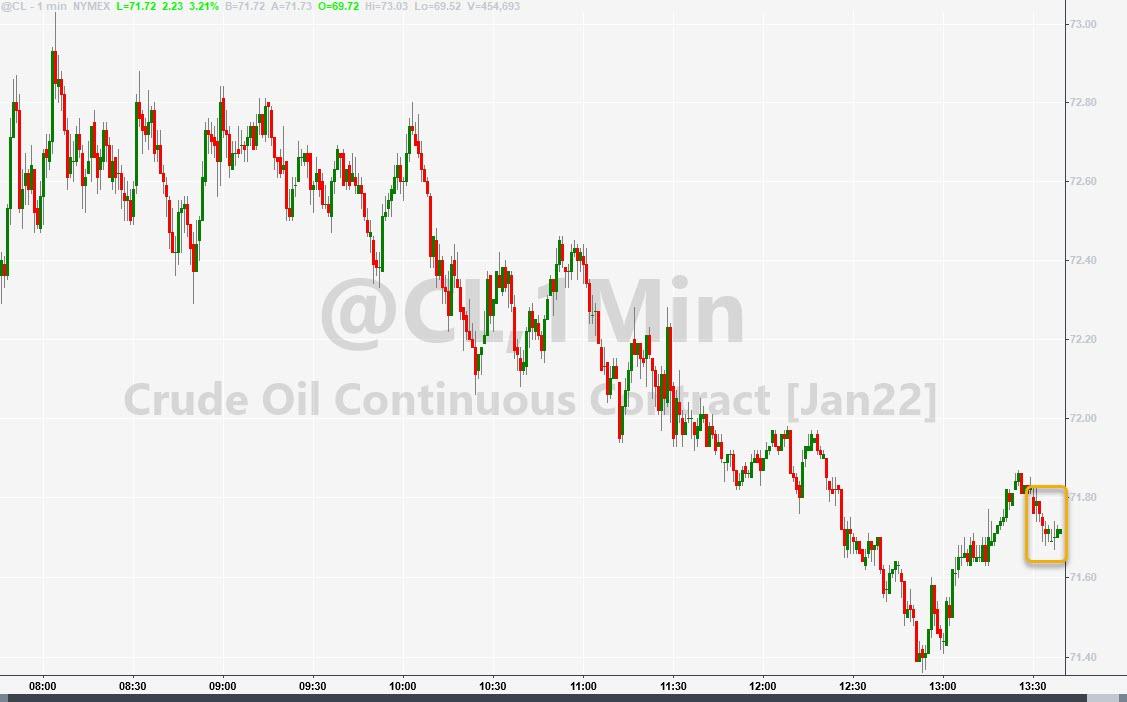

A bigger than expected crude draw last week, according to API...

(Click on image to enlarge)

Source: Bloomberg

WTI was hovering around $71.60 ahead of the API print.

(Click on image to enlarge)

The outlook for oil demand has "returned to being positive, while oil supply remains tight as economies recuperate from the rock bottom situation witnessed in 2020," said Naeem Aslam, chief market analyst at AvaTrade.

However, not everyone is as bulled up as the EIA also cut its oil forecasts for 2022 by 2.7% to $66.42 for WTI and by 2.6% to $70.05 for Brent.

"This is a very complicated environment for the entire energy sector," said EIA Acting Administrator Steve Nalley, in a statement.

"Our forecasts for petroleum and other energy prices, consumption, and production could change significantly as we learn more about how responses to the omicron variant could affect oil demand and the broader economy."

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more