WTI Flirts With The 200-Day SMA Below $40.00/bbl Ahead Of EIA

Prices of the WTI are alternating gains with losses below the key $40.00 mark per barrel on Wednesday.

WTI looks to Powell, EIA

The barrel of the West Texas Intermediate is hovering around the key 200-day SMA just below the key $40.00 mark following two consecutive daily pullbacks and amidst the moderate recovery in the greenback.

Traders continue to look to the impact of the coronavirus pandemic on the global economy and in particular on the demand for the commodity. While demand outlook for crude oil remains fragile, the likeliness of selective lockdowns appears to have mitigated concerns in the industry somewhat.

Also putting extra pressure on prices, Libya’s National Oil Corporation (NOC) is expected to resume the activity as well as exports of crude oil in oilfields and ports free of military presence (paramilitary and mercenary). The NOC expects production to increase to 260K bpd from the next week.

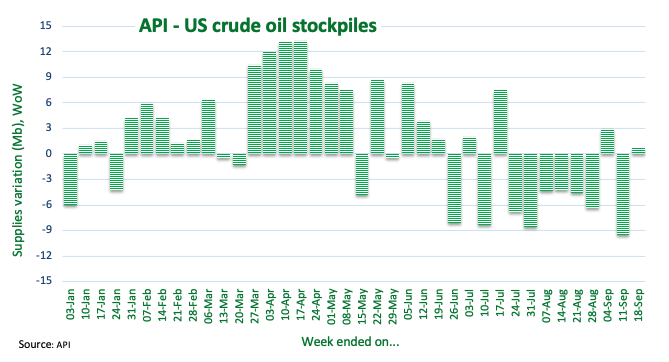

Late on Tuesday, the API reported an unexpected 691K build in crude oil supplies during last week, which is also limiting the upside on Wednesday ahead of the EIA’s weekly report.

Traders will also pay attention to the second testimony by Fed’s Powell before the House of Representatives and the release of Markit’s preliminary manufacturing and services PMIs, as a gauge of the sentiment surrounding the US economic recovery.

WTI significant levels

At the moment the barrel of WTI is gaining 0.47% at $39.92 and faces the next hurdle at $41.46 (weekly high Sep.18) seconded by $43.75 (monthly high Aug.26) and finally $48.64 (monthly high Mar.3). On the downside, a breach of $38.67 (weekly low Sep.21) would aim for $38.56 (100-day SMA) and then $36.15 (monthly low Sep.8).

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more