WTI Extends Longest Win Streak In 13 Months On Weak Crude Inventory Build

Oil prices continued to surge overnight, despite a bigger than expected crude inventory build reported by API. Up 7 days in a row, WTI has topped $54 on signs of tighter global supply and hopes that the Chinese economic stimulus will cushion fuel demand from the impact of the coronavirus.

“The recent bounce-back in oil prices has been driven by a combination of sentiment and supply factors,” said Harry Tchilinguirian, head of commodity-markets strategy at BNP Paribas SA.

“There’s a slower pace of growth in U.S. shale basins, the threat to Venezuelan production, and no apparent resolution to the situation in Libya.”

We suspect another big crude build from the official data today will take the shine off this resurgence...

(Click on image to enlarge)

API

- Crude +4.2mm (+2.5mm exp)

- Cushing +400k

- Gasoline -2.7mm (+400k exp)

- Distillates -2.6mm (-1.5mm exp)

DOE

- Crude +415k (+2.5mm exp, Whisper +4mm)

- Cushing -133k

- Gasoline -1.971mm (+400k exp)

- Distillates -635k (-1.5mm exp)

After the prior week's surprisingly large crude build, analysts expected another increase and got one but a very small one at just 415k. Cushing stocks fell for the first time in 4 weeks and products saw notable draws...

(Click on image to enlarge)

Source: Bloomberg

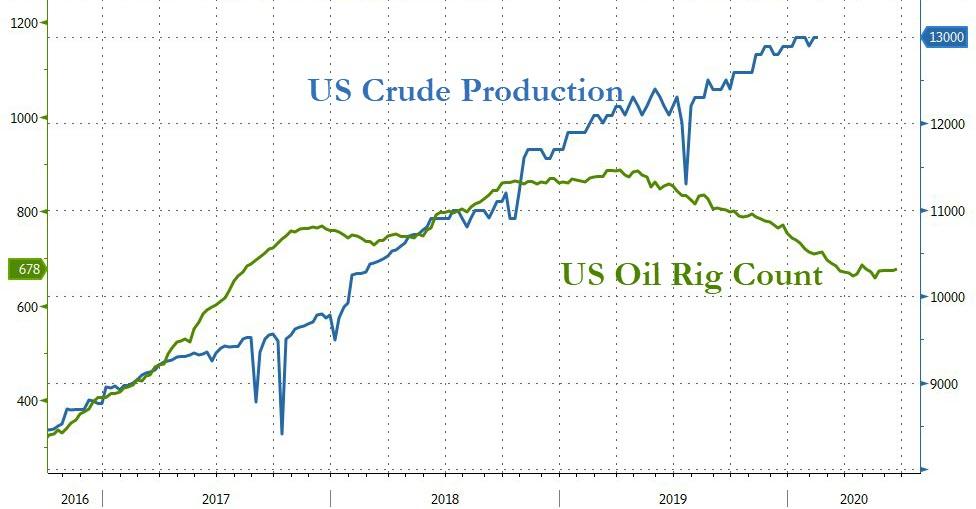

US Crude production remains at record highs...

(Click on image to enlarge)

Source: Bloomberg

WTI hovered around $54.50 ahead of the official data, amid the longest stretch of gains since Jan 2019, and extended gains after the smaller than expected crude build...

(Click on image to enlarge)

Finally, Bloomberg Intelligence Energy Analyst Fernando Valle warns, economic slowdowns in China, Japan and Germany are overwhelming diminishing refinery supply in the U.S. Diesel crack spreads contracted sharply, despite a much larger-than-expected drop in inventories in the prior period. Gasoline saw a slight improvement, but with stockpiles still near all-time highs, we are concerned about the outlook, considering that exports look to be near their peaks.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more