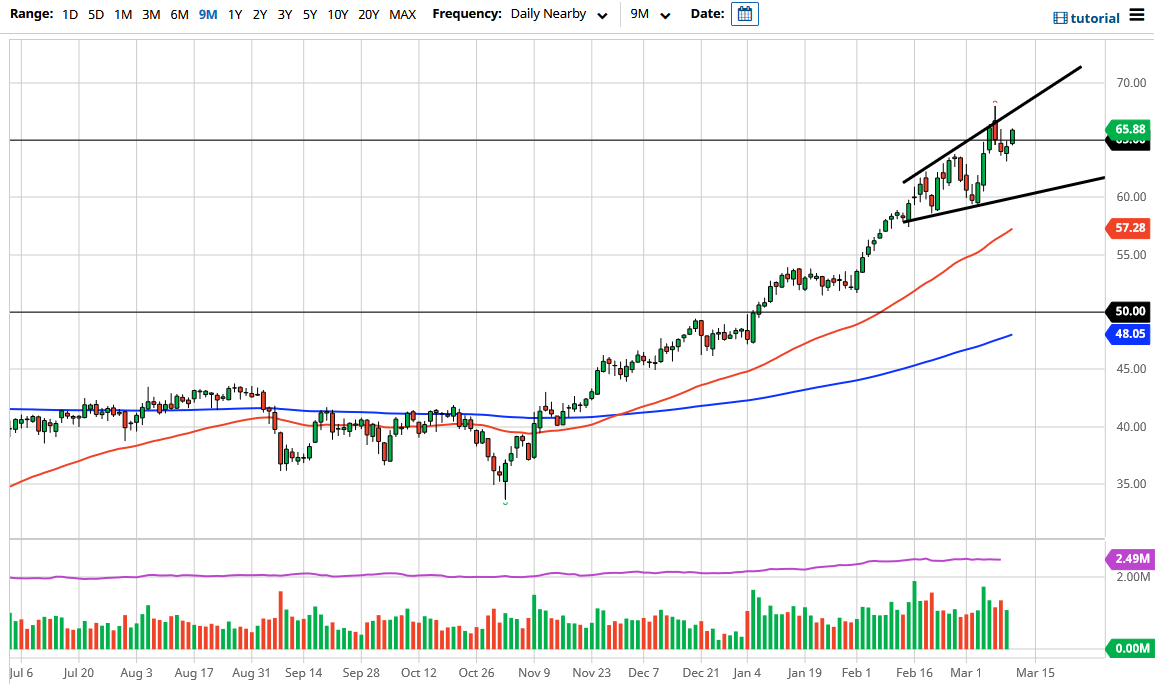

WTI Crude Oil Forecast: Finds Ways To Go Higher

The West Texas Intermediate Crude Oil market has rallied significantly during the trading session, perhaps due to the idea of the stimulus bill finally being passed, but at the end of the day, this should have been a known quantity. Nonetheless, we are above the $65 level and it looks like we are trying to get towards the top of the megaphone pattern. Longer-term, I think that the market could even go to the $70 level but sooner or later we have to come to the conclusion that perhaps the market has priced in perfection or perhaps even something better than that as far as the reopening is concerned.

The candlestick for the trading session on Thursday is closing towards the very top of the range, so that does suggest that there would probably be some follow-through. Ultimately, this is a market that cannot be shorted, although it is probably only a matter of time before we would see gravity come back into play. At this point, I think that short-term traders will continue to buy on the dips but sooner or later we need to pay close attention to the demand picture. Traders are trying to price in whether or not there is going to be massive demand after the reopening, but at this point, one has to wonder how higher oil prices can go in whether or not people are going to be willing to pay them?

I think we probably have short-term bullish pressure, but eventually, the reality of what is going on in the real world comes into play. Demand is going to be a major problem given enough time, but in the short term it does not seem like the market cares and therefore I think we are going to continue to see a “FOMO mentality” in the market. If we were to break down below the $63 level, then we could go towards the $60 level because it would reach towards the bottom of the megaphone pattern that we are trying to form. Nonetheless, it certainly looks as if it is going to be difficult to short unless we get some type of momentum to the downside. On the upside, you are probably looking at scalping the market more than anything else.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more