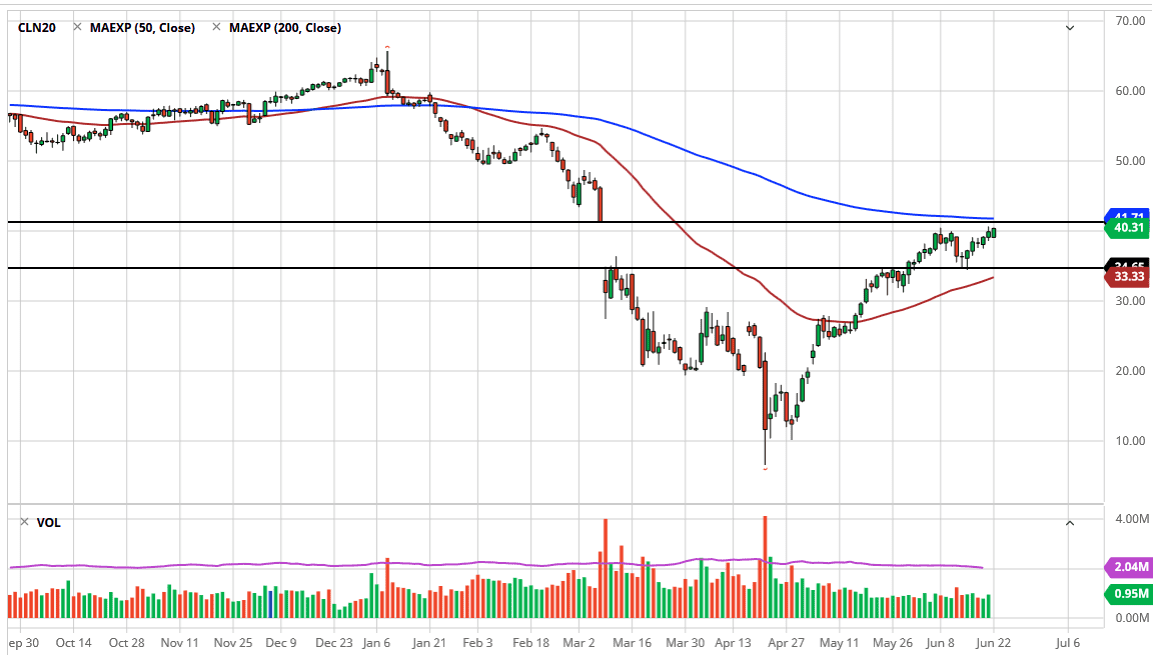

WTI Crude Oil Forecast: Continues Towards 41 Handle

The crude oil markets will continue to reflect a lot of concern out there when it comes to global growth, but at the same time will also reflect what is going on with OPEC+, as they continue to make noise about potential cuts.

The West Texas Intermediate Crude Oil market initially gapped lower to kick off the trading session on Monday, but as you can see we continue to reach towards the $41 level above, which is worth paying attention to as it is the top of the gap that we had been forming for quite some time. Ultimately, I think this market will run into a lot of trouble in that area, as the 200 day EMA is sitting just above there course offers a bit of a brick wall as well.

That would fill the gap, which is something that a lot of technical traders will be looking to do. A pullback from there could open up the door down to the $35 level, and then the 50 day EMA underneath there could be targeted as well, as it is at the $33.33 level. Do not forget, crude oil temp, to trade in $10 increments, so at this point, we are going to try to figure out whether or not the $41 level will hold, and then we will probably go probing towards the downside in order to find the bottom of that range.

Furthermore, you have to keep in mind that we are between the 50 day EMA and the 200 day EMA, meaning that we are in a bit of a squeeze in general. This squeeze obviously will have a significant effect on price, and then eventually we will shoot in one direction or another. Currently, I believe that the odds favor a range between the $30 level underneath and the $40 level or so just above. Keep in mind that the crude oil markets will continue to reflect a lot of concern out there when it comes to global growth, but at the same time will also reflect what is going on with OPEC+, as they continue to make noise about potential cuts. At this point, the only thing I think we could probably bank on is the idea that there is going to be a lot of volatility. However, if we were to break above the $42 level, then we may have an opportunity to rally all the way to the $49 level next. That being said, it certainly looks positive after gapping lower on Monday and turning around to rally right away. In other words, it certainly looks as if the technical traders out there are going to try to hit the target.

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more