Will The 2020s Be Good Or Bad For The Gold Market?

Will the 2020s be better than the 2010s for the yellow metal? We invite you to read our today's article, which provides the macroeconomic outlook for the whole new decade and learn whether the fundamental factors will become in the 2020s less or more friendly toward gold.

People often ask about my economic forecasts for the current year, whether the recession will come or not, etc. I reply that I'm an economist, not a fortune-teller. As the future is inherently unpredictable, I don't like the traditional January game of economic forecasting for the year ahead and I avoid providing detailed price predictions. So, my Readers can be surprised by the title of this article - if I don't like forecasting one year ahead, why the heck I would be forecasting the whole decade?

That's a very good question. As the time horizon lengthens, the uncertainty increases, as more unseen developments can happen and spoil the prediction. However, in a way, it's easier to forecast long-term trends than the short-term details, as far as fundamental factors are concerned. Things are very different in the very short-term (daily-to-day price changes, when fundamentals barely matter, but immediate-term technicals do).

In the case of the big picture, when you outline fundamental trends, the precise timing does not matter. Besides, how often we get a new decade (I know, technically, the new decade starts in 2021, but we already live in the 2020s, don't we?), so let's have some fun and try to sketch the most important economic trends in this decade and their impact on the gold market!

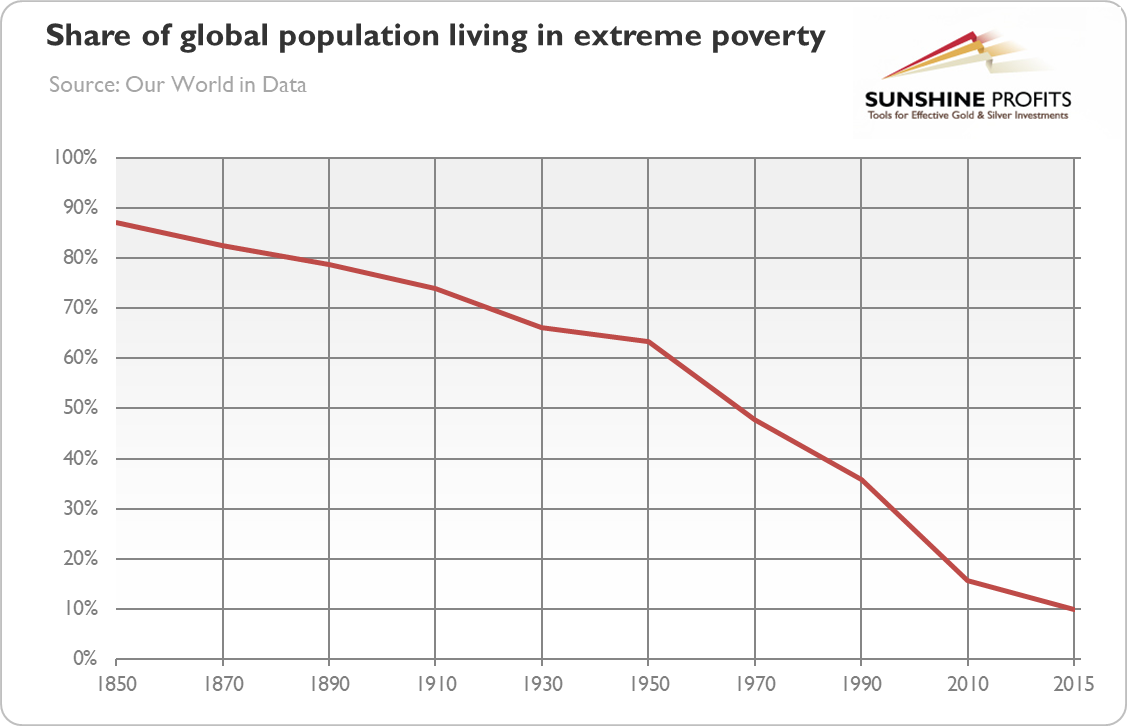

- We will be enjoying better living standards, living healthier and longer lives. Despite the gloomy press news and populists' complaints, the facts are irrefutable. In many dimensions, humanity has never been better off. See below my favorite chart which shows the share of global population living in extreme poverty - it decreased from almost 90 percent in 1850 to below 10 percent in 2015! We believe that this trend will continue, in particular, we expect a significant catching up not only by some Asian countries but also by Africa as a whole.

Chart 1: Share of global population living in extreme poverty from 1850 to 2015.

- However, global growth rates will continue to slow. This is partially because of the demographic situation in the West but also in Japan and China will deteriorate, creating downward pressure on the pace of economic growth. The world has actually hit the "peak youth," i.e., there are more seniors aged over 65 on the planet than children aged under five, and this trend will only accelerate over the 2020s.

- And the economic Japanization is likely to spread to the European Union, hampering additionally the pace of GDP growth.

- There might be also important shifts among the engines of global economic growth. If the Indian government adopts the right mix of structural reforms, the country could replace China as the primus of economic growth.

- Cannabis will be legalized in a larger number of countries and psychedelic drugs will come to the foreground then. Everything shines after magic mushrooms, but nothing shines likes gold!

- Solar panels and batteries will continue to decline in price, encouraging the developments of solar energy and electric cars.

- Automation will accelerate but instead of job displacement, we expect augmentation, i.e., technologically enhancing the workers skills to generate greater value for the customers.

- The US economy will remain one of the most flexible ones in the world, which should support the US dollar and create downward pressure on the gold prices.

- However, both the current asset valuations and the mammoth US public debt depend on the ultra low-interest rates. At some point in this decade, investors will rethink their stance and start to demand higher compensation for the risk or rates of inflation. The increase in the interest rates will send asset prices lower and trigger the debt crisis, making gold shine.

- The more and more pressing public debt problem combined with the economic crisis could shake the confidence in the US dollar, which would benefit gold - especially should the Democrats win the 2020 Presidential elections.

- The Fed will complete the review of its monetary policy and, frustrated with low inflation, will adopt either price-level targets or higher inflation targets. Anyway, its stance will become more dovish, which should support gold prices.

- Over the course of the 2020s, the bull market in gold will arrive for good. In the previous bull market, the price of the yellow metal soared six-fold, from around $260 to around $1800. We do not claim that gold will replay such a great performance, but it should break the $2,000 barrier and $3,000 is also in cards (ultimately, the price may be even higher, as Przemyslaw Radomski, CFA convincingly argued, but we wanted here to provide a safe bet for the next decade).

- Some of these predictions, if not the most of them, will turn out to be inaccurate and they will have to be quickly updated amid the unfolding developments. So, don't take them too seriously. Instead, treat them as interesting thought experiment. The experiment which shows that there is clearly more upside than downside risk for the gold market. Unless we see a breakthrough technological revolution and the acceleration in the productivity growth, the global growth is likely to slow down. We do not make gloomy predictions, as capitalism and globalization will still do their job and pull untold millions out of poverty. However, the global monetary and financial systems are fundamentally flawed. Last year, gold has finally ventured out of its sideways trend - and we believe that it will continue its upward march in the following decade. Not necessarily without a bigger medium-term decline first, though.

If you enjoyed the above analysis and would you like to know more about the most important macroeconomic factors influencing the U.S. dollar value and the price of gold, we invite you to read the ...

more