Why Markets Don’t “Predict”…Recession Fears Turn On A Dime

“Davidson” submits:

This morning’s headline:

Investors, Buy the Dips: Recession Worry Is Overblown for Now

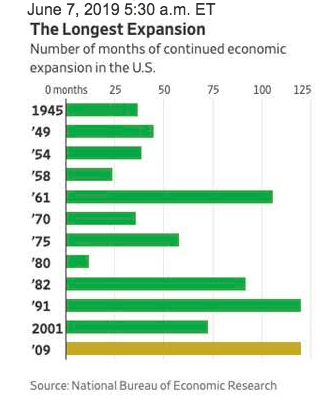

The economic boom looks poised to go on, but a debt-fueled crisis could explode down the road. - June 7, 2019 5:30 a.m. ET

(Click on image to enlarge)

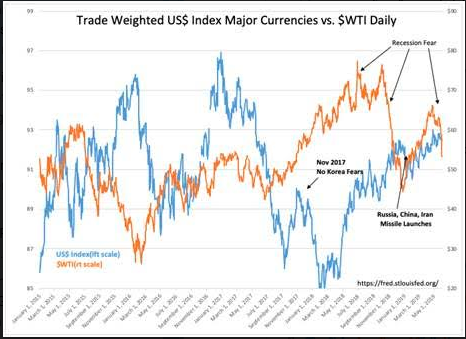

After price-trends corrected Jan 2018, then turned sharply lower in October 2018, advisors, repeated hourly by the media, recommended investors brace for a recession. The calls for an imminent recession produced 3 waves of panic beginning Jan 2018. Algorithms correlated these fears with oil prices(WTI-West Texas Intermediate) The largest SP500 decline of ~20% occurred Oct 2018-Dec 2018 as Momentum Investors were convinced that no market cycle could exceed the 1991 longest cycle recorded. Indeed, there is no ‘egg timer’ on any market cycle. Suddenly, 3 days of higher price trends and recession fears have evaporated. Market psychology behaves like that.

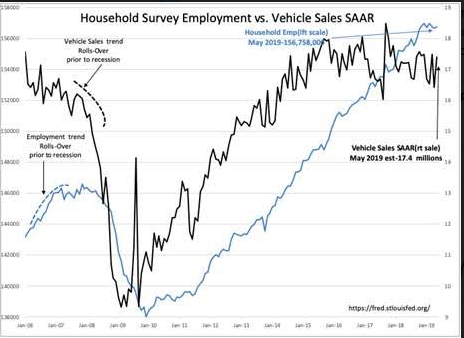

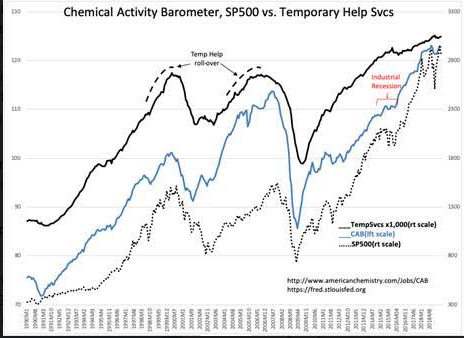

The current market cycle has been extended by tax cuts and reduction of regulations which have boosted employment and wages, especially in manufacturing. Even with the strong US$(US Dollar) climate, US exports have held up as more and more companies embrace ‘Lean Processes’ which have made the US comparatively more globally competitive. There may be additional support coming from easing of Dodd-Frank regulations for smaller bank mortgage lending and the initiative to lower global tariffs. Employment and vehicle sales have remained strong proving Momentum Investors had misplaced concerns. Household Employment has stalled the past few months at record levels after its dramatic run-up Aug 2018 from 155,542 to Jan 2019 of 156,945 of 1.4mil newly employed. Temporary Help, a leading indicator of labor demand is currently poking at new highs.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

The market place is composed of 2 broad categories of investors, those who are Value based with a strong focus on economic indicators and those who are Momentum based with a focus on price trends. Momentum Investors always dominate short-term news but proven wrong so often on economic forecasts that one wonders why they get so much attention. It is Momentum Investors making headlines which feed the media machine. Once the economic data convinces enough investors, all investors tend to fall into similar perceptions. Economic trends remain positive to higher equity prices.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more