Why Is Crude Oil Ignoring U.S. Inventories?

While the current pull-back on black gold is fundamentally triggered by different forces, where is the prevailing wind coming from that is pushing prices lower?

On Wednesday, the day after the US Fed’s Chair Powell showed a more hawkish tone, crude oil prices dropped 2.5% following profit-takings on most commodity markets - new fears emerged that a world economic slowdown combined with rising interest rates could negatively impact the global demand. By the way, talking about profit-takings, our subscribers took theirs on Monday within the last phases of the strong rally in crude oil that hit our last projected targets.

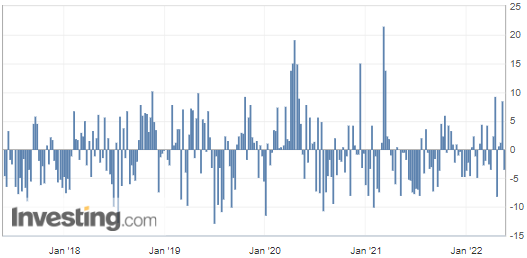

United States Crude Oil Inventories

The commercial crude oil reserves in the United States unexpectedly dropped in the week ended May 13, according to figures released on Wednesday by the US Energy Information Administration (EIA).

US crude inventories have decreased by almost 3.4 million barrels, which implies greater demand and would normally be considered a bullish factor for crude oil prices. However, it appears that with the US Federal Reserve’s sustained hawkish tone, which contributes to pushing commodities to the lower side, the market does not pay as much attention to US crude inventories, which are relegated to the background…

Source: Investing.com)

WTI Crude Oil (CLM22) Futures (June contract, daily chart)

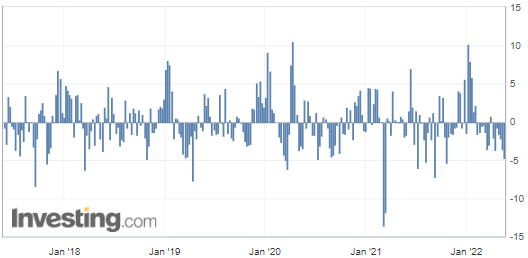

United States Gasoline Inventories

On the other hand, some additional figures extracted from the same EIA report were released:

These are US Gasoline Reserves, which plunged by almost 4.78 million barrels over a week, while the market forecasted a decline of only 1.33 million barrels.

(Source: Investing.com)

RBOB Gasoline (RBM22) Futures (June contract, daily chart)

Consequently, despite demand for black gold, which nevertheless remains at a high level according to the two above figures, crude oil prices continued to slide on Thursday. They proceeded with their decline from the previous day, still dampened by fears of a global economic slowdown.

The possible easing of US sanctions against Venezuela could be considered another bearish factor, coming in addition to the Hungarian veto on the EU’s plan to ban Russian oil. The European problems didn’t stop there, as Turkey opposed the opening of talks on the NATO membership extension to Finland and Sweden after the two Nordic countries submitted a formal application.

The current situation of Hungary is quite understandable since the Central European country is particularly dependent on Russian hydrocarbons.

Disclaimer: All essays, research and information found in this article represent the analyses and opinions of Sunshine Profits' associates only. As such, it may prove wrong and be ...

more