Why Cocoa Prices May Remain In A Bear Market For A While

From cocoa traders in New York to west African farmers and chocolate processing firms, I have clients around the world who are constantly asking me about the weather and what may happen in Ivory Coast, Ghana, Nigeria, and Indonesia.

Cocoa prices have been hurt by COVID demand worries, but also by a big La Nina type crop that poses little threat of any supply squeeze. This is in contrast to corn, soybeans, and soon-to-be coffee where tighter global stocks and recent weather problems have resulted in price rallies, particularly in grains.

Why do I think weather conditions will remain mostly ideal for cocoa through summer preventing any major price spike?

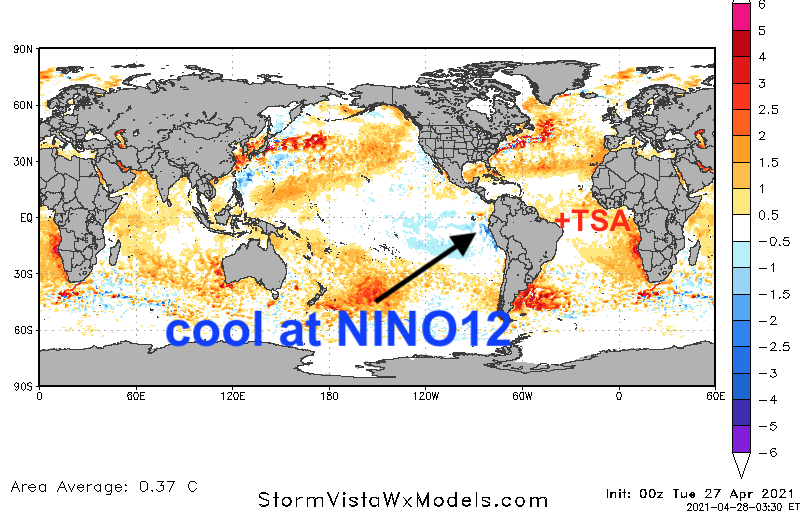

1) La Nina could still bode its head from time to time. I do not see El Nino. Notice the cool ocean waters in the image below.

2) The TSA and TNA are positive (warm around west Africa). These are warm ocean temperatures around West Africa. Normally, we have to see "cool" waters for there to be major cocoa crop reduction issues in the summer. Right now, I do not see this. Warm ocean temperatures not only may be good for west African cocoa production but spawn another active U.S. hurricane season.

3) Global Angular Momentum (GLAAM) is negative. This has to do with torque in the atmosphere over the equator. Without getting too Scientific, this has to do with the ebbs & flows of momentum near the Equator and where there is low Torque this represents some sort of La Nina conditions and is favorable for west African cocoa production.

The chart below shows how cocoa futures are approaching a triple bottom on the charts. Normally, triple bottoms do not hold, so expect to see further pressure in cocoa prices in the near future.

Conclusion

As Covid ends and global demand increases cocoa prices could see some occasional buying. However, to garner a major bull market, this will take a supply deficit in 2021. Cocoa has a long history of rallying during an El Nino, as crops can be hurt by dry weather. However, during neutral or La Nina conditions, 70% of the time, cocoa is in a bear market. I expect occasional La Nina conditions to continue preventing any major supply disruption. This is in contrast to coffee where I am watching Brazil weather and some global weather problems.

This is an excerpt from James Roemer's premium subscription newsletter. You can receive an issue to Climatelligence for just $13 more

Fascinating!