Why Are Commodities So Damn Cheap?

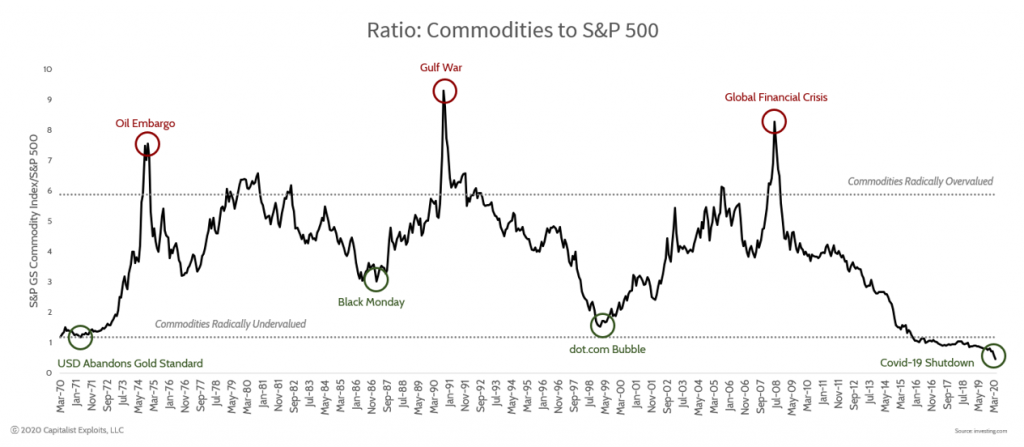

Relative to the S&P 500, commodities are the cheapest they’ve been in more than 50 years. The COVID-19 pandemic has accelerated a global paradigm shift that had already begun to take place. Investors that are prepared today stand to make significant profits.

Video Length 00:10:16

Commodities are Mispriced

Commodity markets are cyclical. Prices go through periods of high and low valuations based on supply availability and demand for goods. As materials can be harvested, mined, or gathered more efficiently, they become cheaper to produce and supply grows. If demand does not grow proportionally, the price decreases.

There is a natural ebb and flow to the market. When prices are high, supply eventually increases until demand is met. Typically supply continues to increase until it outpaces demand. At which point, prices drop along with supply and excess product is consumed. If, on the other hand, the economy grows and the demand for goods outpaces supply, prices increase.

This natural pendulum swings from side to side as the market tries to balance at an equilibrium point.

Commodity cycles tend to have wild swings due to the lack of actionable data and the long lead time required to ramp-up or slow down an operation.

Today the pendulum has been artificially pushed in one direction… and it’s about to swing back with a vengeance.

Commodities are the cheapest that they have been since the 1970s.

(Click on image to enlarge)

The above chart shows the value of commodities relative to the S&P 500.

A decade of historically low interest rates has pushed investors to take riskier and riskier bets in order to find returns; thus driving up the price of almost all stocks.

Disinflation & Why it Matters

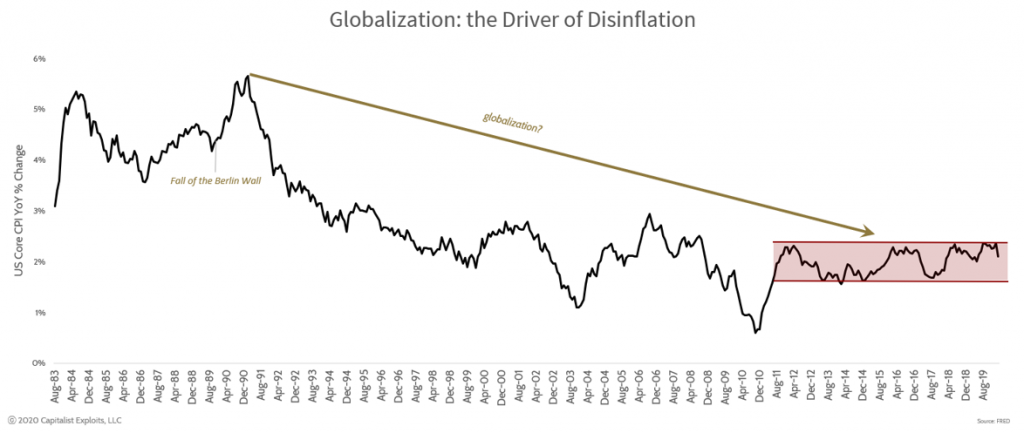

Since the fall of the Berlin Wall, the world has gone through a period of extreme globalization, resulting in more or less free trade. You can see examples of this all over the globe such as the signing of NAFTA, the creation of the European Union, and China creating global trade partnerships.

Globalization has been the driver behind the offshoring of American manufacturing jobs which, in turn, has also driven down the cost of consumer goods.

(Click on image to enlarge)

The above chart demonstrates the decline in the growth rate of US Core CPI. Note that the inflation rate has hovered around 2% since the great financial crisis (GFC), largely due to the FED’s quantitative easing programs. From a technical charting perspective, this indicates that we are reaching thebottom of the deflationary period.

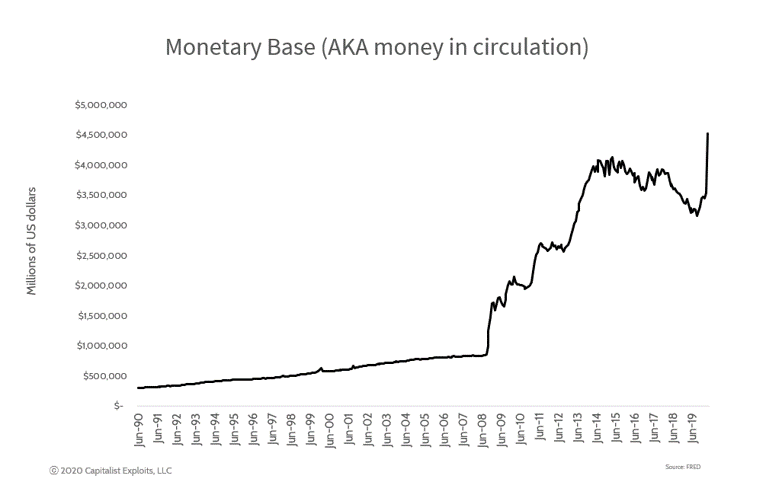

Governments have aggressively printed money and debased their currencies (now called quantitative easing) reducing effective purchasing power.

(Click on image to enlarge)

You can see in the chart above that the FED’s money printing machine has once again been turned on to prop up the currently stalled economy.

For the most part, we’ve not felt these inflationary effects because consumer goods have been devalued at an even greater rate due to globalization.

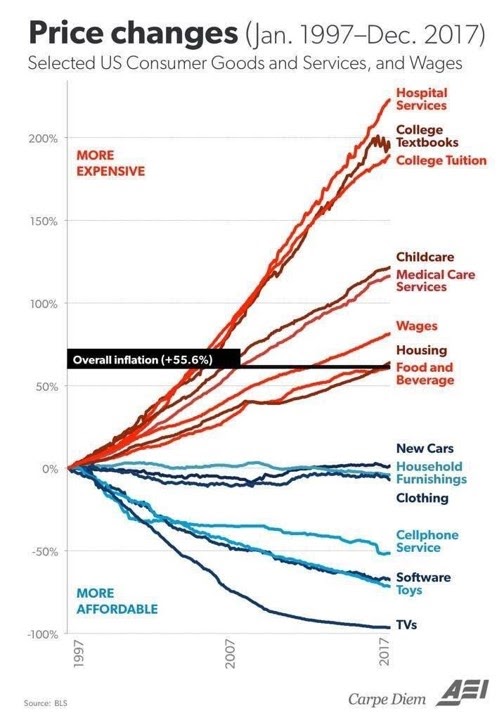

Don’t believe me? Take a look at the chart below.

(Click on image to enlarge)

The only goods and services that have been immune to the effects of globalization are the ones that cannot be outsourced such as healthcare or housing.

Corona-Catalyst

The world has been slowly trending away from globalization towards a protectionist/nationalistic approach. You’ve seen examples of this with the renegotiation of NAFTA, Brexit, the trade war between the US and China, and ,of course, the election of Trump.

Now, in the midst of the COVID-19 pandemic, people are waking up to exactly how much of the supply chain of our daily goods come from foreign powers such as China.

There is an ever increasing push to bring those supply chains home.

With the US unemployment rate now holding above 10%, we can expect a major infrastructure bill to be signed sooner rather than later. Something both Hilary Clinton and Donald Trump lauded as part of their campaign platform. There would be no better time to see a bi-partisan agreement for an infrastructure bill than right now.

This pandemic is the catalyst for change that many have been waiting on.

Now what?

With the possibility of supply chains being brought back to America, an infrastructure bill, and the never ending money printing… there has never been a clearer sign that the cycle has shifted and global inflation is about to begin in a big way.

In this environment the best way to protect and grow your capital is simple: Own Commodities!

At Resource Insider we are putting our money where our mouth is and investing our own capital in the natural resource sector.