Where Next For The Price Of Oil? - Monday, Feb. 1

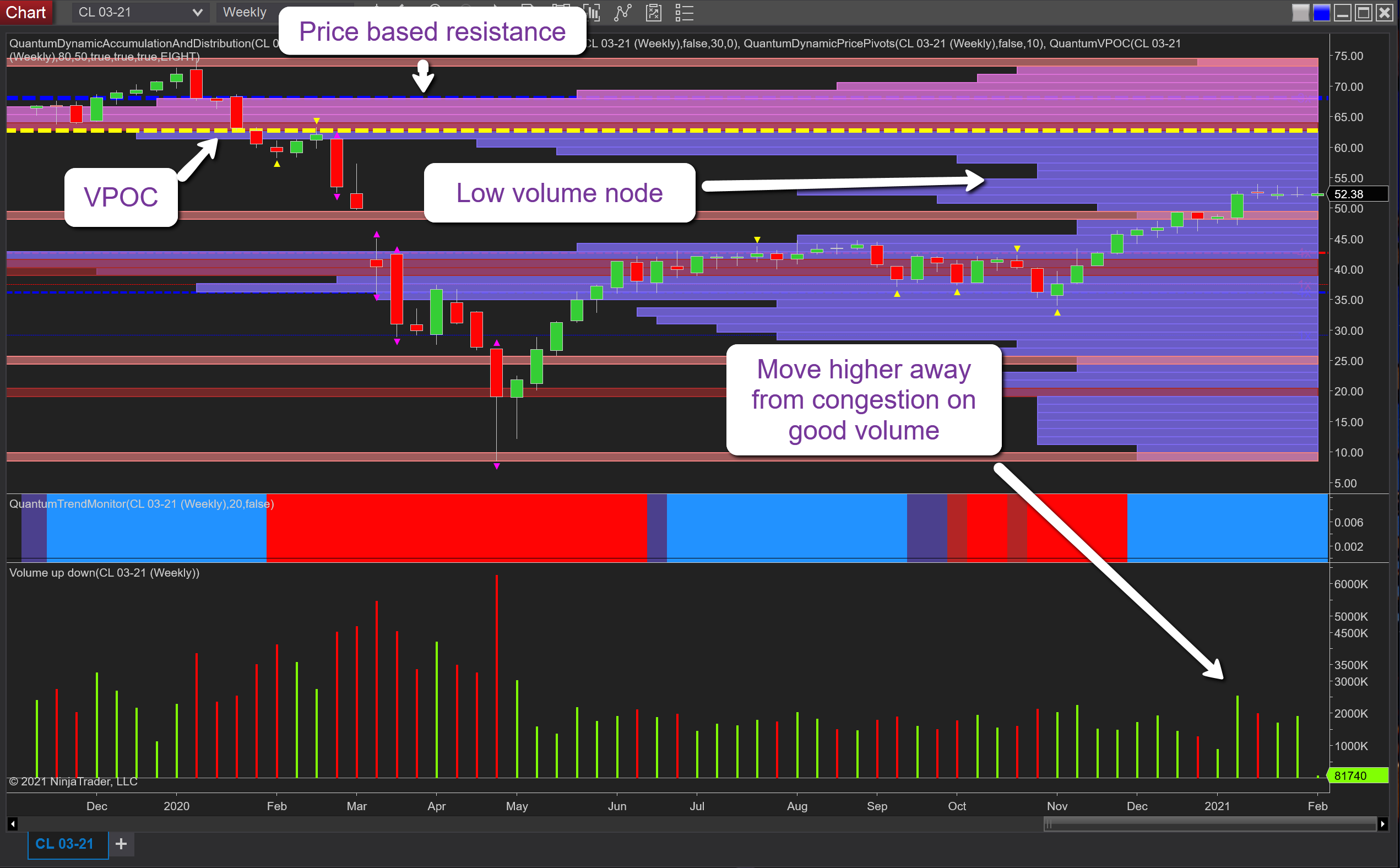

At the start of a new week and trading month, time to take a look at crude oil as it continues to claw its way back after last year’s collapse, and to explore where the price is heading longer term from a technical perspective. And here I’ve taken the weekly chart which clearly displays the extended congestion phase of last year which saw the price of oil oscillate between $35per barrel and $43 per barrel over a period of several months, before finally breaking free of this region towards the end of the year. The validity of this move was confirmed in early January with the wide up candle on high volume during the second week taking the oil price beyond the $50 per barrel area and where we are now witnessing a further congestion phase anchored around the $52.50 per barrel level with a series of Doji candles. Ahead, there are two important levels and areas, both of which are part of the volume point of control indicator for NinjaTrader.

The first is the low volume node on the VPOC histogram which extends from $55 per barrel through to $57.50 per barrel and as such offers little in the way of resistance from a volume perspective and is, therefore, a straightforward move through this area. Once through here the VPOC itself then looms above at $63.00 per barrel and denoted with the yellow dashed line. At this point, we can expect to see an extended congestion phase develop and even more so as there is the price based resistance denoted with the blue dashed line of the accumulation and distribution indicator at $68 per barrel. This is an extremely strong level and one which has been tested on many occasions as evidenced by the thickness of the line and so will present a formidable barrier to any long term recovery.

So in summary, a relatively easy journey to $57.50 per barrel with prices then likely to struggle between here and $63.50 and where an increase in volume will be required to sustain a longer-term bullish rally.

(Click on image to enlarge)

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more