Where Next For Oil?

Following the recent surge higher in oil prices a look at the daily, weekly, and monthly charts for a view of where the commodity may be heading next.

(Click on image to enlarge)

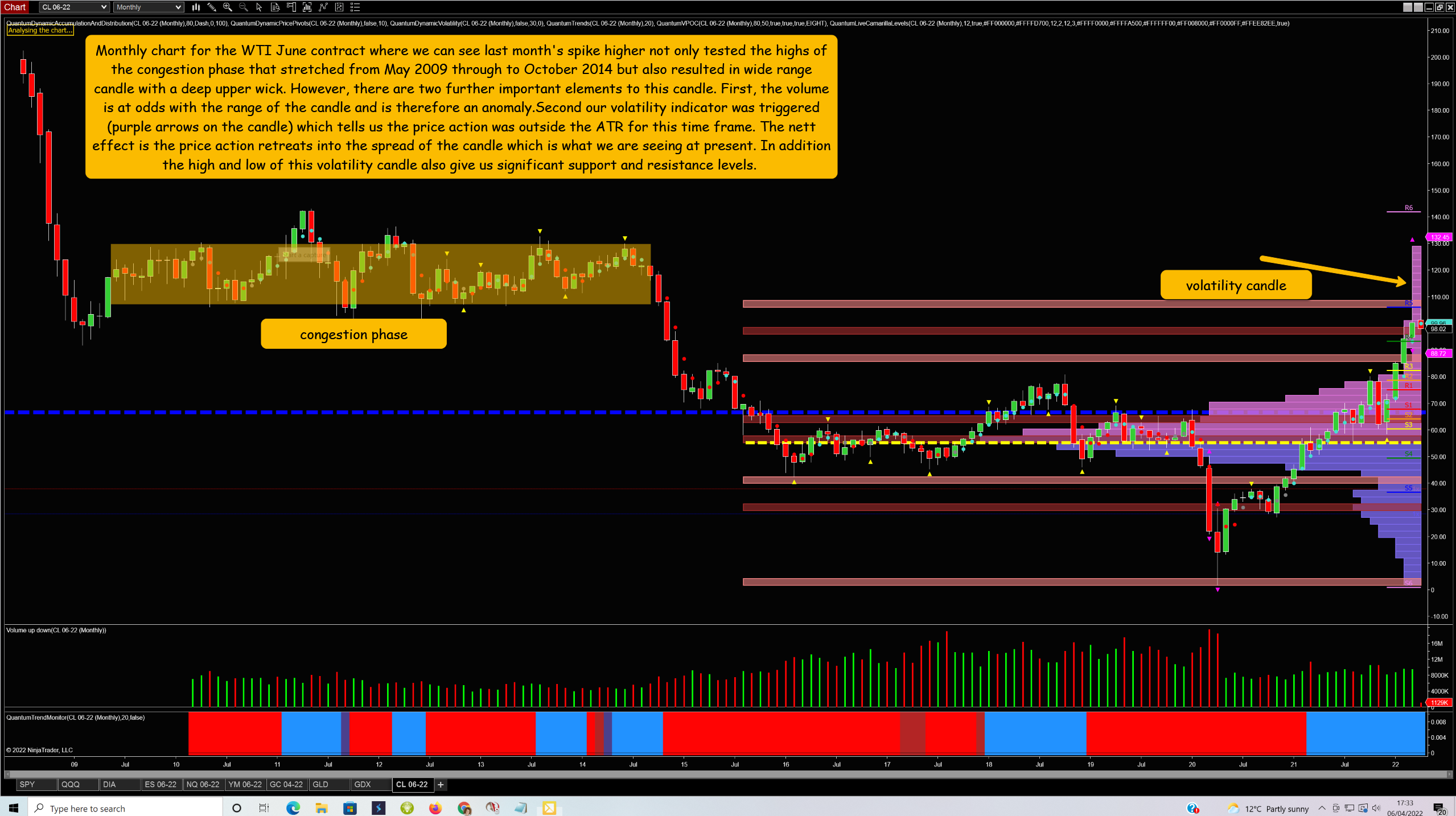

Starting with the monthly chart here we have the price action trading within the spread of last month’s volatility candle but approaching the low of that candle which also coincides with our R4 Camarilla pivot which should provide a degree of support.

(Click on image to enlarge)

Moving to the weekly the key level (at least for this week) is the S3 pivot at $90 per barrel. Of our 6 levels, the third is probably the most important and is where price often pauses and consolidates. What we also need to note is the price action is trading in a low volume node on the volume point of control histogram so price moves are likely to have momentum as there is little resistance in the way of volume.

(Click on image to enlarge)

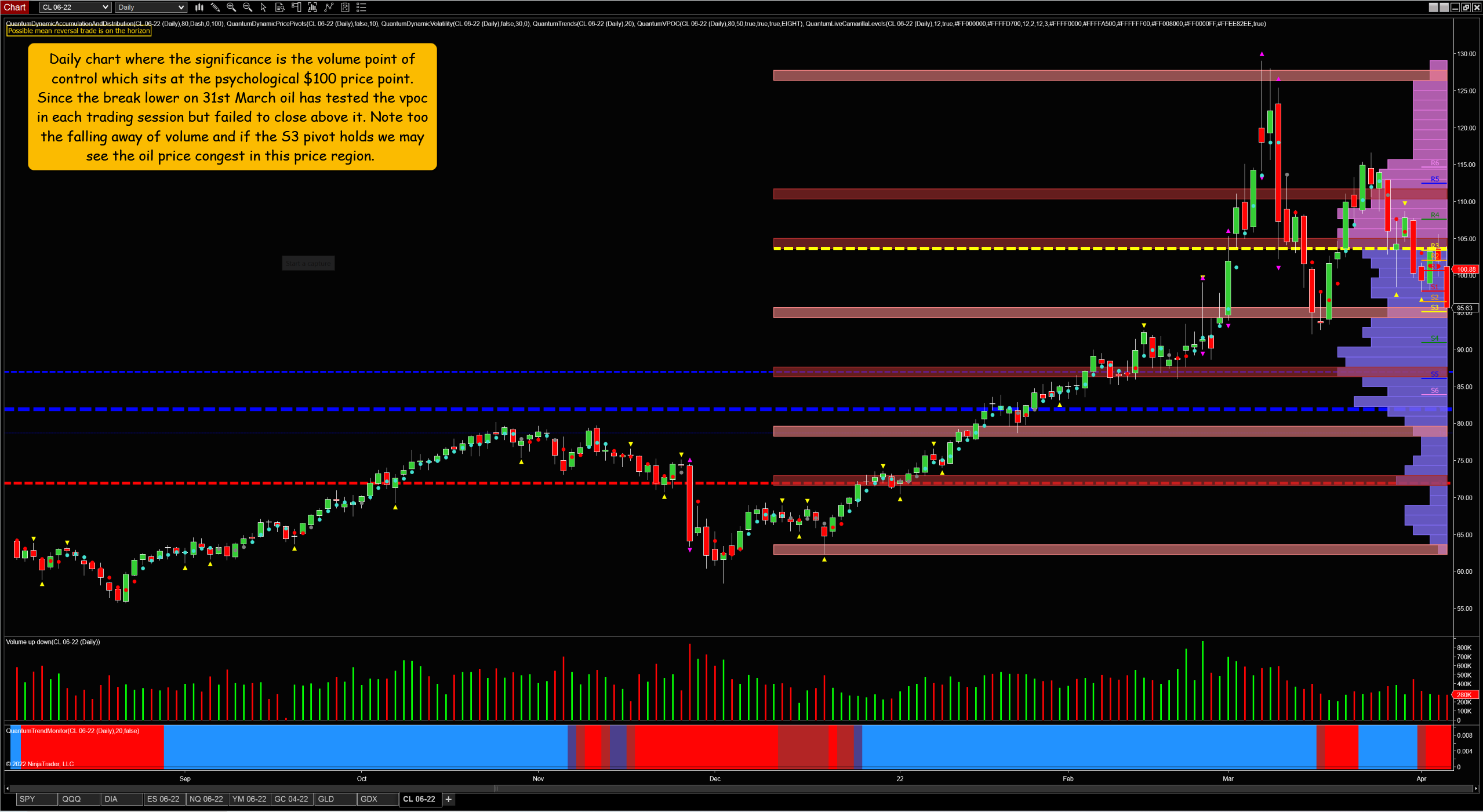

Finally, to the daily and as noted on the chart the significance here is we are currently trading below the volume point of control with the price action fast approaching the S3 pivot at $95.

From a fundamental perspective, the picture is one wherein an effort to tackle rising gas prices President Biden has authorized the release of an unprecedented 1m barrels per day for 180 days from the SPR (Strategic Petroleum Reserve). This increase in supply is in addition to the increase in production agreed by OPEC and its allies of 432k barrels per day although this is not due to begin until May despite calls for the increase to be brought forward. Plus at the time of writing the IEA has also agreed to release 120 mln barrels of oil to ease prices, with the US providing half, the rest coming from other IEA members. In my years of writing about oil, I don’t recall such a concerted effort to increase supply but then we are in unprecedented times. The question is then when will this additional supply begin to impact the price to which there is no easy answer. My own view is the additional supply is likely to have an effect on prices once OPEC and its allies begin to ramp up production. At this point, the ques

Meantime all we can do is watch the charts, and take note of key levels in the current move lower as this is where the price is likely to pause and may even bounce. And, as always volume will validate the price action.

NB – Since writing the above the price action has indeed paused at the levels outlined above.

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more