What Does The Present Gold:USD Ratio Say About The Future Price Of Gold?

This article analyzes the relationship - the correlation - between the U.S. dollar and the price of gold bullion.

1. Whenever the value of the U.S. dollar decreases gold usually goes up.

This negative (i.e. opposite) correlation is because:

- A falling dollar increases the value of other countries’ currencies. This increases the demand for commodities including gold. It also increases the prices.

- When the U.S. dollar starts to lose its value, investors look for alternative investment sources to store value such as gold.

2. It is possible, however, for the U.S. dollar and gold price to increase at the same time.

This can occur because of:

- a crisis in some other country or region which would cause investors to flock to safer assets—the U.S. dollar and gold,

- monetary policy and inflation in the U.S. vs. other countries and by

- economic prospects in the U.S. vs. other countries. Investors need to consider all of these factors.

3. A rise in the USD deters investors from other countries, so gold demand is also negatively affected.

This correlation occurs because:

- when the value of the dollar increases relative to other currencies around the world, the price of gold tends to fall in dollar terms. It is because gold becomes more expensive in other currencies. As the price of any commodity moves higher, demand recedes.

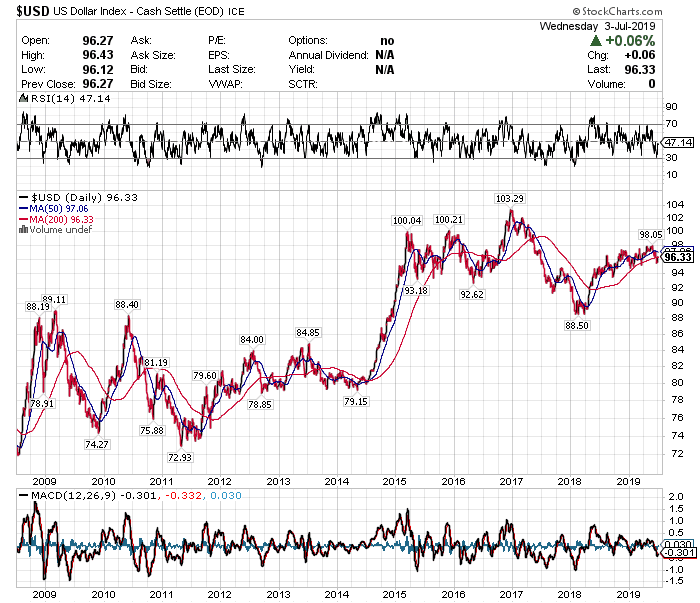

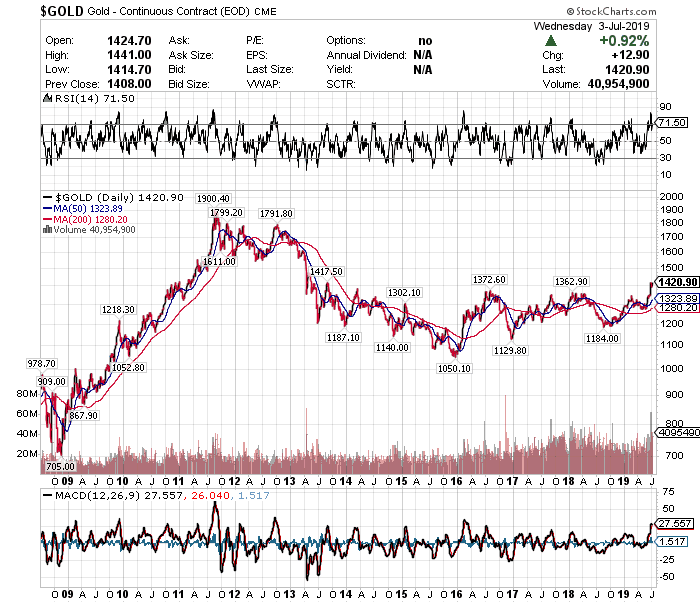

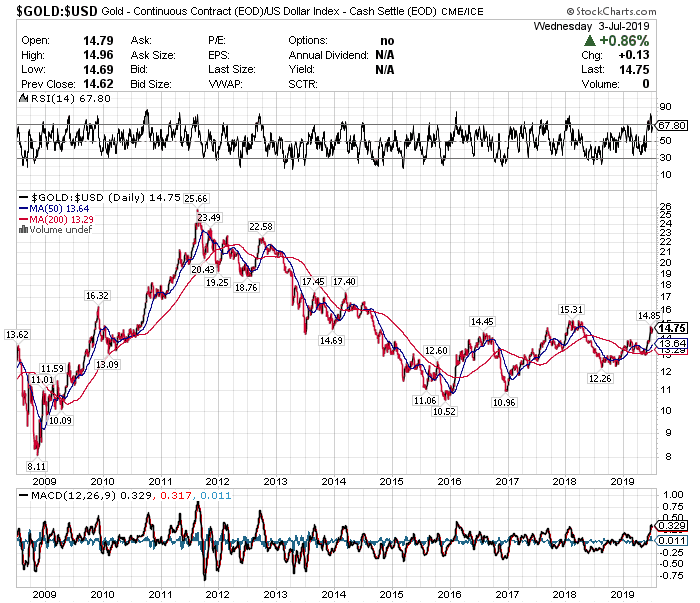

True to point 3 above, the USD has been going UP since May 2011 (see Chart 1); Gold has gone DOWN since then (see Chart 2) with the Gold:USD ratio has gone DOWN from 23.49 in May 2011 to 14.75 as of today (Chart 3):

Chart 1 - USD

Chart 2 - Gold

Gold’s 10-year chart below shows that gold has been readying to break out upside from its 6-year long Saucer base pattern all year. Once it does succeed in breaking out above it, a lot of investors and speculators are going to pile in and drive a huge rally, at which point the PM sector will soar as any improvement in the gold price will go straight through to their bottom lines. As a result, with the Fed set to cut rates in a desperate attempt to shore up crumbling stock markets, the dollar could well tank, which means that gold and the PM sector generally will take off like a rocket.

Chart 3 - Gold:USD Ratio

The above chart shows that gold prices rise more often than not when the dollar drops, but many other factors are involved. There are simply too many influences at play and way too much data but there are two simple conclusions to draw from this:

- The strength of the U.S. dollar doesn't set the value of gold, and

- the value of gold is poorly defined by the U.S. dollar.

Looking ahead, though, many analysts think that gold will eventually beat the U.S. dollar given the growing headwinds for the U.S. dollar such as:

- growing recession fears,

- weaker manufacturing data

- and a Federal Reserve that will not be raising interest rates anytime soon

all of which will continue to benefit gold.

For a rather unique approach to how USD fluctuations impact the value of gold go here and check out the Kitco Gold Index (KGX) and an article (here) that I wrote on the subject.