What Can We Learn From US Crude Inventories?

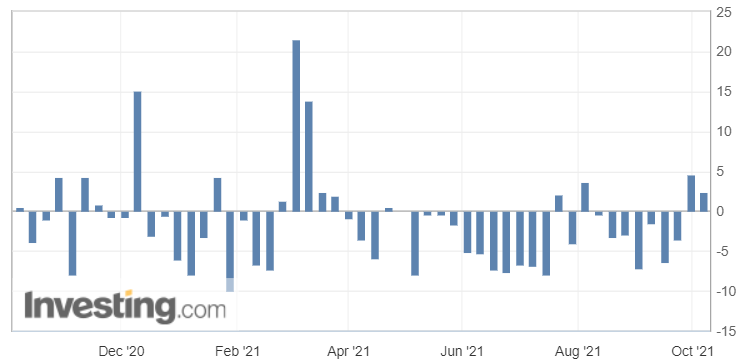

Crude oil inventories turned positive for the second week in a row. Was that the only reason for the recent plunge of black gold?

Fundamental Analysis

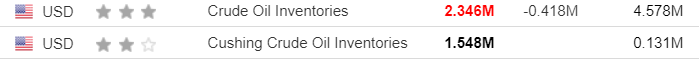

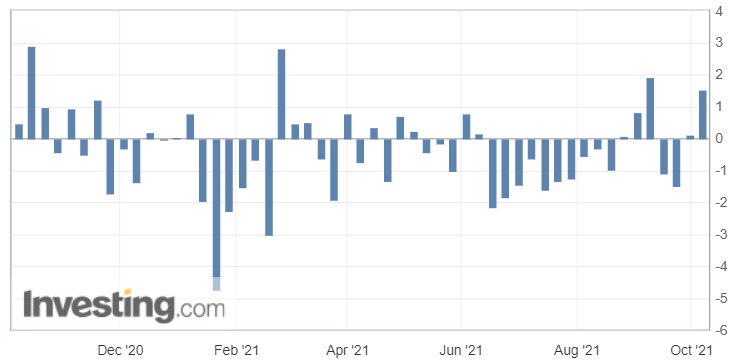

The larger-than-expected rise in crude reserves in the US weighed down oil prices on Wednesday. During the week ending on Oct. 1, crude inventories totalled about 2.35 million barrels according to the Energy Information Administration (EIA), while a number of analysts polled by Bloomberg expected no more than one million barrels. The additional increase signals that the production capacities which were impacted by Hurricane Ida in the Gulf of Mexico are gradually getting back to normal on an operational level.

Consequently, WTI crude oil futures tumbled more than 2% at the end, even though they are still sustained by the maintenance of the OPEC+ gradual production increase of 400k barrels a day in November!

In the meantime, Vladimir Putin's accommodating remarks on Russian gas production pushed natural gas prices down after an initial surge at the start of the market session, making for another choppy day in the market.

Disclaimer: All essays, research and information found in this article represent the analyses and opinions of Sunshine Profits' associates only. As such, it may prove wrong and be ...

more