Weekly Ag Markets Update - Monday, July 6

Wheat: Winter Wheat markets were lower as the Winter Wheat harvest expanded north and as the Spring Wheat was developing under good growing conditions. Yield reports from the region have been variable, but generally a little better than expected, so USDA might raise its production estimates nest month. The Winter Wheat markets hold to bearish trends on the weekly charts. Spring Wheat markets show downtrends as good conditions are also reported in much of Canada. It remains dry in the western sections of the Great Plains but this will aid harvest progress now. Better rains are reported in Europe and Russia. Australia remains in good condition. Prices usually move lower and remain down through the harvest.

Weekly Chicago Soft Red Winter Wheat Futures:

(Click on image to enlarge)

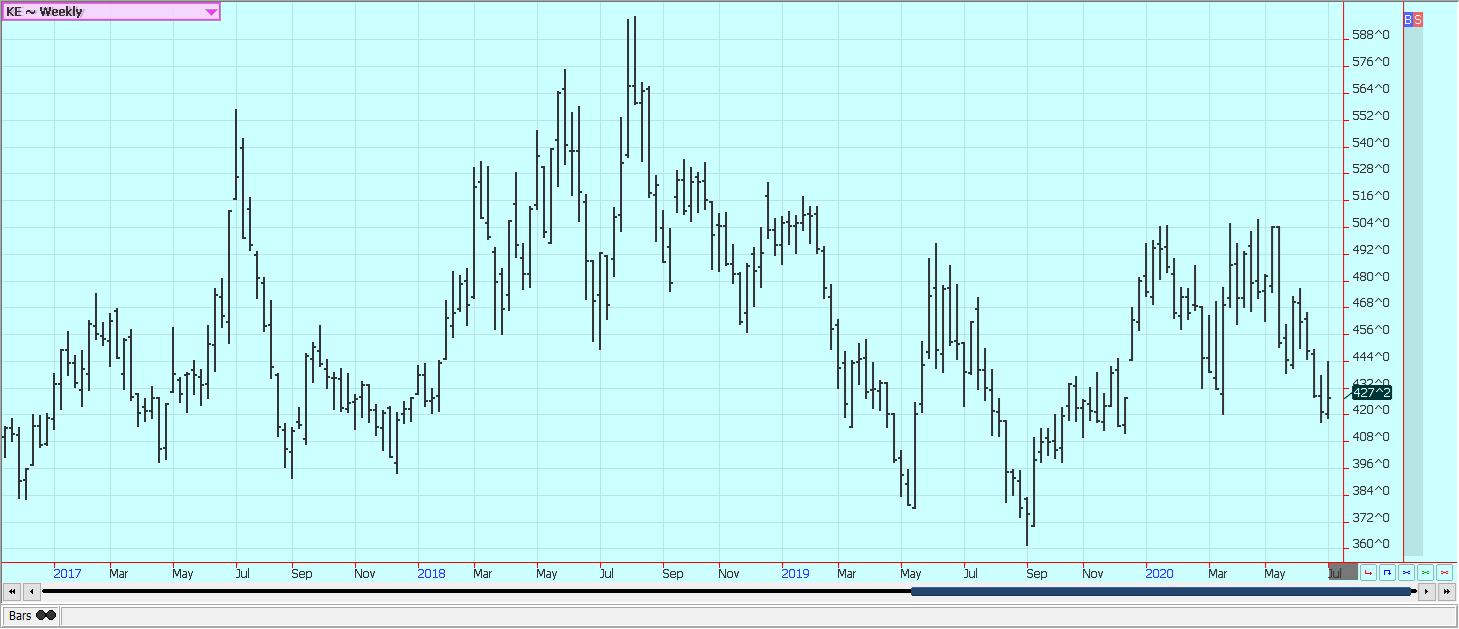

Weekly Chicago Hard Red Winter Wheat Futures:

(Click on image to enlarge)

Weekly Minneapolis Hard Red Spring Wheat Futures:

(Click on image to enlarge)

Corn: Corn was a little higher in reaction to the surprise cut in the planted area shown by USDA. The quarterly stocks report was bearish but the surprise of the report was a cut in the planted area by US farmers from 97 million acres down to 92 million. Futures markets have had hot and dry weather in much of the Midwest this week to support prices, but the weather market is coming as there are some forecasts for hot and dry weather for the next week or two. The ability of futures to hold rallies will depend on how much heat and for how long it stays dry in the Midwest. There have also been problems with demand. Meats processors are back and are aiming to restore 80% to 85% of capacity kill rates in their plants. The backlog of Cattle and Hogs will slowly disappear under this scenario and meats wholesale and retail prices are falling. Ethanol demand is also improving as lockdown orders are lifter in most states and in Europe. Demand for gasoline and ethanol has gotten a little stronger and should continue to improve over time.

Weekly Corn Futures:

(Click on image to enlarge)

Weekly Oats Futures:

(Click on image to enlarge)

Soybeans and Soybean Meal: Soybeans were higher on more Chinese demand and less than expected planted area as shown by USDA on Tuesday. The quarterly stocks report was in line with trade expectations. China has become a much more active buyer of Soybeans here in the US and has promised to ramp up purchases in order to comply with commitments it made under the Phase One trade deal. China has remained a very active buyer in South America even as it has increased Soybeans buying here in the US, so the overall amount taken from the US might not match the hopes of the trade. Brazil prices have been creeping higher for the rest of the world as it starts to run out of Soybeans to export, so China and the rest of the world will look to the US and Argentina for additional supplies. The US weather is considered good for growing Soybeans at this time but forecasts call for hot and dry weather in the next couple of weeks. Ideas are that USDA will show slight deterioration in crop conditions this week.

Weekly Chicago Soybeans Futures:

(Click on image to enlarge)

Weekly Chicago Soybean Meal Futures:

(Click on image to enlarge)

Rice: Rice was a little higher in new crop months and lower for another week in old crop July. New crop months were relatively little changed as new crop prospects appear solid for increased production in the coming year. The combination of good export buying in general and the buying inside the US due to the Coronavirus has made the market short old crop Rice. There are ideas that the mills are well covered into new crop, but little Rice is available from producers. The crops that got planted are in very good condition in the south and near the Gulf Coast but planting was more problematic in parts of Mississippi, Arkansas, and Missouri. Ideas are that the long grain got planted and producers did not plant medium grain if some prevent planting was needed.

Weekly Chicago Rice Futures:

(Click on image to enlarge)

Palm Oil and Vegetable Oils: World vegetable oils markets were higher last week. Palm Oil closed higher after news of renewed demand interest from India and China and on reports of less production from Malaysia.SGS and Amspec reported improved exports in its data last week. Higher world petroleum prices helped with ideas of increased bio fuels demandPalm Oil has been hoping for better demand from importers as world economies slowly open after being closed by the Coronavirus epidemic. Indonesia continues to focus its Palm Oil on internal demand for bio fuels. Soybean Oil and Canola were higher. Soybean Oil found support on increased demand ideas partly fueled by higher world petroleum prices. Canola fell initially on improved growing conditions in the Canadian Prairies. Canola has found support from the weaker Canadian Dollar and ideas that not all areas were in good shape. The weather has been warmer the past couple of weeks after weeks of cold and wet weather.

Weekly Malaysian Palm Oil Futures:

(Click on image to enlarge)

Weekly Chicago Soybean Oil Futures:

(Click on image to enlarge)

Weekly Canola Futures:

(Click on image to enlarge)

Cotton: Cotton closed higher as bad growing conditions continued in West Texas and as farmers planted less than expected area to Cotton at 12 million acres. Signs of an improving economy in the US and around the world really helped ideas of better Cotton demand as did reports of a lot of masks being made for use during the Coronavirus epidemic. The world is starting to slowly recover from the Coronavirus scare and some stores are starting to open again after being closed for weeks. However, economic improvement in the US was thrown into doubt as Coronavirus cases surged higher in states that had reopened. The retail demand has been slow to develop as many consumers got hurt economically due to stay at home orders during the height of the pandemic and have little disposable funds to spend on clothes. Demand will slowly improve but the industry should have plenty of supplies to work with in the short term. The US weather situation is mixed, with good rains noted in the Southeast and good conditions in the Midsouth. However, it has been very hot and dry in West Texas, and crops there are suffering.

Weekly US Cotton Futures:

(Click on image to enlarge)

Frozen Concentrated Orange Juice and Citrus: FCOJ was a little higher. Florida production is now estimated at less than 68 million boxes. Support is coming from the continued effects from the Coronavirus that are keeping people at home and drinking Orange Juice. Demand from grocery stores has remained strong in response to the increased consumer demand. Inventories in cold storage remain solid so there will be FCOJ to meet the demand. There is increasing concern about the foodservice demand not improving even with the partial opening of the states. The weather in Florida is currently good for the crops. Southern areas are cooler and have seen more frequent showers. The tree condition is called good. The Valencia harvest is almost over. Brazil has been dry and irrigation has been used.

Weekly FCOJ Futures:

(Click on image to enlarge)

Coffee: Futures were higher and trends are turning up in both markets. The lack of offer from Brazil has keyed the recent price action. The Brazil harvest is active but shipping and collection have become very difficult due to the widespread outbreak of the Coronavirus there. Ideas are that production will be very strong this year as it is the on year for the trees. The strong production ideas are coming despite hot and dry weather seen in the country at flowering time. Vietnam also had hot and dry weather at flowering time and production ideas there are less than original expectations of a bumper crop. The demand from coffee shops and other food service operations is improving but is still at very low levels. Consumers are still drinking coffee at home and the return of the Coronavirus outbreak will keep things that way. The logistics of moving Coffee from Central and South America remain difficult. Shipping logistics have improved somewhat, but many are still having trouble getting the Coffee to ports to move to consumer nations.

Weekly New York Arabica Coffee Futures:

(Click on image to enlarge)

Weekly London Robusta Coffee Futures:

(Click on image to enlarge)

Sugar: New York and London closed higher. Ideas are that there is plenty of Sugar for the world market, but getting the Sugar moved is becoming increasingly difficult with the widespread Coronavirus outbreak in both Brazil and India. Brazil mills are currently producing about 48% Sugar from the cane crush, from about 33% a year ago. The overall crush rate is below the year-ago levels. India is thought to have a very big crop of Sugarcane this year but getting it into Sugar and into export position has become extremely difficult due to Coronavirus lockdowns. Thailand might also have less this year due to reduced planted area and erratic rains during the monsoon season. There are reduced flows from rivers from China as well.

Weekly New York World Raw Sugar Futures:

(Click on image to enlarge)

Weekly London White Sugar Futures:

(Click on image to enlarge)

Cocoa: New York closed slightly lower and London closed lower for the week. London has been the weaker market. There are a lot of demand worries as the Coronavirus is not going away and could be making a comeback in the US. Harvest is now over for the main crop in West Africa and the results so far are very good. The reports from West Africa imply that a big harvest in the region. However, the Midcrop could be less due to dry weather earlier in the season. Arrivals are on a pace about the same as last year. Ideas are that Southeast Asia also has good crops.

Weekly New York Cocoa Futures:

(Click on image to enlarge)

Weekly London Cocoa Futures:

(Click on image to enlarge)

Disclaimer: Past results are not necessarily indicative of future results. Investing in futures can involve substantial risk of loss & is not suitable for everyone. Trading foreign exchange also ...

more