Weekly Ag Markets Update - Monday, Dec. 21

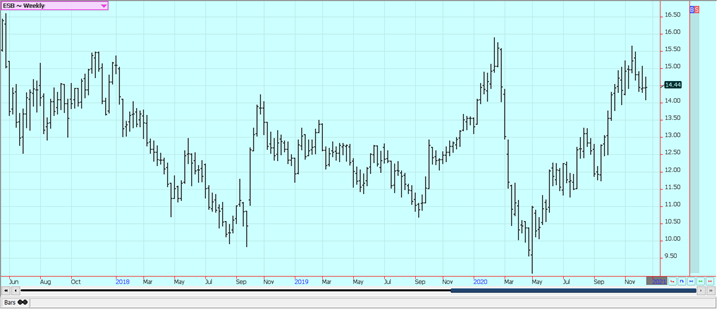

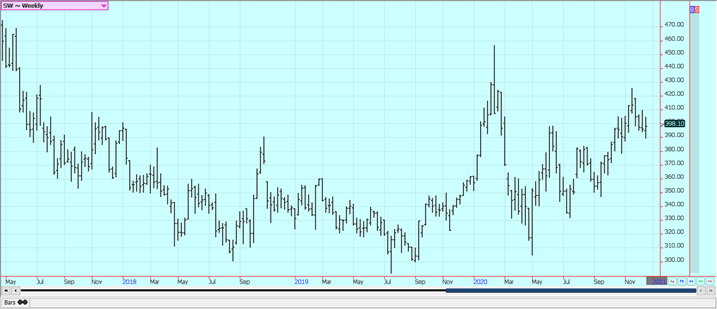

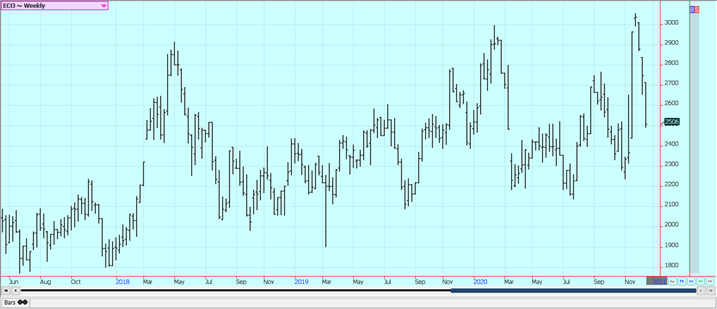

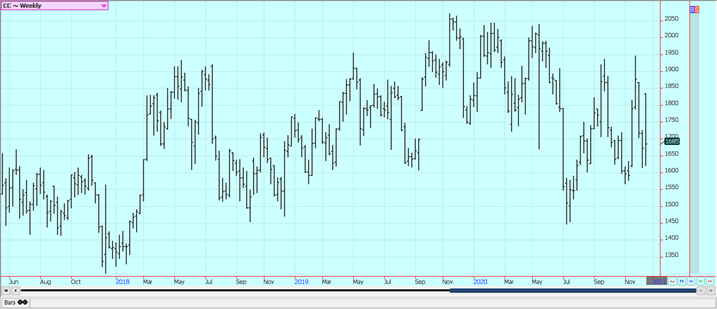

Wheat: Winter Wheat markets were lower in reaction to news that the Russian government is looking to tame food inflation inside the country by taxing and issuing new export quotas on Wheat along with some other agricultural products. Minneapolis Spring Wheat contracts closed higher. US prices moved very close to international prices and US markets searched for new demand. Export demand has started to improve with the close price relationships. World prices have held steady or worked a little higher even with additional supplies available to the market as Russian prices remain elevated. Australian supplies have increased as its harvest is moving forward.US weather is mixed with still dry conditions in the western Great Plains even though a few areas got some snow. Some precipitation was reported in the eastern Great Plains and in parts of the Midwest. Parts of eastern Ukraine and southern Russia remain dry.

Weekly Chicago Soft Red Winter Wheat Futures

Weekly Chicago Hard Red Winter Wheat Futures

Weekly Minneapolis Hard Red Spring Wheat Futures

Corn: Corn was higher and broke out to the upside on the daily and weekly charts. Oats moved lower as the sharp rally came to an end. New export demand was noted from China by USDA in the weekly export sales report. Export demand has held strong as US Corn is about the cheapest feed grain in the world market. Domestic demand has been less due to reduced demand for ethanol processing and questions about feed demand. It has rained in parts of Argentina and in much of Brazil in the past week. Drought could develop in Brazil and Argentina despite the rains this week as the overall weather patterns have been dry and as dry weather is in the forecast for Argentina and southern Brazil. The drought is especially serious in South America for the first Corn crop but the second crop could also be affected due to late planting in central and northern Brazil. Dry weather has delayed the Soybeans planting and that will delay the second Corn planting later. Farmers will not plant if it gets too late in the year as the rains will shut off before the crop gets mature.

Weekly Corn Futures

Weekly Oats Futures

Soybeans and Soybean Meal: Soybeans and Soybean Meal closed higher on better demand for US Soybeans and despite rains in South America. Futures were able to move above 12.00 per bushel and a new leg higher has started on the daily and weekly charts. The weekly export sales report was above expectations and the NOPA crush was very strong.US ending stocks estimates now are very tight and are likely to get even tighter as tie goes on. China continues to buy in small amounts each day but has canceled and switched some contracts made to unknown destinations. Production potential is being threatened in South America due to the lack of rainfall. The situation is most serious in central and northern Brazil but has improved in southern Brazil and Argentina due to recent rains. These rains are leaving southern Brazil and Argentina now and will move to the north. Southern Brazil and Argentina will now turn warm and dry and this will be much more consistent with atypical La Nina pattern. The world will need very strong production from South America to meet the projected demand. The stocks to use ration for Soybeans is now very small and the situation is the tightest projected in years.

Weekly Chicago Soybeans Futures

Weekly Chicago Soybean Meal Futures

Rice: Rice was higher last week as trading reflected the lack of activity in the domestic cash market. The weekly export sales report featured strong demand from Venezuela and strong demand overall and caused futures to rally. Trading volumes have been less for the last couple of weeks. The cash market is slow and the lack of business is reflected in futures volumes traded. Reports indicate that domestic demand has been poor to average with better consumer demand more than offset by much less demand from schools and other institutions. Futures have ignored the bearish data from the monthly WASDE reports in the past week and a half.

Weekly Chicago Rice Futures

Palm Oil and Vegetable Oils: Palm Oil closed higher and made a new high weekly close. The market was supported late in the week by ideas of tight supplies coming down the road. Production of most vegetable oils in the world is less this year due to a lack of production of oilseeds. The production of Palm Oil is down in both Malaysia and Indonesia as plantations in both countries are having trouble getting workers into the fields. Palm Oil prices are relatively high right now so importers are looking at importing Soybean Oil instead due to cost and quality. Soybean Oil and Canola were higher on strong demand ideas. Production problems for Soybeans in South America and a strike by workers at ports in Argentina helped Soybean Oil. Very strong Palm Oil prices have made buying Soybean and Canola oils the better option. Trends are up in Soybean Oil and in Canola. Demand for Canola has improved in recent weeks and farm selling has been less as farmers have reduced supplies.

Weekly Malaysian Palm Oil Futures

Weekly Chicago Soybean Oil Futures

Weekly Canola Futures

Cotton: Cotton closed higher again and made a new high close on the weekly charts again.USDA surprised the market over a week ago when it released its monthly supply and demand reports. The reports showed a significant drop in production of US Cotton and much reduced the US ending stocks levels. The reports were bullish and a move to the upper end of the 70 cents range is possible. Harvest is wrapping up amid drier weather conditions in West Texas and the Delta and Southeast. The weekly export sales report showed very strong demand once again last week. Export demand has held strong despite stay at home orders and weaker economies around the world. Traders now hope for even more demand later as the vaccines are given out and the world economies start to recover.

Weekly US Cotton Futures

Frozen Concentrated Orange Juice and Citrus: FCOJ closed higher last week after making new lows for the move on the charts. The price action turned positive in the last couple of days. The weather in Florida remains mostly benign. Florida has been spared any hurricanes or other serious storms this year in a year that has been very active for tropical storms. The Coronavirus is still promoting consumption of FCOJ at home. Restaurant and food service demand has been much less as no one is dining out. The weather in Florida is good with frequent showers to promote good tree health and fruit formation. Brazil has been too dry and irrigation is being used. Showers are falling in Brazil now and these need to continue to ensure good tree health. However, it could turn warm and dry again next week. Mexican crop conditions are called good with rains.

Weekly FCOJ Futures

Coffee: Futures were higher last week in both markets. The move came despite CONAB, the Brazilian crop agency, estimating a new record production for the current year. The market is looking ahead to next year. It has been a weather market and the weather has improved. Vietnam has harvested its production under mostly dry conditions. Central America is also drier for harvesting. Brazil is getting some rains now to improve flowering after an extended dry season, but the rains are sporadic and not everyone is getting helped. The demand from coffee shops and other food service operations is still at very low levels as consumers are still drinking Coffee at home. Reports indicate that consumers at home are consuming blends with more Robusta and less Arabica. The weather is good in Colombia and Peru.

Weekly New York Arabica Coffee Futures

Weekly London Robusta Coffee Futures

Sugar: New York was about unchanged for the week and London closed higher. It has been raining in south-central Brazil and the production of cane should be improving. The first half of November crush was down almost 20% from the previous year as cane production has been hurt due to dry weather earlier in the year. Brazil mills have been producing more Sugar and less Ethanol due to weak world and domestic petroleum prices. India has a very big crop of Sugarcane this year. The Indian government has not announced the subsidy for exporters of Sugar so no exports are coming out of India yet. Sources told wire services that any subsidy will need to be significant to get export sales on the books. Thailand might have less this year due to reduced planted area and erratic rains during the monsoon season. The EU is having problems with its Sugarbeets crop due to weather and disease. Coronavirus has returned to the world and has caused some demand concerns, especially for Ethanol.

Weekly New York World Raw Sugar Futures

Weekly London White Sugar Futures

Cocoa: New York closed lower and London closed slightly higher last week. Importers are still looking for ways to source Cocoa without paying a premium demanded by Ivory Coast and Ghana. Both countries have instituted a living wage for producers there and are looking to tax exports to pay the increased wages. Buyers have been accused of using certified stocks from the exchange instead of buying from origin. However, it looks like the exchange buying has come to a halt for now. There are a lot of demand worries as the Coronavirus is making a comeback in the US. Europe is also seeing a return of the pandemic.

Weekly New York Cocoa Futures

Weekly London Cocoa Futures

Disclaimer: A Subsidiary of Price Holdings, Inc. – a Diversified Financial Services Firm. Member NIBA, NFA Past results are not necessarily indicative of future results. Investing in ...

more