US/World February S&D Reports - China’s Historic US Corn Purchases Didn’t Change USDA Stocks

Market Analysis

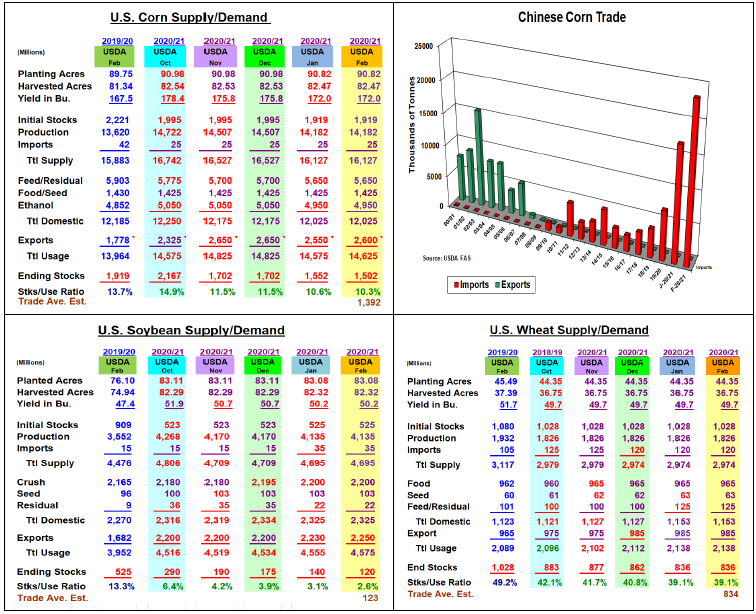

February's USDA US & World supply/demand reports had their changes. However, the World Board’s minimal decline in its US corn exports and their modest drop in corn’s ending stocks was the biggest surprise. The USDA did slightly increase soybeans 20/21 exports as expected & left the US wheat balance sheet unchanged. Changes in the USDA’s world wheat & corn usage and ending stocks also seemed to impact this month’s US corn balance sheet.

Instead of 150 to 200 million bu. increase in the US corn exports in the latest US S&D report after last week’s hefty 5.8 mmt (230 million bu) Chinese purchase, the World Board raised this year’s US exports by just 50 million bu. This modest adjustment resulted in a 20/21 ending stock level of 1.5 billion bu. How did this occur with no changes in corn’s feed or ethanol demand levels this month?

The USDA did increase China’s corn imports by 6.5 mmt to 24 mmt this month, their highest total ever. But, the World Board also increase China’s and the World’s wheat feeding outlook by 5 mmt while reducing Europe’s and other countries' corn imports by 3.8 mmt. Utilizing locally avail-able wheat for feeding isn’t unusual, but the USDA’s forecast that China’s corn stocks will rise by 4.5 mmt will remain a hot topic in the corn market going forward.

February’s US soybean balance sheet followed the trade’s script when the World Board increased its 2020/21 export forecast by 20 million bu to 2.25 billion. With no changes in their US crush or import outlooks this month, the USDA’s latest stocks forecast is now 120 million bu, the lowest levels since 2014 with a similar 2.6% stocks/use level. The USDA didn’t change its Argentine or Brazilian bean crop estimates of 48 & 33 mmt this month either.

As mentioned, the USDA didn’t change wheat’s 2020/21 US S&D levels despite export taxes being imposed on Russia’s remaining exports this crop season. Along with the China’s higher feed usage, India’s domestic wheat demand was also raised by 3.5 mmt. slicing the USDA’s world stocks to 304 mmt, which is still a historic level.

(Click on image to enlarge)

What’s Ahead

The USDA’s approach to the recent Chinese corn purchases was unexpected & surprised buyers. This has opened the ag markets to fund liquidation. Given the general tightness of US supplies, the focus will remain on China’s trade activity, but it will also switch to the upcoming S American harvest and its results. Hold 2020/21 corn & wheat sales at 90% and beans at 80% while keeping 2021/22 sales at 20%.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more