USDA June Corn Stocks - Ethanol Rebounding While Exports Slow, But Feed Use May Recover

Market Analysis

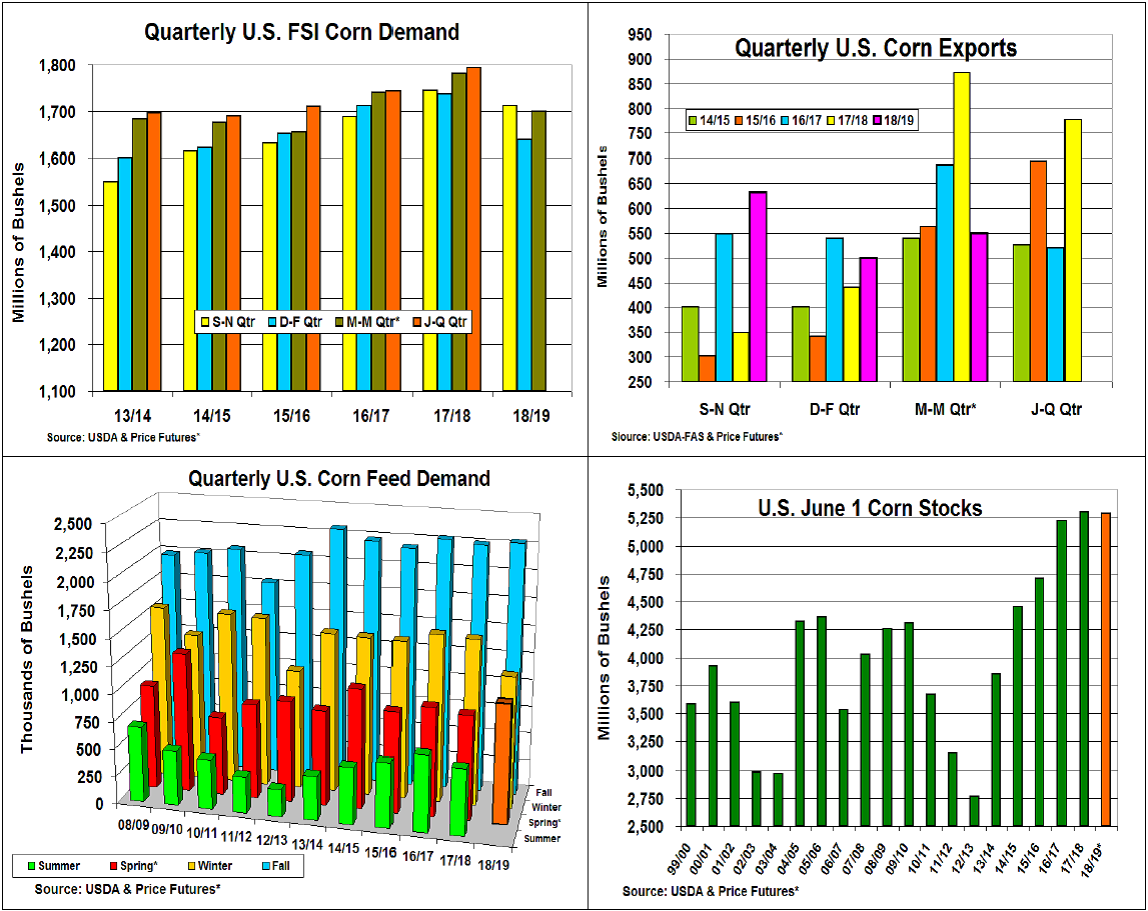

The market’s focus will be split between the upcoming USDA’s quarterly stocks and 2019 acreage reports both being released on June 28. We look at the corn stocks report here. After higher industry waivers were issued and a harsh winter cut ethanol output last quarter, US production picked up in the last 6-7 weeks of the spring quarter rebounding this domestic corn demand back to its last fall’s corn usage level. During March, many WCB biofuel plant outputs were curtailed because of flooding either damaging or limiting rail routes to get their product moved to other regions of the country. Last month’s US ethanol production jumped ahead of the summer driving season with a 1% yearly gain bringing last quarter’s total industrial demand to 1.7 billion bu.

US export shipments began the first half of this crop year on a strong pace because of last year’s drought-reduced S. American corn crops. However, 2019’s rebound in both Argentina and Brazilian outputs has provided renewed export competition. Adding to this past quarter’s sharp decline vs. 2018’s record exports has been this spring’s extreme Midwest rains. This has shut down Mississippi barge traffic north of St Louis for virtually all of April and May. This spring’s 550 million in exports leaves 518 million bu. to hit the USDA’s 2.2 billion bu. forecast.

This year’s surprising March 1 corn stocks prompted a significant cutback in corn’s US winter feed demand. We are expecting a rebound during the latest quarter. Even if feed buyers were utilizing their inventories and inexpensive by-products and small grains, this year’s larger cattle feedlot numbers (2-4%) and higher hog & poultry slaughters suggests a 14% increase over last year similar to 2012/13 and 2009/10 years. This 1.075 billion bu. of feed demand will bring last quarter’s overall corn usage to 3.325 billion bu. This projects 2019’s June 1 stocks to be 5.290 billion, 15 million bu. lower than last year.

(Click on image to enlarge)

What’s Ahead

The upcoming quarterly stocks will update the market on old-crop supplies. However, this year’s record US planting delays impact on 2019 corn seedings will be the trade’s focus on June 28. Given the significant number of unplanted acres (25 million), the June 28 report likely won’t capture all the US farmers’ decisions. July weather is huge. Use Dec strength in $4.80-$4.95 range to add 15-20% to 2019/20 sales.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more