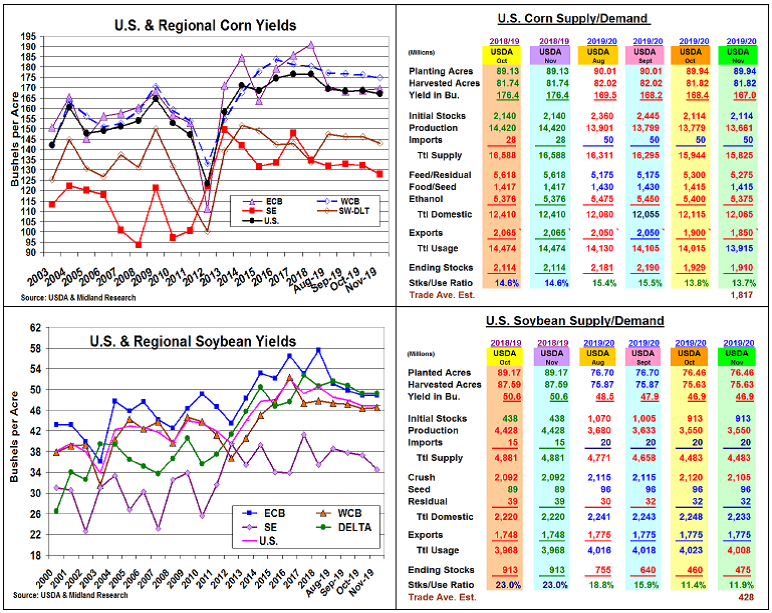

US November Crop & Supply/Demand - Demand Reduced Steady To Lower Beans & Corn Crop Impacts

Market Analysis

Even with a network malfunction that delayed the USDA numbers a few minutes, November’s data didn’t spark much upside price action. A Trump statement just before the USDA report that he hadn’t agree to any tariff rollbacks despite reports from trade talks the previous day limited Friday’s upside price action. However, this month’s lower US corn (-118 mil bu.) and smaller wheat (-42 mil bu.) crops lifted their values for many sessions despite no change in the November’s US soybean crop.

In corn, this month’s lower WCB (-2.1 bu.), SE (-4.3 bu.) and SW/DLT (-2.9 bu.) yields were significant, but the ECB average yield went up 0.7 bu. with IA and IL’s Nov yields left unchanged. This resulted in a smaller US yield of 1.4 bu. at 167 bu. Overall, however, corn’s crop size was 18 million above expectations. The dispersal of corn’s demand outlooks also had surprises when the USDA cut feed & ethanol demand by 25 million along with a 50 mil smaller export outlook. This resulted in just a 19 million smaller ending stocks of 1.91 billion bu.

In soybeans, the US average yield was left unchanged at 46.9 bu. vs. expectations of 46.6 bu. level. This fall’s drought in the SE slipped this area’s yield by 2.8 bu, but the USDA left the Delta & ECB yields unchanged and upped the WCB by 0.1 bu. Similar to corn, both IL and IL state yield were left unchanged. With no harvested area change, the US output stayed at 3.55 billion bu. The USDA also decided to slice 15 million from its US crush demand despite tightening world vegetable oil supplies & slow S. American bean plantings. Overall, this month’s US ending stocks rose 15 million to 475 million bu.

In wheat, the USDA revised down the total US output by 42 million bu. to 1.92 billion. The resurvey of N Plains’ spring & durum crops were behind this cut as 890,000 harvested acres were dropped. This pulled wheat’s US ending stocks off 29 million to 1.014 billion bu.

(Click on image to enlarge)

What’s Ahead

US commercials still need supplies going into winter & the closure of the US barge system later this month for export & processing. With the US harvest winds down, the market will remain quite sensitive to upcoming weather & trade news. Given the current fund short positions, prices action above Dec’s $3.85 & Jan’s $9.37 levels could open 12-17 cent rallies to advancing corn & bean sales by another 20%.