US July Wheat And S/D Updates - US Supply/Demands Revised, But Summer Weather Now The Focus

Market Analysis

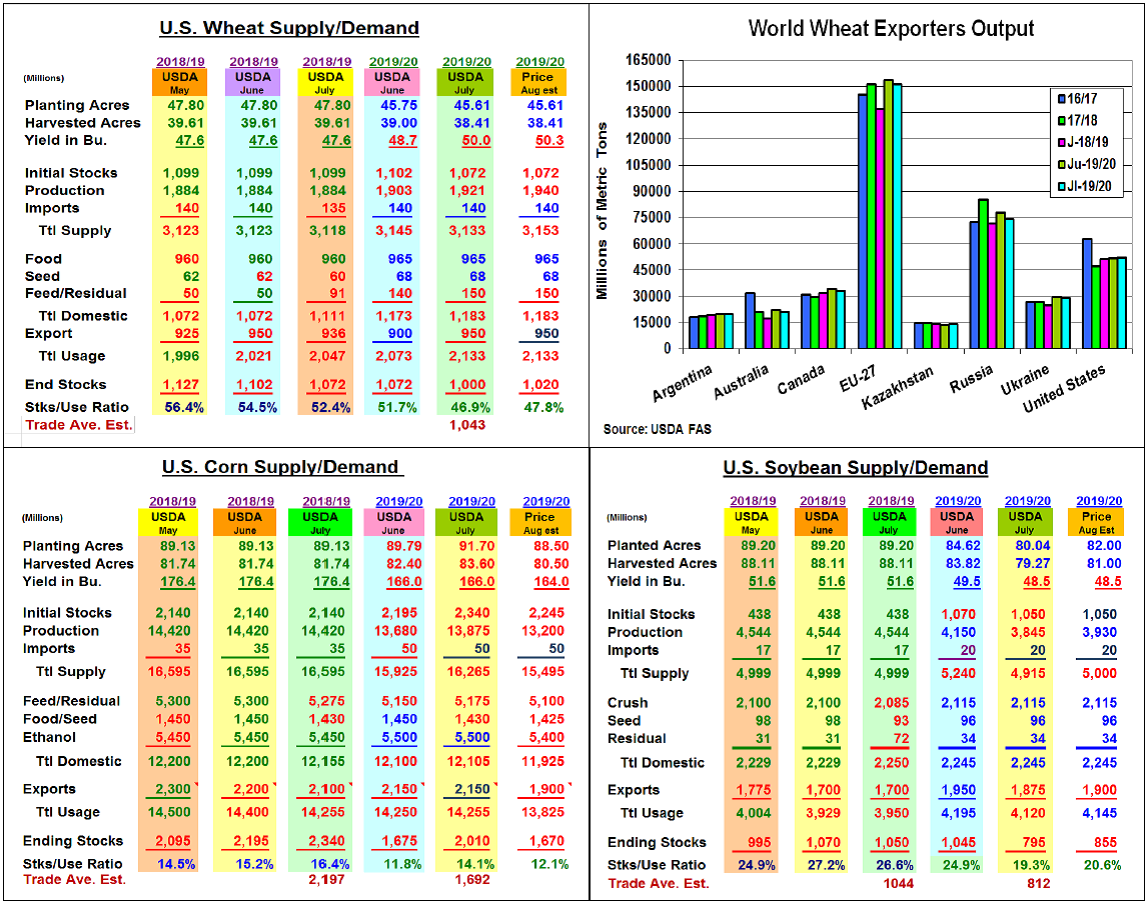

This month’s US 2019/20 supply/demand updates had lower than expected wheat and soybean ending stocks while corn’s balance sheet had a negative slant with larger stocks than the trade average. As anticipated, all three major US crops utilized last month’s acreage report levels in the World Board’s supply calculations. However, the USDA left corn’s US yield estimate unchanged from their June level while they shaved 1 bu in soybeans 2019/20 yield forecast. The big surprise in July’s revisions was the USDA’s 9.8 mmt cut in wheat’s major world exporters output.

Despite higher graze out of S. Plains acres, higher wheat yields across the US Plains boosted hard red’s output by 10 million bu. while higher PNW yields in-creased winter white wheat’s crop by 5 million. US northern wheat yields were up slightly vs. last month, but smaller June plantings left output near unchanged. The big adjustment in wheat’s 2019/20 US balance sheet was the 50 million bu. jump in exports because of the world’s smaller output led by Russia’s 3.8 mmt drop.

Soybeans lower June stocks prompted 41 million bu. higher old-crop residual level, but 20 million less in crush & seed usage left stocks only 20 million bu. smaller. However, the USDA’s 1 bu yield drop sliced 2019/20’s stocks to 795 million, 250 million bu. less than June.

No change in corn’s 2019 yield despite 1.9 million more plantings and cuts in old-crop feed & export demand pressured prices initially. Corn’s 145 million larger old-crop carryover and 195 million bu. larger 2019/20 crop size were behind the USDA’s ending stocks re-bound to 2 billion bu. for this grain’s 2019/20 crop year. However, Midwest forecasts of hot/dry weather to resume this weekend and continue into next week along with expectations of smaller US corn plantings on August's resurvey helped firm prices into the close.

(Click on image to enlarge)

What’s Ahead:

The USDA’s June 28 announcement of a major resurvey of US plantings prompted us and others to expect lower corn and higher soybeans acres on the next August crop report. This idea & the forecast of stressful weather resuming in the Midwest this weekend shifted the markets away from July’s revisions. It remains prudent to advance soybean sales to 30-40% on price strength into Nov’s $9.30-$9.45 range.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more