US Corn & Bean Crops Were Smaller, But Demand Was Cut Too

Market Analysis

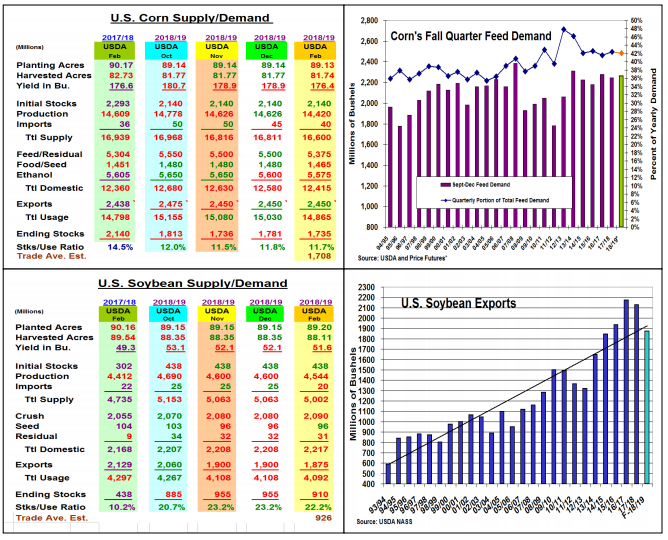

The month’s crop and stocks updates provided some surprises for the bulls and bears again this year. 2018’s final output levels provided some larger-than-expected cuts in corn and soybeans yields and outputs. However, both crops ending stock adjustments were limited because of lower 2018/19 demand levels. This year’s initial winter wheat seeding report returned to its past trend. Last fall’s 838,000 lower-than-expected seedings leaves only 2 years in 35 years with significant higher plantings.

Corn’s final US yield dropped by 2.5 bu. to 176.4 bu. from Nov. & was1.5 bu. lower than the trade’s average. This year’s final harvested area also slipped by 27,000 acres resulting in 206 million bu. lower corn crop which was also 112 million bu below the trade’s survey level. Last fall’s wet and cold weather in the WCB lowered yields by 2-6 bu. except in IL and ND. Last fall’s Dec. 1 corn stocks of 11.952 billion bu. were lower than expected. However, this year’s first quarter export (+81%) and ethanol (-1.1%) usage suggest last fall’s feed demand was virtually the same as 2017 (+0.5%). This lack of change prompted the USDA to slice its 2018/19 feed outlook by 175 million bu. to 5.375 billion similar to last year’s 5.3 billion final feed demand. This month’s modest 46 million bu. drop in corn’s ending stocks to 1.735 billion bu. was surprising given corn’s 200 million smaller crop.

This year’s soybean crop was lowered by 56 million bu. to 4.544 billion last week when the US yield was reduced by 0.5 bu. to 51.6 bu. Poor harvest weather lowered yields across the WCB and the SE while the ECB yields were mixed. Last week’s Dec 1 stocks at 3.736 billion bu, were up sharply from last year’s 3.161 billion level because of China’s reduced imports. Despite Chinese bean purchases of 8-10 mmt since Dec 1, the USDA cut bean’s exports by 25 million bu. because of last fall’s slow shipment pace countering Feb’s smaller crop.

What’s Ahead

After a limited impact from last week’s delayed crop production and stocks reports on prices, the markets will be likely refocusing on the erratic weather of S. AM and US/Chinese trade talks with the US in Beijing this week. Given the uncertainty of the upcoming trade talks, producers should utilize March price advance to the $3.82 and $9.20 areas to cover near-term cash needs.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more