Uranium Stocks Soar To 6 Year Highs On Blowout Cameco Earnings, Hugh Hendry Reco

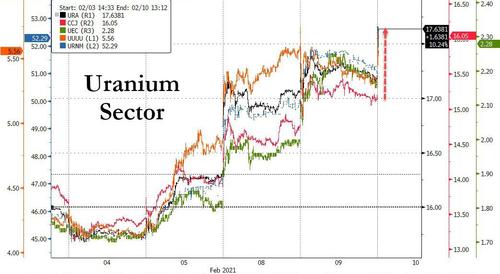

The recent surge in Uranium stocks continued this morning after Cameco smashed Q4 estimates and provided a positive sector outlook.

Cameco, which last week jumped on what a TD Securities analyst said was a residual Reddit short squeeze, reported 4Q adjusted EPS C$0.12, smashing the estimated loss/share of C$0.02.More importantly, the company - which is the operator of the largest uranium-producing mine in the world, Cigar Lake in Saskatchewan - said that heading into 2021, it remains positive about the long-term fundamentals for the uranium market, citing a focus on electrification globally and Biden administration support for nuclear power. It added that demand for nuclear power is growing for traditional and non-traditional uses.

“These are the fundamentals that give us growing confidence the uranium market will undergo a transition similar to the conversion and enrichment markets,” CEO Tim Gitzel said.

On the other hand, Cameco said that it is Cigar Lake production remains suspended due to the Covid-19 pandemic, resulting in an uncertain production plan for 2021, and expects to incur C$8 million to C$10 million per month in care and maintenance costs. Paradoxically, this remains positive for the industry as it means there is far less supply which in turn is pushing prices higher, and lifting stocks.

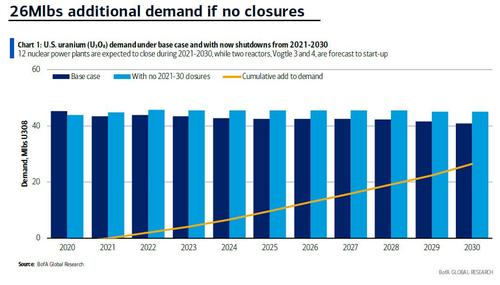

The strong earnings followed a note from Bank of America published in early February according to which nuclear reactor closures in 2021-2030 could be delayed to beyond 2030, which would lead to "an additional 26Mlbs of global uranium (U3O8) demand over that period."

The uranium sector was further buoyed by a tweetstorm from iconic investor Hugh Hendry, who on Sunday tweeted "A lot of you are invested in uranium. I commend you. I wish I was. Uranium is the rockstar of commodities. It doesn't mess around - bull and bear markets are of epic proportions."

A lot of you are invested in uranium. I commend you. I wish I was.

— Hugh Hendry Eclectica (@hendry_hugh) February 6, 2021

Uranium is the rockstar of commodities. It doesn't mess around - bull and bear markets are of epic proportions.

To our readers, Hendry said nothing new, as we have previously repeatedly laid out the bullish case for uranium stocks in general, and Cameco (CCJ) - which controls the world’s largest high-grade uranium reserves and low-cost operations and is one of the largest global providers of the uranium fuel - in particular (here, here, here and here),

There was some actual news yesterday when Power Magazine reported that Honeywell announced its plans to reopen its sole US uranium plant (i.e., Metropolis Works in Illinois – i.e., the US’ sole uranium conversion facility).

“As the only domestic uranium conversion facility, Honeywell’s Metropolis Works facility has been an important national strategic asset, well-positioned to satisfy UF6 demand both in the U.S. and abroad,” the company said on Tuesday.

Commenting on this development, GLJ Research overnight published a note, stating that "with our model pointing to a sizeable deficit in uranium supply emerging in 2020 – driven by near-record-low uranium spot prices, as a present, which has rendered the bulk of the world’s uranium supply loss-making – any spike in demand for uranium substrate would, we believe, result in substantially higher prices (our bull thesis on the global uranium space is supported, in part, by the fact that uranium demand is largely inelastic to price [i.e., utilities will buy, no matter what the price])."

The conclusion:

The Uranium sector supply/demand balance is the tightest we've seen since pre-Fukushima. Furthermore, producers who account for over 50% of global supply are keeping capacity at bay for the sole purpose of driving Uranium prices higher. When you add to this the Uranium stocks are now gaining attention from ESG investors due to their low GHG footprint and quintessential role as a clean energy alternative, we see the set-up for incremental/new Uranium investments as opportune. Under this backdrop, we prefer Cameco given its low-cost industry positioning and solid balance sheet - Cameco currently boasts a cash-to-debt ratio of 79.5%, which was enabled by the company fortifying its balance sheet during the most recent downturn.

And on the back of CCJ's blowout earnings, the Hugh Hendry reco, the growing industry optimism and rumbling that there may be an ESG push behind the scenes, it is no wonder that the uranium sector is surging this morning, with CCJ surging 5.7%, rising above $16 to a six-year high, with UUUU +4.7%, UEC +5%, and DNN +8%.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Good focus on uranium, I did so as well today. Keep up the good work throughout!