Two Trades To Watch: Gold, DAX

Image Source: Unsplash

Gold edges up from three month low. DAX rises after a volatile week.

Gold edges up from three month low

Gold has steadied after losing 1.6% in the previous session. The pair closed below the 200-day moving average and is set to lose over 3% across the week in its worst weekly performance in two months.

The USD trading at a 20-year high, and fears of a more hawkish Fed are dragging on demand for the USD denominated, non-yielding Gold.

Attention will now turn to US consumer confidence, with is expected to decline to 64 in May, down from 65.2 in April. Although so far, the more pessimistic outlook hasn’t changed consumer habits.

Where next for Gold prices?

Gold has been trading within a falling channel since mid-April, falling below its multi-month rising trendline, closing below the 200 SMA, and hitting a low of 1810.

The RSI hasn’t quite tipped into oversold territory, leaving room for further downside. Sellers would need to break below 1810 to open the door to 1800 and 1781, the lower of the falling channel and the January low.

Buyers would need a move over the 200 sma at 1836 and the rising trendline at 1854 to establish a meaningful recovery and bring 1867, the May 9 high, into play.

(Click on image to enlarge)

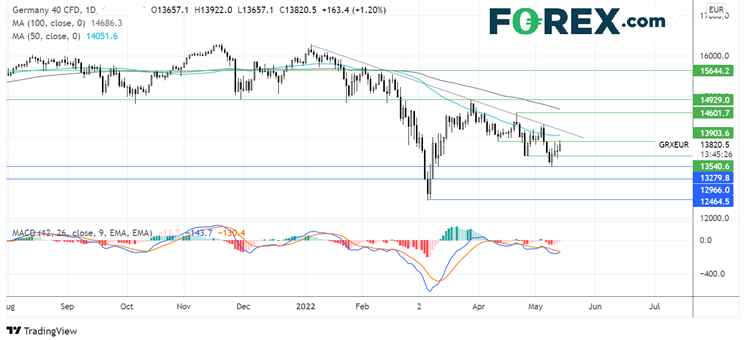

DAX rises after a volatile week

European stocks are heading higher on the final day of a volatile week. Investors have weighed up persistent inflation concerns, hawkish central bank fears, and tighter monetary policy’s impact on global growth.

European indices have followed the lead from the US, where inflation, both PPI and CPI, eased less than feared. Powell acknowledged the scale of the challenge that the Fed faces in an interview on Thursday.

Deutsche Telekom will be in focus after reporting strong quarterly earnings and lifting its full-year outlook.

Eurozone industrial production numbers are also due.

Where next for the DAX?

The DAX is extending its rebound from 13280, the weekly low. The rise above resistance at 13500 and the bullish crossover that appears to be forming keep buyers optimistic about the further upside.

Buyers will need to overcome resistance at 13885, the April 11 low, to expose the 50 sma at 14030. A move over 14300 would create a higher high.

On the flip side, sellers will be looking for a move below13500 to open the door to 13280 and a lower low ahead of 12975.

(Click on image to enlarge)