Two Trades To Watch: DAX, Oil

Photo by Christian Wiediger on Unsplash

DAX rebounds ahead of ZEW economic sentiment data. Oil falls extending yesterday's steep selloff.

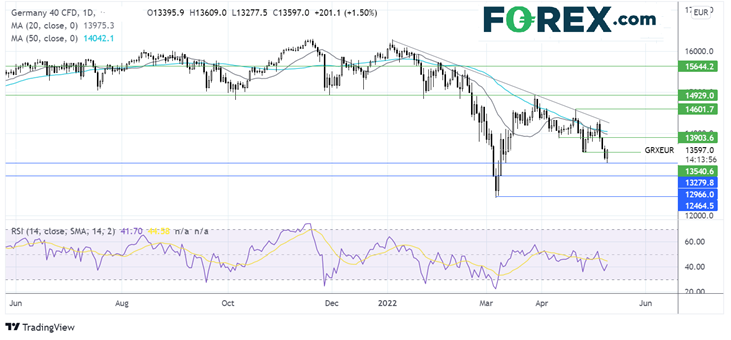

DAX rebounds ahead of ZEW economic sentiment data

Europe stocks are attempting a rebound after a steep sell-off in the previous session and a blood bath on Wall Street which saw the Nasdaq drop 4.3%.

The DAX closed 2.3% lower yesterday after investors sold out of riskier assets amid fears over surging inflation, rising interest rates, and a recession.

While risk is attempting to reset stagflation and recession, fears remain.

Attention is now turning toward German ZEW economic sentiment data, which is expected to show a deterioration to -42.5 in May, down from -41, which was already the lowest level since the pandemic’s start.

Where next for the DAX?

The DAX found support yesterday at 13280 and has rebounded back above resistance at 13550, the April low. However, the bigger picture remains bearish as the price trades firmly below its falling trendline resistance, and the RSI remains in bearish territory.

Sellers need to break below 13280 to continue the bearish trend towards 13000, the psychological level, and 12430, the 2022 low.

Buyers will need to extend gains above 13900 to expose the 50 & 100 sma. It would take a move above 14300 to create a higher high.

(Click on image to enlarge)

Oil steadies after a steep selloff

Oil dropped over 5% yesterday and is holding steady today amid fears over tighter lockdowns in China, the world’s largest oil imported, a stronger USD, and recession fears weigh on the demand outlook.

Fears over the global growth outlook have overshadowed supply concerns. Furthermore, the USD trading around a 20-year high also makes oil more expensive for buyers with foreign currencies.

The EU proposed a phased-in ban on Russian oil last week; however, this still needs to be voted through. Hungary and some other Eastern European countries are still against the proposal calling for exemptions.

API inventory data is expected to show that crude oil inventories fell last week.

Where next for WTI oil?

WTI faced rejection at 110.50 and rebounded lower, falling below the 50 and 100 sma. The price found support around the key 100.00 level and May low and is attempting to rise.

Oil continues to trade above its multi-month rising trend line, which, combined with the long lower wick on today’s candle, keeps buyers hopeful of further gains. A move over the 50 & 100 sma at 103/104 is needed to continue the move higher towards 110 to create a higher high.

Sellers will be looking for a move below 100.00 which would open the doors to support at 94.70, a level that has offered support and resistance at several points across the past few months.

(Click on image to enlarge)