Timing And Watching Silver

COVID-19 has had a dramatic impact on productivity and business. As such, the burdens on governments and their budgets are enormous. The likelihood of a fiscal stimulus in U.S. is extremely diminished.

Timing is everything!

It isn’t smart to try putting all eggs in one basket and hoping for the best. Various asset classes can and will go through a dramatic dip. For example:

- When real estate, Russel 2000, S&P 500, Dow, and Nasdaq roll over, you will want to be out of these markets.

- In the case of gold, silver and crypto, incorrect speculation regarding money could cause those assets to drive lower. Hence, during such times, you want to be out of those markets.

- When your cash will lose half of its worth, you don’t want to be holding cash.

- But when hyperinflation hits, you need to be fully invested in safe havens like gold, silver, platinum, and bitcoin.

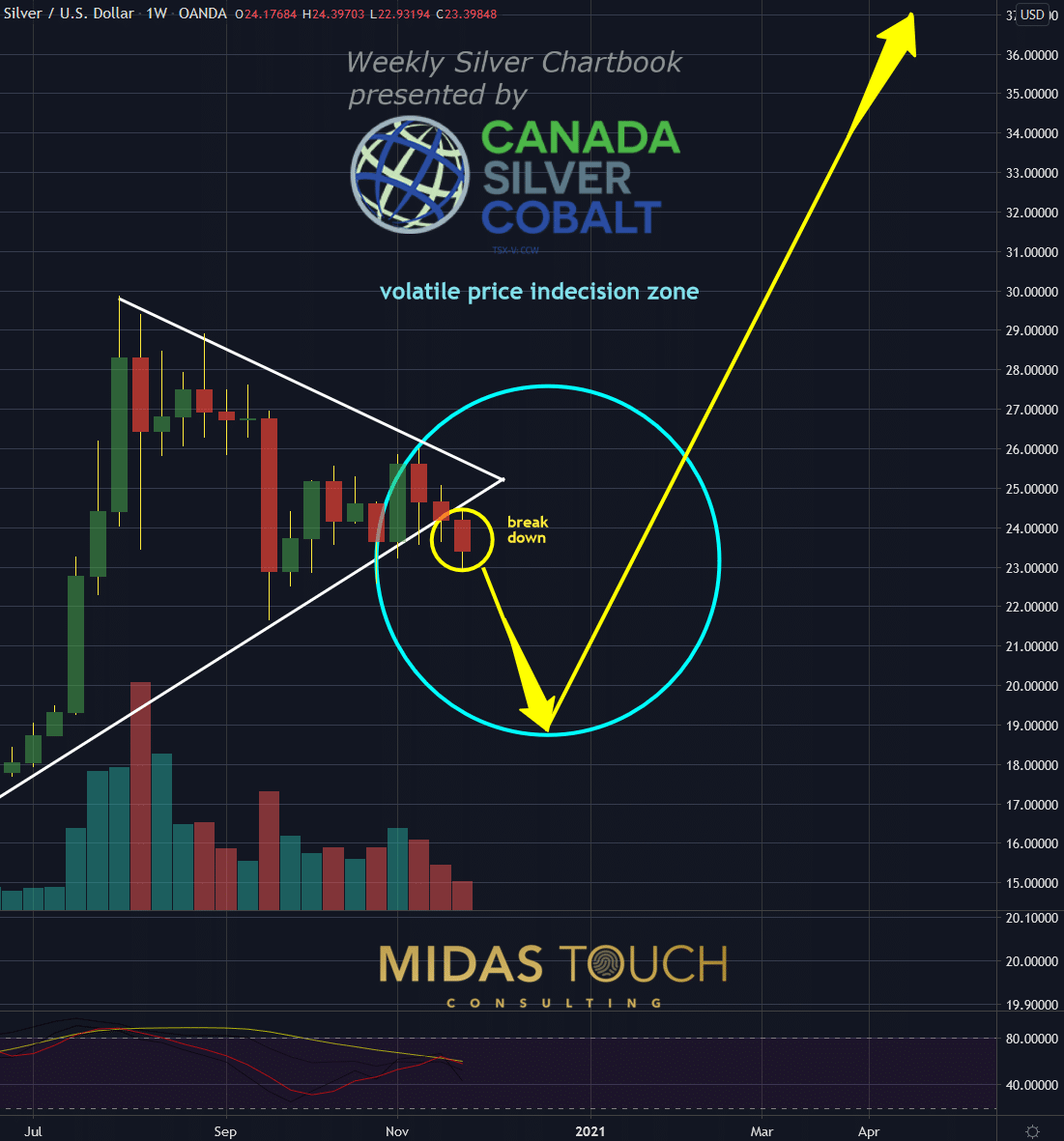

Silver Weekly Chart, assuming the timing is right:

Silver in US Dollar, weekly chart as of November 18, 2020

Above, you can see a chart from last week’s silver chart. The assumed trendline break has now manifested as anticipated (see below). This has set in motion some turbulent times for the silver market.

With a strenuous year for everybody, not just market participants, a quieter holiday season is anticipated. Nevertheless, with a still unresolved political arena in the US, increasing negative numbers in the pandemic scenario, and an unstable monetary system around the globe, we could easily be in for a surprise.

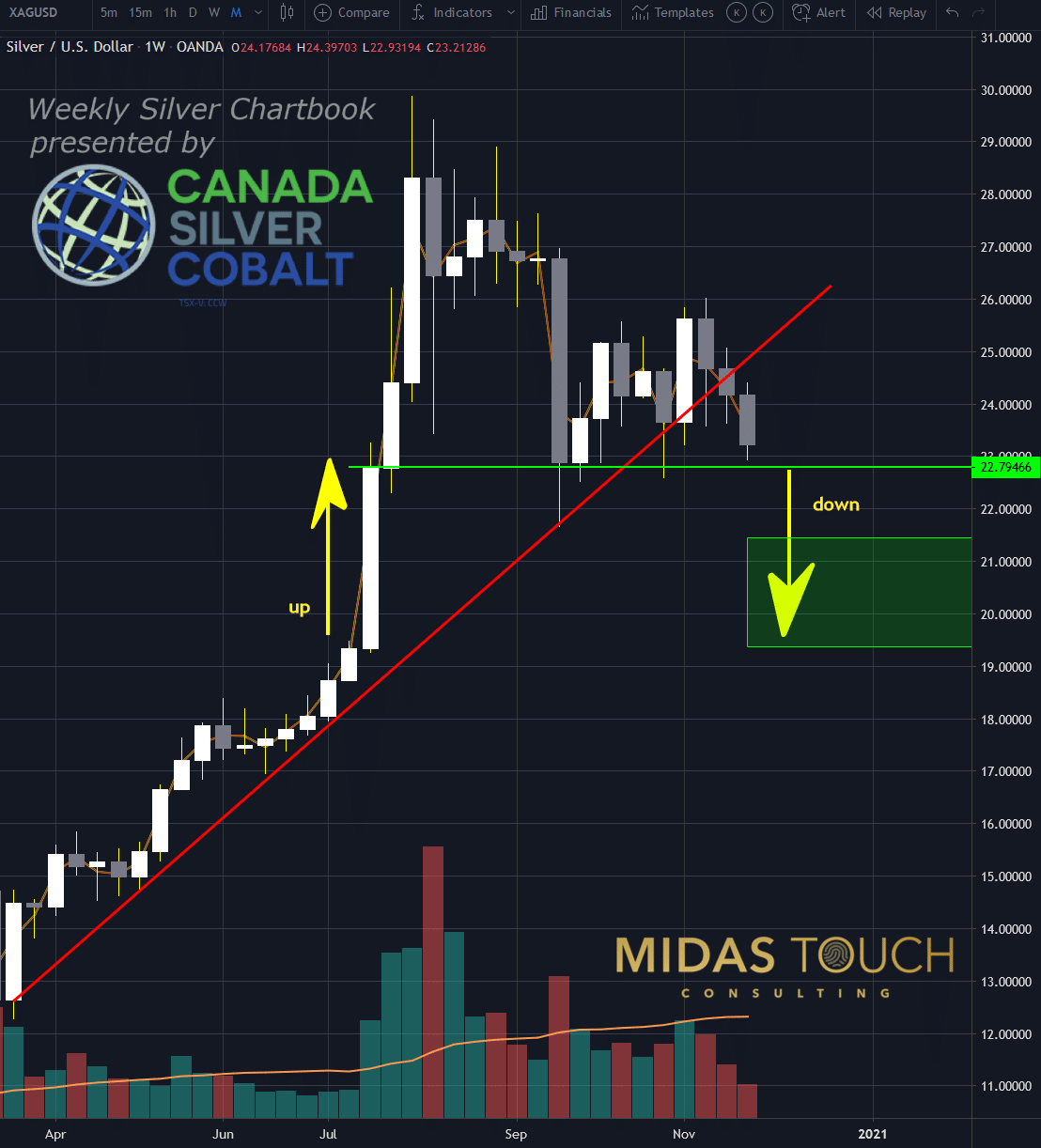

Silver Weekly Chart, Early warning signs:

Silver in US Dollar, weekly chart as of November 26, 2020

With a significant trendline that held steadily for eight months since March of this year, silver has entered into a different arena of price behavior. While this is a conservative support zone to add to your physical holdings of silver for a multi-year time frame, the weekly trading arena has shifted its consensus. We are now near the low end of a sideways trading range, which is in danger of breaking even lower.

Silver Weekly Chart, Watch out:

Silver in US Dollar, weekly chart as of November 26, 2020

Although market participants are expecting quieter times as we approach the year's end, many areas are still unresolved. As a result, silver prices could break through the support they are sitting on and then swiftly slide into a move down, reversing from the move up from July.

Should this scenario pan out, we would expect a swift bounce that requires active participation to take advantage of a temporarily oversold market.

Timing and Watching Silver

One needs awareness, smart money management, and good timing to stay out of trouble. This means a “stay out of trouble” approach is much more significant than a “how can I make profits” approach. Playing defensively this time rather than being aggressively allocated may result in more growth and profit. Plan your trades and trade your plan. Timing is everything.

Disclaimer: All published information represents the opinion and analysis of Mr Florian Grummes & his partners, based on data available to him, at the time of writing. Mr. Grummes’s ...

more