Time The Entry Properly

We see trading ranges on all of our favorite markets going into Tuesday morning, which means my plan is to fade the breakouts using failure patterns…

But we also have some strong momentum moves into this afternoon’s closing bell, which means timing the entry properly is going to require some attention to details – are you ready?

Crude Oil is bullish and trading back inside the range from earlier this month, which tells me to avoid buying this high, and wait for a deep pullback to buy instead…

So my plan is to wait for the pullback to the low of a new Hidden Channel where I can look for buy set-ups using a seller-failure pattern and a target back up to re-test the high.

E-Mini S&P Looks Ready for a Reversal

E-Mini S&P is bearish with two strong legs lower into a Spike & Channel pattern, telling me to look for sell set-ups off the high…

The challenge, however, is this rising support trend-line coming up off the lows, which is tipping us off to a possible short-covering rally back up into the range tomorrow morning.

Nasdaq is Setting-Up for a Snap-Back

Nasdaq is bearish with an “overshoot” at the low of a bear channel, which often results in a short-covering rally going all the way back to the channel high…

Knowing this, my plan is to look for a buy set-up using the “nested” 2-Try Failure pattern, waiting for the sellers to try twice before I attempt buying into the stops.

Gold Buyers May Be In Trouble at These Highs

Gold is bullish into a trading-range this evening, which tells me to buy the low and sell the high of the range on Tuesday morning…

But the real clue is this recent “pump and dump” off the highs, which tells me these buyers bit off a little more than they can chew…

Knowing this, I’m looking for buyers to try and fail at these highs, giving me the opportunity to get short with a target going back into the range from earlier this morning.

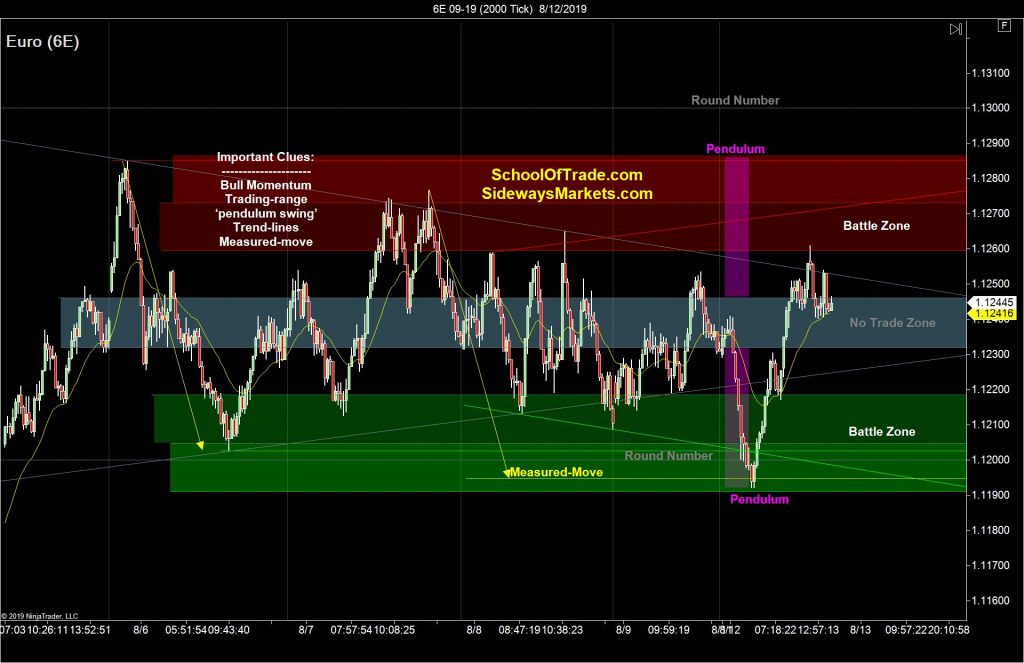

Euro is Still Rotating Back and Forth

Euro is still choppy and range-bound, rotating back and forth inside the same range from last week…

So the plan stays the same – buy the low, sell the high, and avoid the middle of this range – using the 2-Try Failure set-up to time the entry properly.

Disclaimer: Join our Free Trading Course. Joseph James, SchoolOfTrade.com and United Business Servicing, Inc. are not registered investment or ...

more