This Is Great News For Gold

The 2010s were not kind to precious metals, in either nominal or relative terms. Gold and silver are down from their 2011 highs and waaayyy down versus equities and other favorite assets of the 1% like fine art and trophy real estate.

But this imbalance has begun to reverse, in two ways.

First, stocks have soared to nosebleed valuation levels — see Nasdaq caps $7 trillion decade with its best rally in 10 years. Apple, Gooogle, and Netflix might continue to rise from here, but they’re no longer anyone’s idea of a safe haven.

Second and a lot more interesting, “collectible” assets, those “God isn’t making any more of” things like Van Goghs, vintage Jaguars and dusty thousand-dollar bottles of vinegar, er, wine, having soared for a decade, are finally starting to roll over. From Monday’s Wall Street Journal:

The Finer Things in Life Weren’t Good Investments in 2019

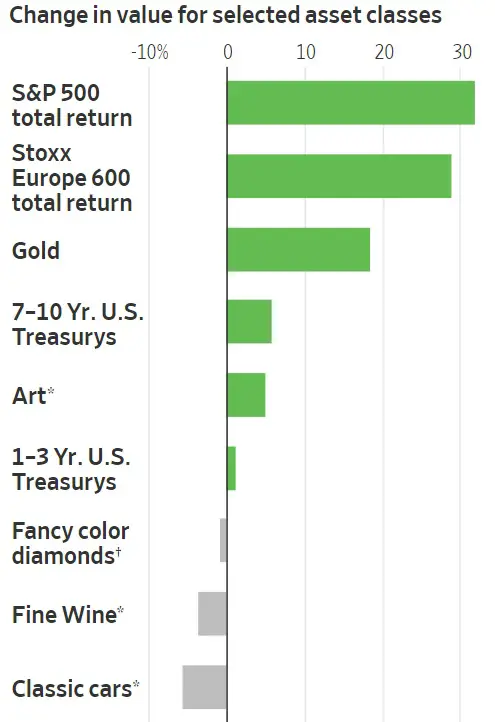

When stocks and bonds do well, the rich usually feel richer, driving sales of luxury assets like wine, diamonds and fancy cars. That wasn’t the case in 2019.

The market for luxury assets has been subdued this year, despite a record year in financial markets. Driving the decline were geopolitical tensions, including uncertainty around Brexit and the U.S.-China trade conflict.

“The froth has gone out of the market. People have realized you can’t just buy stuff and expect the value to go up,” said Andrew Shirley, a partner at global real estate consulting firm Knight Frank and editor of the group’s Wealth Report.

Just about every financial asset did well this year. Major stock market benchmarks in the U.S. and Europe hit record highs. Bond prices surged as yields tumbled, thanks to looser monetary policy from major central banks, including the U.S. Luxury assets, however, were weighed down, partly by lack of Asian demand. Chinese buyers account for around one-third of world-wide sales for big luxury companies.

“There is a lot of uncertainty in Chinese markets and the riots in Hong Kong didn’t make it easy for people to come spend money in Hong Kong,” said Eden Rachminov, chairman of the board at the Fancy Color Research Foundation, a Tel Aviv trade group that tracks diamond prices.

Colored diamonds—the rarest kind—lost 0.8% in value in the first three quarters of 2019, a figure which researchers say is expected to roughly stand for the full year.

Global trade tensions had a direct impact on the wine industry in October, when Washington imposed a 25% import tax on most wines from the European Union as well as whiskey and liquor.

Investors who put money into fine wine at the beginning of the year saw an average loss of around 3.6% by the end of November, according to the Liv-ex 1000 index, a broad measure that covers wine prices across regions.

(Click on image to enlarge)

Meanwhile, those investing in classic cars have seen a loss of 5.6%, according to Historic Automobile Group International’s Top Index, which covers rare and collectors’ cars.

The art market has also shown a broad slowdown and signs of caution among art investors. Art Market Research’s All Art Index, the closest thing the industry has to a benchmark, was up just 5% this year to November, compared with a 12% rise in 2018.

The number of blockbuster sales dipped markedly. Out of the 40 most expensive paintings ever bought at auction, 18 were sold in 2018 compared with just three in 2019, by Art Market Research estimates.

Now pretend you’re someone with a lot of wealth to protect. The trophy assets you’ve been buying are not only losing value, they’re costing you time, money and stress to insure, store and guard. What’s the point if, after all this loving care, they don’t actually preserve your capital?

Still, your money has to go somewhere. So you look around and see that gold and silver are not only cheap in terms of their recent past, they’re easy to understand and buy compared to Maseratis and Monets, inexpensive to store, and have held their value for 3,000 years, something no bottle of wine can claim.

And lately, they’ve been going up.

(Click on image to enlarge)

Precious metals, in short, are now just about the only trend that looks friendly. So expect a rising proportion of wealthy investors’ spare cash to flow their way in coming years.