The Worst Is Behind Us For Liquified Natural Gas Markets

COVID-19 and the ramping up of LNG export capacity has weighed on gas markets this year. However, with demand recovering, and limited further export capacity coming online over 2021 we believe regional gas prices will be well supported (UNG).

Soggy demand and growing capacity

As seen with most markets this year, liquefied natural gas (LNG) was unable to escape the COVID-19 related demand hit, with industrial gas demand weighed down by lockdowns.

This saw LNG prices in Asia trading to record lows, which also weighed on regional gas hub pricing around the globe, and in particular Europe. This only added to what was already set to be a bearish year for LNG markets, following a mild winter, along with the fact that around 24mtpa of LNG export capacity was scheduled to start up over the course of the year, with the bulk of this capacity coming online in the US.

Therefore the market witnessed a large number of US LNG cargo cancellations over the summer, with the price collapse in Asia and Europe making it uneconomical for buyers in the region to take delivery of cargoes. Nearly 175 LNG cargoes were cancelled between April and November 2020, with the majority of these cancellations taking place in June-August 2020 - a seasonally softer period for gas demand.

If we look at export data from the US, volumes collapsed over the summer months as a result of these cancellations. Volumes hit a low of below 1.9mt in August, which is the lowest monthly number seen since 2018, and well below the roughly 5.5mt exported in February. However since then, and with cancellations easing, we have started to see volumes pick up once again. Due to the recovery we are seeing, along with strong export volumes at the start of the year, total exports from the US over the first 11 months of this year are still up around 32% YoY according to IHS Markit, and full-year exports will still see very impressive growth.

In Asia, while LNG imports over April and May fell YoY, we have seen quite the recovery in demand since. Data from IHS Markit shows that LNG imports into Asia over the first 11 months of this year totalled a little over 233mt, which is still up almost 7% YoY.

As for Europe, the region continued to see strong growth in LNG imports until the end of May. However, since then, volumes have come under pressure as a result of cancellations, while more recently given the premium that the Asian market is trading at to Europe, any spot cargoes will likely make their way to Asia rather than Europe. However, over the first 11 months of the year, imports total a little over 82mt, up 2% YoY, according to IHS Markit data. We will need to see how imports into the region progress over December, but there is a very real chance that total imports this year finish up lower YoY.

These cancellations have helped to rebalance regional markets, which has been more supportive of prices in recent months, while a number of unplanned outages in the US as a result of hurricane activity, along with extended maintenance at some LNG plants in Australia, have only provided further support.

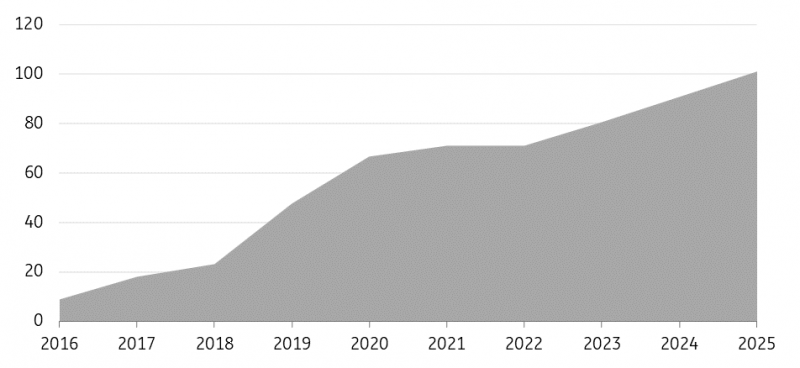

Limited US LNG export capacity set to come online over the next two years (mtpa)

EIA, ING Research

Improving fundamentals over 2021

However, the recent strength in the Asian and European market should mean that the worst of cancellations are behind us, with the spread between spot Asian LNG prices and Henry Hub in the US averaging US$3.30MMBtu, a level which more than makes sense to see these flows. Meanwhile, with US forecaster NOAA forecasting a 95% chance of a La Nina weather event over the Northern Hemisphere, winter could be constructive for Asian LNG demand, with colder than usual weather in North Asia associated with La Nina events.

While, in terms of liquefaction capacity, we appear to be behind the bulk of capacity additions, at least for the next several years. In 2021, only about 8mtpa of capacity is expected to come online, which should be much more manageable for the market to absorb, particularly with demand expected to grow at a healthy pace.

This all suggests that regional gas markets will be better supported over 2021. Although clearly, COVID-19 remains a risk if we see further waves over 2021. If we were to see a mild winter for some reason, this does leave the gas market on a weak footing at a fairly early stage next year.

If we are to see further LNG cancellations in 2021, it will likely be in the summer months again, given that is the low point in gas demand. However, for now, the forward curve does not suggest that we will see cancellations, with European gas prices trading above the short-run marginal cost for US LNG supply. Admittedly, it is fairly close, and so it wouldn’t take too much to push the market to levels where the risk of cancellations starts to grow. However, even if we were to see some cancellations, they are unlikely to be on the same scale as we have seen this year.

ING forecasts

Source: ING Research

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more